Dear Fellow Traveler:

Every night, there’s a negotiation in my house. It goes on for a good 15 minutes.

How many more pieces of chicken does my daughter have to eat?

Slices of broccoli? Carrots… she ends by saying she is full… and then asks 30 seconds later…

If she can have ice cream…

This evening has been a long, whiny session… I left a few minutes ago.

My wife is in the other room explaining the importance of nutrients… and my daughter is conceding to one more piece of broccoli and two more pieces of chicken.

Hey… at least there’s a negotiation…

Can’t say that for this poor guy…

Anatomy of Government Overreach

There’s government overreach…

And then there’s the government overreach.

The Commodity Futures Trading Commission (CFTC) is a powerful federal agency that regulates futures and options markets.

In August 2023, it filed an emergency action against My Forex Funds, a trading platform, and its owner, Murtuza Kazmi.

The action shut down the entire business and froze all their assets overnight.

So what did the company do?

The CFTC claimed the company had transferred $31.5 million CAD to "an unidentified Kazmi account" (Kazmi being the owner). The agency also contended that Kazmi’s company fraudulently booked its customers for CAD 310 million in total fees.

This CAD 31.5 million transfer was argued as evidence that the company might be hiding or dissipating assets. They suggested that Kazmi was running a large-scale, Ponzi-like scheme.

But that’s not close to what happened…

That money wasn't sent to any personal account.

It was paid to the Canadian Revenue Agency for TAXES!

And - THE CFTC ALREADY KNEW THIS when they filed their case.

They had received an email from Canadian authorities BEFORE filing their complaint, clearly stating these funds were tax payments.

But the agency went ahead with its allegation anyway.

When the defendants pointed out this error, did the CFTC immediately correct the record and apologize?

Of course not.

Instead, they doubled down.

It’s Going to Get Worse

In a court hearing months later, a CFTC investigator said he learned these were tax payments after filing the declaration - another lie.

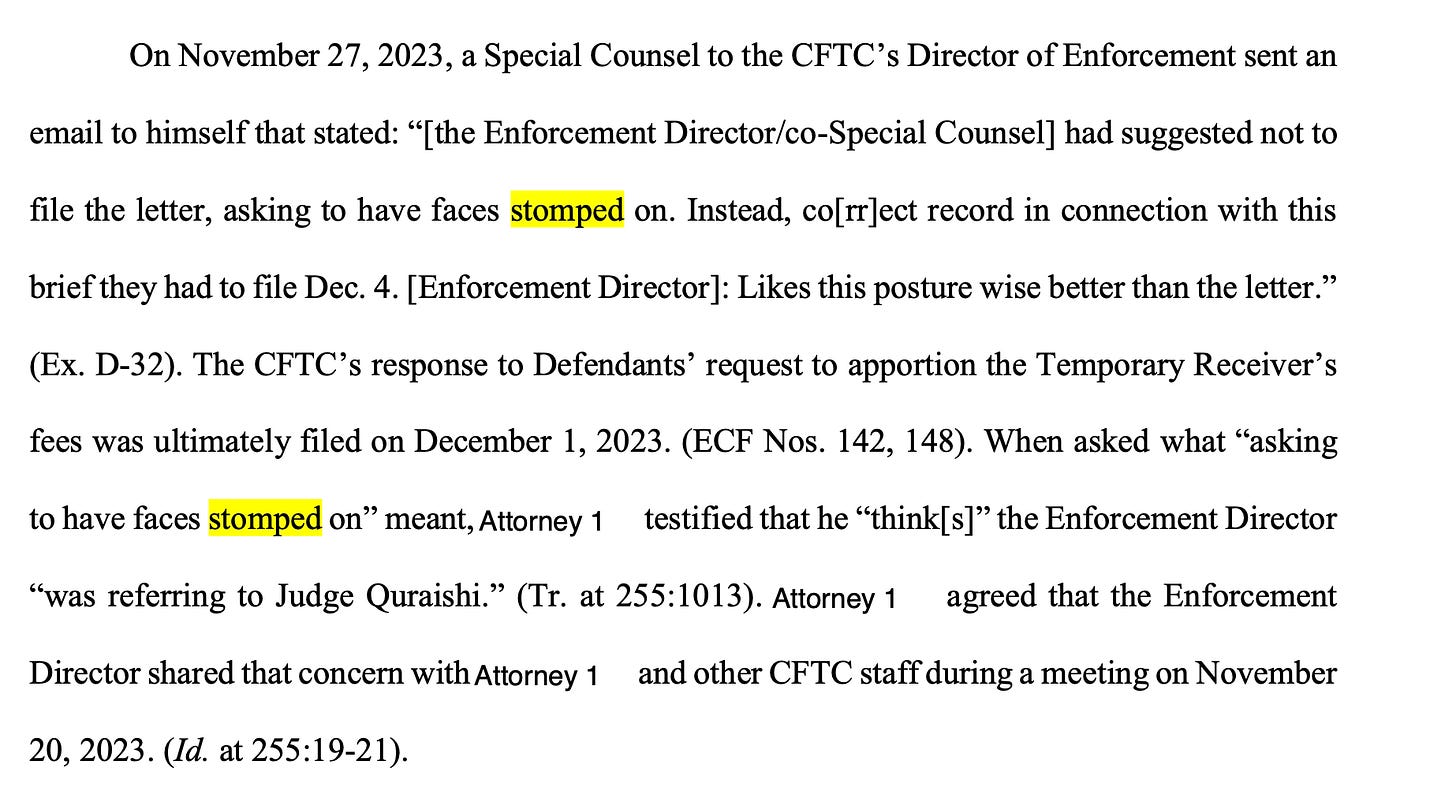

Then, internal emails show CFTC officials discussing how to minimize this "error" and even suggesting that the judge get his "face stomped on" when he questioned their conduct. Here’s the report from the CFTC investigation…

When the agency finally acknowledged the error, it did so in a FOOTNOTE of an unrelated filing, and it did so only after being repeatedly called out.

Here’s What Happens Now

A Special Master (a court-appointed investigator) has looked into all this and just released a scorching report concluding the CFTC acted "willfully and in bad faith" throughout the case. That report is right here… and it’s nauseating.

The report recommends that the entire case be dismissed and the CFTC pay the defendants' legal fees. The Special Master's conclusion…

"The CFTC, by virtue of its standing as a law enforcement arm of the United States government, is held to the highest standards... However, at almost every stage in this case, the CFTC failed in this regard."

What Does This Mean?

This case perfectly illustrates why a recent Executive Order on "Fighting Overcriminalization in Federal Regulations" is crucial.

Before this EO, things weren't crimes until someone in a government office decided they were. Now, agencies have to specify exactly what constitutes a crime.

The financial impact on My Forex Funds was ugly. Millions in assets were frozen, operations were halted entirely, and reputations were damaged.

And it all happened on a lie.

What's even more troubling is that this isn't an isolated incident.

It follows a similar pattern to the SEC v. DEBT Box case, in which another federal agency was sanctioned for misleading a court to obtain an asset freeze.

Most shocking of all?

Current CFTC Acting Chair Caroline Pham had raised concerns about this case BEFORE the complaint was even filed.

She was not only ignored but also allegedly faced retaliation for speaking up.

It took her becoming Acting Chair to address the misconduct finally.

So…

A federal agency could essentially destroy a business based on false information they KNEW was false. This is Soviet-era insanity.

Though it took too long, the judicial process ultimately uncovered the truth, with a Special Master thoroughly investigating the misconduct. But that took two years.

CFTC Acting Chair Caroline Pham has publicly acknowledged the misconduct and promised reforms, though it remains to be seen if any individuals will face consequences.

This wasn't just one rogue employee - the Special Master found that high-level CFTC officials were involved in covering up the misconduct rather than correcting it.

Major credit goes to the defense attorneys who persisted against overwhelming odds, facing the full weight of a federal agency determined to hide its misconduct.

What a world…

Stay positive.

Garrett Baldwin

You likely receive hundreds of pitches.

This isn’t one of them.

Hello @Garrett Baldwin,

Have deep respect for what you have built here.

The 100x Farm is a quiet strategy sanctuary for investors and capital stewards with long memories and longer horizons.

No noise. No dopamine. No trend-chasing.

Just deep-cycle clarity earned slowly, shared rarely.

We don’t believe in inbox conquest.

But if the idea of sowing $10,000 seeds to harvest $1 million trees over 20- 30 years feels familiar,

you and your patrons may already belong here.

What if the next 100x isn’t a stock but a forgotten business model hiding in plain sight?

Every thesis is backed by real capital, filtered through over 100 long-cycle lenses before it earns a word.

And if nothing else, this may help you filter what isn’t worth your time.

No urgency. No ask.

Only signal.

Warmly,

The 100x Farmer

https://youtu.be/xUGmdJqlzKg?si=cu8K-BqnAzNDodDz