False Alarm? (Not Likely)

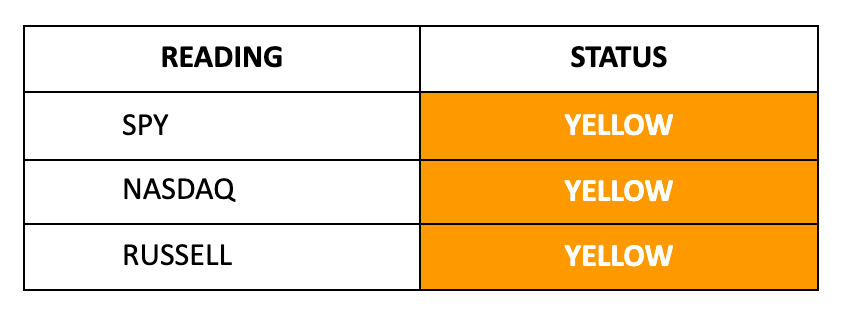

Look for crowding... and a push toward 6,000 in the next week or so. We're not out of the woods though. Liquidity is stagnant, and things outside our control loom.

The battle for 5,800 rages on with futures up slightly as traders weigh a calmer Treasury market against a potential end to the market's six-week win streak.

While Thursday's tech-led rebound, fueled by Tesla's blockbuster report, which wiped out all its losses for 2024 and added $150 billion to its value, suggests the bulls haven't lost their grip just yet, keep an eye on energy's weakness and the resilience in cyclicals for advanced warning. The markets are climbing a wall of worry.

The bigger picture hinges on bonds—caution rather than panic is warranted unless the S&P cracks decisively below 5,800. While election headlines dominate, we’re starting to turn our attention to the looming wave of refinancing headed our way in 2025.

There are things bigger than politics, like debt, OPEC, and global capital flows.

For now, watch that 20-day moving average like a hawk.

Insider Buying:

Low buying activity remains: 114 total filings this week.

Top Buy: $10.3m of Five Point Holdings (FPH) by di…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.