An Ominous 5th Anniversary

I was sitting in my office in Bonita Springs, Florida, reading reports on China when a mathematical equation told me that "Hell is coming" long before Bill Ackman would.

Dear Reader:

“You really piss me off sometimes,” a friend told me yesterday

He continued: “I didn’t know you worked for a lobbying shop in Washington D.C. You never talk about these things.”

He’s right.

I rarely write about my nomadic background.

Here’s a quick cheat sheet… before I get to what's likely to happen in the markets.

“Hi, I’m Garrett”

I left Baltimore in 2000. I studied investigative journalism at the top college program in the country. Then, in my mid-20s, I worked in competitive intelligence for a company in the northern suburbs of Chicago before going to Wall Street.

Stop… “Competitive intelligence? Do I mean corporate spying?”

Yes.

I spied on soda manufacturers’ bottling plants to capture supplier costs and tracked satellite data of Chinese shipping containers. I also spied on UPS on behalf of their shipping competitors (largely around their marketing plans for their UPS Stores.)

However, we also worked to prevent information theft.

For example, a client hired me to dress as a delivery driver in Chicago, demand a signature from an executive in the building (I was let up to the office), and try to take as many ‘proprietary’ documents as possible off people’s desks when no one noticed.

[I got a marketing presentation outlining their business strategy for the next 18 months. There were security lapses all over that company’s headquarters in Chicago.]

In 2006, I went to New York. I moved for a small bank’s consulting arm in the Trump Building and worked as a lead analyst to restructure Capital One’s direct mail network. I also worked on all those awesome presentation decks to analyze potential client takeover targets. Never again. At night, I wrote a novel about drug trafficking on the U.S.-Mexico border (it was rejected 232 times by literary agents.)

I soon got a degree in economic security from a program that heavily fed careerists for the FBI, CIA, and other public agencies. (I stayed in the private sector.) At the same time, I then worked for a K Street lobbying/advocacy shop in Washington, D.C., that shaped public narratives and support on economic, energy, and political matters.

Stop. “What do you mean shape public narratives?”

Honestly?

Corporate or NGO propaganda efforts and astroturfing in media and political debate.

For example, we convinced America to support (or ignore the ethical challenges of) one of the nation’s largest banks before the Dodd-Frank Act was drafted.

We also changed the national narrative after the BP oil spill and got Americans to support the U.S. energy industry and detract from further offshore drilling regulations.

This pissed the Obama administration off something terrible.

It's funny how easy that is to do… change the national narrative…

The money in this industry is staggering. I see these outcomes of well-crafted and survey-centric talking points in the media almost daily on both sides of the political aisle. It’s why I rarely listen to national media anymore (most of the talking points originate from one of two advocacy centers in Washington. I worked for one of them.)

I hit an ethical wall… and turned back to my graduate work.

While finishing my Masters degree on the 2008 financial crisis at Hopkins, I started working on financial research for Baltimore-based Agora subsidiaries in 2011 (full-time and as a consultant for 12 years).

While working with Money Map Press… I earned two other degrees in agricultural economics and an MBA in Finance. I also got a certificate from Harvard Business School on Global Business, where I learned to track cross-border capital flows. (A book I wrote about Justin Bieber that sold well in China paid for those degrees…)

Stop. “Back up…”

Sorry, we have to keep moving.

With that academic background, I’d been achieving my 10,000 hours across momentum, liquidity, capital flows, insider buying, and central banking activity.

I soon worked out of the Chicago Mercantile Exchange as a journalist covering hedge funds and private equity and as an analyst on global grain markets. I also consulted for political risk consultancies and worked on projects in two dozen countries.

(Don’t get me started on the 15-hour ride in a truck from Yellowknife, Canada, to Edmonton after a consulting gig with a trucker named Glenn.)

Yes, it was a busy and nomadic 15 years.

But that was life before COVID hit… and before my daughter arrived.

That’s when my other passions began.

I Track Money (Wherever It’s Going)

So why not talk about all these things?

Well, it all comes down to the career things you’re most proud of.

And for me… it was an event that happened on February 22, 2020.

Five years ago today.

That was a day that changed everything…

In my academics and stock market analysis, I tracked momentum, liquidity, capital flows, insider buying, and central banking and fiscal policy activity. It all fed into an equation that became our ON-OFF switch in the markets…

After many months of testing, that day was the first time it ever went negative.

I calculated our Equity Strength Signal for February 21, 2020, a day after the markets closed.

That was February 22, 2020.

What followed… was this.

A Third Friday (February 21) into Monday selloff that altered my life.

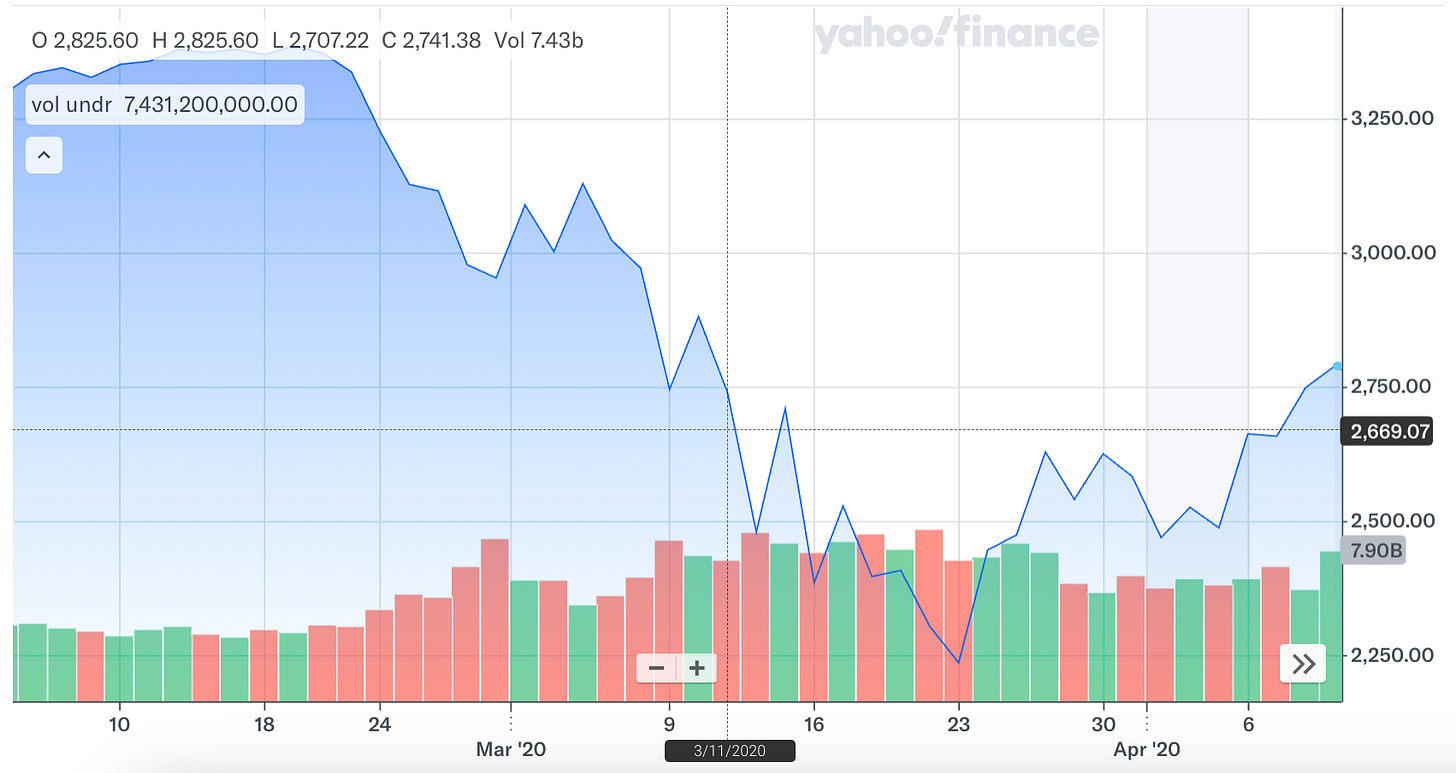

That’s the S&P 500 selloff barreling into the COVID market crash in March 2020.

I’d called friends on Wall Street that weekend. I’d warned several fund managers and other experts, writers, and publishers in this space. I wasn’t the only one. I’ve put in this link a search of news and opinion articles published in Google News from January 1 to February 23, 2020. You’ll see that there was plenty of pessimism.

It turns out that money started exiting the arena at a frantic pace on February 21 and accelerated over the next two weeks. We saw it leave in real-time by tracking stocks on the S&P 500 using a performance bell curve.

Extreme selling had surged ahead of extreme buying.

I explained what I had studied and rewired for the previous six months had shown strong momentum in the equity markets. Markets had JUST HIT RECORD HIGHS.

But suddenly, something was wrong. The number of stocks starting to move into - what we’d later define as “Fallout” mode - had spiked in the previous days.

I moved HEAVILY to cash on February 24, 2020 (which made it possible for me to buy a house just a few months later).

I didn’t fully understand what I’d stumbled upon, but I replicated a financial study I’d read two years prior, added some technical analysis, and POOF!

Our Equity Strength Signal emerged.

The U.S. economic shutdown wouldn’t come until weeks later, days after NBA players left the court on live television on March 11, 2020.

March 11 was the day that everyone realized how serious the situation was.

The U.S. COVID shutdown started four days later on March 15, 2020.

Here’s the S&P 500 in that period.

The S&P 500 fell more than 15% in the time that signal went negative a few weeks earlier until the night of the famous NBA game.

The S&P 500 would bottom on March 23, three days after Quad Witching and a day after Federal Reserve’s Neel Kashkari appeared on 60 Minutes to profess their quantitative support plans.

Our signal wouldn’t go positive again until early April 2020, about two weeks after the Federal Reserve and Congress injected untold amounts of capital into the system to prevent a deflationary collapse.

The stock market started to skyrocket, even though everyone was at home.

Five Years of Intense Academic Work

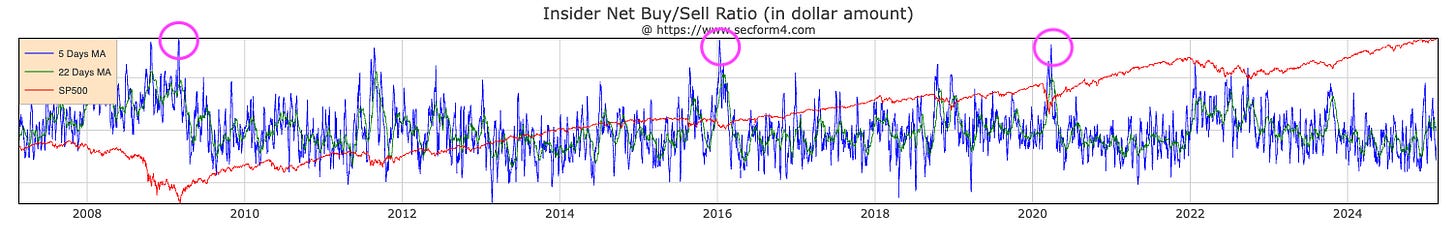

That bottom in late March (when the Fed announced its plans) was the largest day for insider buying activity compared to selling since the Shanghai Accord in 2015 and the first Quantitative Easing round in March 2009.

See the blue line?

That’s the five-day moving average of insider buying activity to selling dating back to the 2008 Financial Crisis. Those three pink circles were extreme market bottoms combined with sizable insider buying and notable accommodation by central banks to pump money into the system. They all preceded MASSIVE moves higher for stocks.

That 2020 insider buying activity anchored my academic analysis over the last five years. It helped us understand the relationship between extreme insider buying events and central bank stimulus or fiscal policy changes to support the broader financial system.

That period helped me understand the basis of liquidity in the system and how it applied to insider buying, financialization of the economy, and, of course, momentum.

Since that day, I’ve written extensively about how the works of Tobias Moskowitz (Yale), Grant and JD Henning, Gary Antonacci, and Robert Stambaugh—combined with my father-in-law’s and my back-of-napkin measurements around MACD—produced a different worldview.

As a result, we’ve avoided every major drawdown in the last three years - since we started talking about it in January 2022 - on-air at Money Morning LIVE! and in this publication (and its predecessors).

Here are the events we’ve successfully avoided in the last few years.

February 21, 2020 (COVID crash)

June 8, 2022 (Largest hedge fund selloff in 15 years)

GILT/MBS crisis (Went negative after Jackson Hole Speech in August 2022)

Silicon Valley Bank Financial Crisis (March 7, 2023)

GILT Bond Crisis (October 2023)

Money Market/April Tax Downturn (March 2024)

Japan Nikkei Implosion (Red on August 1, 2024)

U.S. Inflation Worries (Red on December 10, 2024)

Traders have used this to exit long call positions (to avoid larger losses) or to flip the switch and place short-term bets against the S&P 500 and individual sectors.

Investors who read me have sold calls on long-term positions to generate more income.

It comes down to how you want to use it. Different people have different strategies.

It took me a while to determine that my optimal way to use it was to wait for negative momentum events - and then look for ways to buy the dip.

I wrote a whole series on how I do this… for free.

What Do I Do Now?

Now… here’s the kicker.

Our signal went negative again yesterday.

Ominously, this happened five years to the day because I caught it live yesterday and emailed readers (all readers, even free ones) about the current situation.

You received an email yesterday with this story.

But readers of Republic Risk were the only ones who got the more important warning.

The deeper dive into the FNGD is a critical signal that helps us determine the severity of the red signal.

We’ll be watching BTC and the Israeli markets tomorrow to understand whether this is a head fake.

And we’ll watch the FNGD to see if it breaks above its 50-day.

Our S&P 500, NASDAQ and Russell 2000 signals are negative… right now.

There are a lot of things I’m covering this week at Risk Republic.

I have a deep dive into what’s happening in Japan with their slumping banking system…

What’s going on with the trade tariffs, and how can that hammer consumers…

The rising domestic costs of electricity and utilities, and why that’s a problem for the cyclicals…

China, gold realignment, and more.

But most of all, I will guide you through this month. I expect a more volatile next 30 days with the most challenges we’ve seen since five years ago.

I don’t foresee a repeat of 2020.

But I see problems building in March, and you’ll want help navigating any ongoing downturn.

Here’s my offer.

If you're not a subscriber, I’ll cover everything for $7.99 for the next 30 days.

This covers the February jobs report, the tariff implementation, the focus on Japan’s inflation battle, the upcoming Fed meeting on March 18, Quad Witching on March 20, updates on PCE Inflation, CPI numbers, NVIDIA earnings, and much more.

Click the link below. I’ve altered my pricing for today only.

This is a fifth-anniversary deal…

The price returns to $18.00 at midnight tonight.

Or if you want the whole year, I’ll drop it down 20% from our annual price.

This offer goes away permanently on Sunday.

Stay positive,

Garrett Baldwin