Have Cash... Will Travel...

The warnings about the credit system are starting. These are usually self-fulfilling. The good news is that chatter for bailouts is already beginning...

Good morning:

I’ll be discussing this today at 8:45 live… so feel free to stop buy here.

Again… 8:45 … so ten minutes from now. Join me…

The warnings are already starting.

With the 10-year bond now up at 4.4%, the concern is that this massive equity downturn will spread to the credit system.

That’s a problem. Russell Clark warned this morning that clearinghouse reform has come back to bite the markets. And now there could be very serious problems around the Basis Trade. More on that in a moment… but first… he writes:

“Cash is king. No asset is safe from clearinghouse driven liquidation. It ends with intervention or the blow up of famous high performing hedge funds. Good luck out there."

I’ve seen similar proclamations in recent days. Quoth the Raven has warned about the Basis Trade. Bloomberg is warning about the basis trade.

What’s the Basis Trade, Garrett?

The basis trade is when hedge funds buy Treasury bonds and sell Treasury futures simultaneously to profit from a small price gap (the “basis”) between them.

An example:

Winning Trade:

Buy 10-year Treasury at $99, short futures at $100.

Prices converge—bond rises to $99.75, future drops to $99.75.

On 50x leverage, that $0.75 gain on $1 costs = 37.5% profit on capital.

Losing Trade:

Buy a bond at $99, short the future at $100.

Rates spike—bond drops to $95, future stays at $100.

That $4 bond loss on 50x leverage = 200%+ loss, triggering a margin call and forced liquidation.

So… one more time.

Since the price difference is tiny, they use massive leverage—often 50x to 100x—to make the trade worthwhile.

They borrow cheap money (usually overnight) to buy the bonds, hold them, and roll the futures.

If the gap narrows as expected, they make a profit.

If not—or if borrowing costs spike—they can lose big. Low-margin, high-leverage arbitrage only works if the math holds and markets stay stable.

Isn’t finance wonderful?

Here’s the kicker…

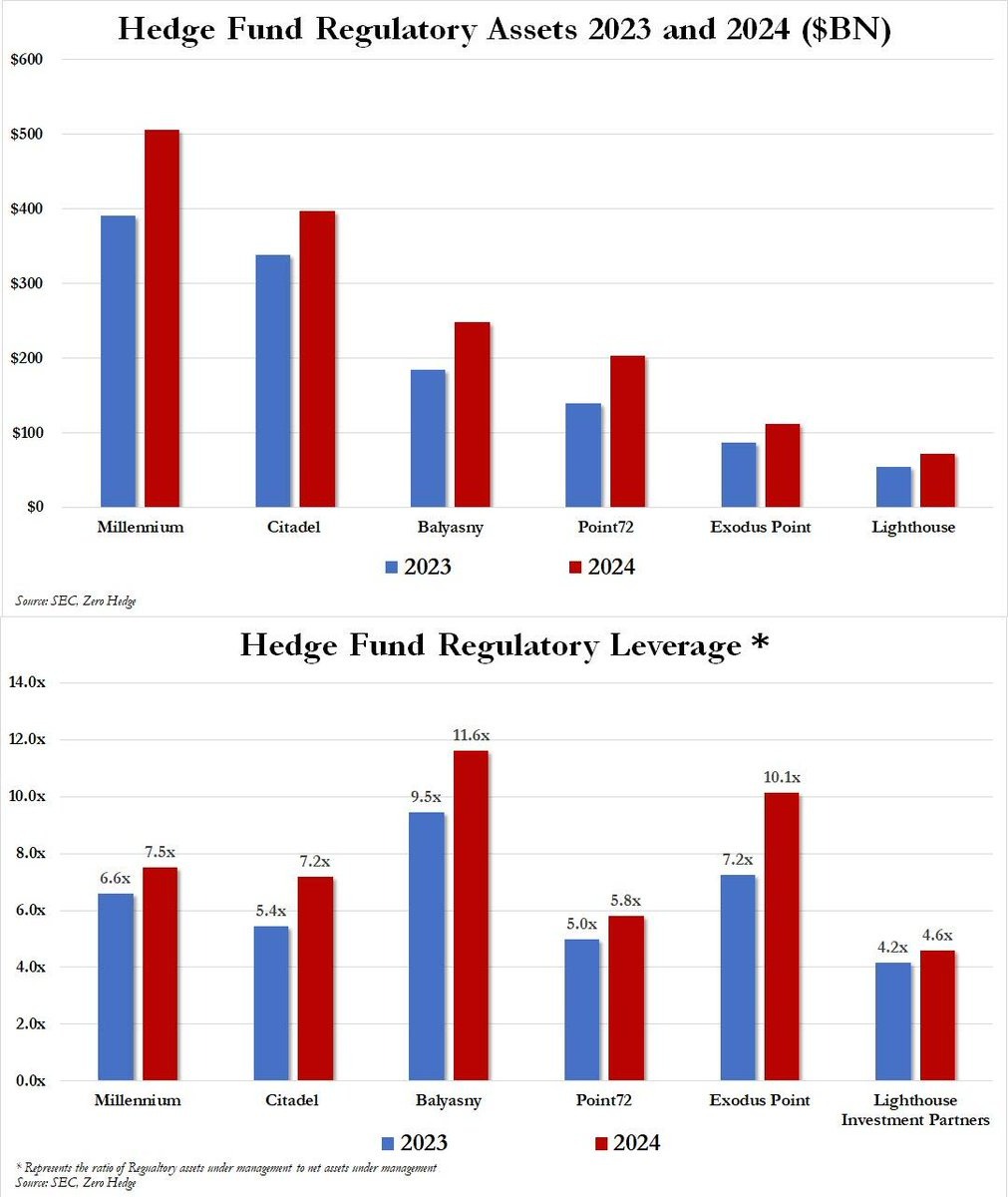

ZeroHedge notes that “the ‘big 6" multi-strategy hedge funds have $1.5 trillion in 2024 regulatory assets between them (up from $1.2 trillion in 2023) much of it invested in just one trade: Treasury basis.”

This is the modern financialization in action. All our best engineers finding ways to squeeze money out of the system instead of proactively putting it to work.

There is no intention to hold the bond for yield. There is no real economic activity supported. This is just leveraged plumbing arbitrage relying on stable markets, cheap funding, and precise models.

It’s not about investing.

It’s about milking a glitch in the system—until it breaks.

Then everyone pretends to be shocked.

And then, they all ask for a bailout…

So, here’s the game plan…

Step 1: Wait to see if there is an implosion

Step 2: Wait for the Fed and Treasury Department to coordinate on policy.

Step 3: Wait for Insiders to buy like bottom of every credit crisis since 2008 collectively.

Step 4: Buy the S&P 500 (edited)

This happened in 2009, 2011, 2015, 2018, 2020, and 2022.

It’ll happen again.

Now… let’s get to the real insight of the day…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.