10 Things That Likely Won't Matter...

Low tourism is not a real economic risk to America. The biggest risk is something that we won't know until it's too late.

Good evening:

I don't know what it is... but every single children's choir I've ever heard sounds alike. We're just returning from my daughter's first-grade spring concert, and I'd a realization that I'd either listened to this song or this band before.

Anyway... It's incredible how quickly a school year goes by. We've now been here one year. And while the scenery changes, the rules of the financial markets remain the same.

Let me explain...

The Economy vs. The Market

One of my favorite market analysts is Torsten Sløk, Chief Economist at Apollo. Before joining Apollo in 2020, Sløk spent 15 years at Deutsche Bank, where his team consistently ranked at the top in Institutional Investor surveys for fixed income and equities research. Sløk is undoubtedly one of the leading names in global geopolitical risk and understanding its impact on international markets.

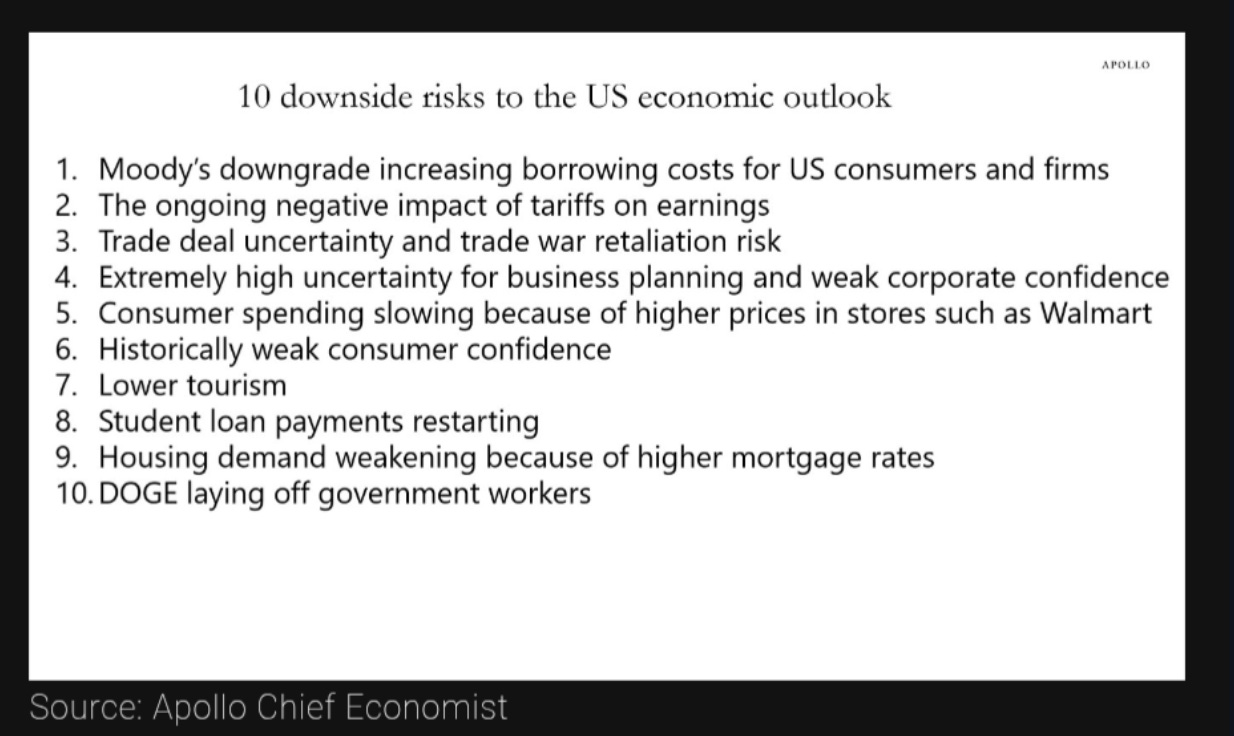

Today, he released the 10 downside risks to the U.S. economic outlook...

This is an interesting list.

But here's the thing... when it comes to the market, Apollo, like so many others, must signal the truth to all of us:

The economy is not the market... and the market is not the economy.

The Real Risk

The No. 1 Risk isn't Moody's or low tourism.

The risk is fueled by an unknown, driven by incredible recklessness at the fiscal and monetary levels. The true No. 1 risk is a fat tail risk that Sløk doesn't even list.

And we probably don't even know what it is yet.

When the Fed injected trillions of dollars into the economy during the COVID-19 shutdown, everyone should have realized the complete disconnect between the stock market and the broader economy. But they should also recognize the incredible fragility fueled by non-stop monetary expansion.

And yet, we still see weekly articles about the aggregate earnings season and the impact on forward-looking market expectations.

Capital Drives Markets

At the end of the day... it is capital (lots and lots of capital) that drives markets.

This chart, provided by Michael Howell at CrossBorder Capital, illustrates a direct correlation between the Global MSCI Index (a global equities index) and his measure of "Global Liquidity."

If we continue to witness robust global growth in that pool of capital, don't be surprised to see equity markets continue to climb higher. It is only when there is a disruption to that flow's expansion that we see the sharp reversals.

Crisis Regularity

Liquidity is also responsible for the regularity of the crisis that seems to surround us. The economy is not responsible for the massive four- or five-sigma events that have occurred in the equity markets over the last few years.

Today, I asked ChatGPT to give me the mathematical breakdown of the four worst equity and economic moves that we've witnessed in the last three years alone:

The 2022 GILT Crisis

The 2023 Silicon Valley Bank Crisis

The 2024 Nikkei Crash

The 2025 Market Collapse fueled by deep concerns about the bond markets

This was the summary:

The Nikkei Crash (-12.4% drop in a single day): a four-sigma event (one in 63 years)

The UK GILT Crisis (200 basis point spike in 3 days): a four-sigma event (one in 63 years)

The Silicon Valley Banking Crisis (60% drop for a stock in a single day): a five-sigma event (once in over 13,850 years)

The March/April crash: approximately a 4.6 sigma event (once every 10,000 trading days, or approximately 40 years)

What's striking is how these "once-in-a-generation" events now happen with alarming frequency.

Traditional statistical models assume markets follow normal distributions, but reality has proven otherwise. We're witnessing a new paradigm where extreme volatility is no longer the exception—it's becoming the rule.

These aren't anomalies anymore; we appear to be in a perpetual state of economic crisis, jumping from one "black swan" to the next with barely enough time to recover.

These are generational market events that occur approximately once a year in the post-COVID era.

So... maybe we should focus less on how many people DOGE might fire or the number of student loans in default, and focus on the real risk:

Our monetary system is an absolute dumpster fire...

We need to address this.

That starts with teaching people how the financial system works…

Meanwhile… we’ll just keep swatting away the black swans by focusing on our Daily Momentum Signals and focus on Aggregate Insider Buying.

Stay positive,

Garrett Baldwin

Secretary of Black Swans

Wow! I wrote a piece about "Gray Swans" circling the sky's and how quickly they can turn black. How many? The darkest gray was the US debt and servicing that debt. My estimate for rolling $7.6T this year was $9.4T. Bessent is my only hope! Thanks GB.