BREAKING: US Credit Rating Downgrade - What It Means For Your Money (and What to Do)

The U.S. downgrade will set the tone for the markets over the next year... and I don't want you to be left behind.

Dear Fellow Traveler:

Moody's has just slashed America's pristine credit rating, signaling serious concerns about ballooning national debt.

This rare downgrade threatens to drive up Treasury yields IMMEDIATELY.

This could quickly trigger higher mortgage rates, credit card interest rates, and loan costs across the board.

What’s worse? Another potential rollercoaster for investors after this recent crash.

Expect market volatility as investors adjust portfolios.

Your stocks could face pressure while gold may surge as a safe haven.

There is good news… I’m giving you a chance to get my daily research for the lowest price ever. Under $99 for the full year.

And before you think about closing this window… give me just a minute of time to show you exactly how good I am at what I do…

I just navigated my readers through this recent downturn in my paid letter to on this substack called The Capital Wave Report.

It looked like this…

I sent them a warning on February 21, telling them that market momentum had broken down. I even sent this to free subscribers like you… Then provided an even deeper dive into my methodology and why it was essential to join me AHEAD of the most recent selloff…

From there… I was playing chess against the machine that is the stock market…

And winning… momentum continued to fall… and we remained very cautious. I received emails from readers telling me that I had saved them hundreds of thousands of dollars… and one subscriber even sent me a steak.

Fear soon filled the market…

On March 12, I assessed buying pressure in the markets… and told readers that markets were about to squeeze. That started two days later…

As optimism returned two weeks later, our signal went red on Triple Witching (March 21), but really went bad with a confirmation on March 26…

From there, the S&P 500 immediately tanked, falling from all-time highs to within range of my worst-case scenario level laid out in my annual 2025 forecast.

Right around 4,850.

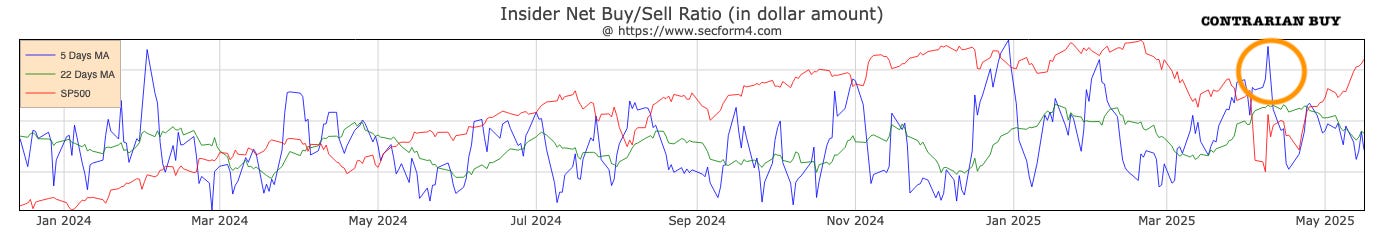

Then on April 9, I found my contrarian signal - a surge of insider buying. There it is… something that I discuss EVERY SINGLE MORNING in The Capital Wave Report.

I also informed my readers about record levels of Leveraged Nasdaq 100 (TQQQ) buying, setting the tone for the reversal.

That triggered a surge in buying…

On April 23, I told them market momentum had returned when the S&P 500 was near 5,300. (It’s at 5,900 just a few weeks later)

And it’s been a surge ever since.

This is NOT an accident… this is what I do.

Now… Here’s the thing… the Downgrade changes everything… and we’ve moved back toward overbought levels.

The next 30 days could be quite a doozy..

If you missed the recent rally, don’t worry.

This cycle will repeat in the future…

Just as it did - and I promptly guided investors through countless times in 2022, BEFORE the Silicon Valley Banking Crisis in March 2023, before the Nikkei Crash last August, and during December’s huge selloff (from my hospital bed).

Which… by the way… I helped readers avoid… This was our tracker of momentum from 2022 to 2024…

JOIN US… BE A PART OF OUR COMMUNITY

I’m making you an offer today that you can’t refuse.

And I’m stressing this… I care about your money… and your performance. I am a very defensive minded person… I played goalie in every sport - and my job is to help you manage risk and find opportunities to buy great stocks at much lower prices when the opportunities emerge.

I’m cutting this price today to just under $99 for a full year.

Today only… after the downgrade.

What you’ll get:

That’s a morning report, the momentum readings, weekly insights on potential breakout stocks, insights on insider buying activity, and commentary on how and where money’s moving around the globe in all directions…) You’ll receive mid-year portfolios, the 2026 annual forecast, and much more…

I honestly cannot go any lower, because this is a daily insight you’ll find nowhere else.

I’m the only person who holds this “Waterfall Worldview” — and I deliver it to investors with unwavering confidence each day.

You’ve seen what I've accomplished in the last 60 days…

Again, you’ll get insight into major market developments, delve deeper into risk, provide momentum readings for each sector and broader index (including the Nasdaq and Russell 2000), and analyze insider buying and global central bank activity.

This is a letter for serious individuals who want to protect and preserve their wealth… and, more importantly, capitalize on the broader market’s fear and greed as it unfolds.

You won’t find this letter anywhere else… But it lays out how the financial system operates, the signals most investors miss, and gives you an exceptional edge and conviction to avoid major downturns and buy when others are fearful.

This is the summation of four degrees and 13 years in financial publishing.

You’ll also receive your daily Me and the Money Printer letter - and one more bonus…

On June 1, I’ll release my latest report on American Sovereign Wealth…

This will break down the top owners of capital-efficient assets that generate ample rent for investors, helping them preserve wealth, generate income, and build gains.

So, this one-time link does not expire.

I appreciate your time and consideration.

Stay positive,

Garrett Baldwin