Is That Money Ever Coming Home?

A momentum rally has accelerated in Europe and China. All while the dollar is dropping. That can only mean one thing.

Dear Reader:

I had an entire article planned today centered on “Trading Trump” after last night’s speech.

But since I’m heading to New York for the weekend, that will be Saturday’s story.

Instead, I want to bring you back to where we sat on February 21.

That day, I sent a warning that our reading had gone negative.

Since then, the S&P 500 has lost slightly more than 5%.

As you know, our signal measures stocks in very specific buying and selling conditions. Yesterday, buying pressure fell to its lowest since the Fed began Quantitative Tightening in late 2021.

So, markets were heavily bearish.

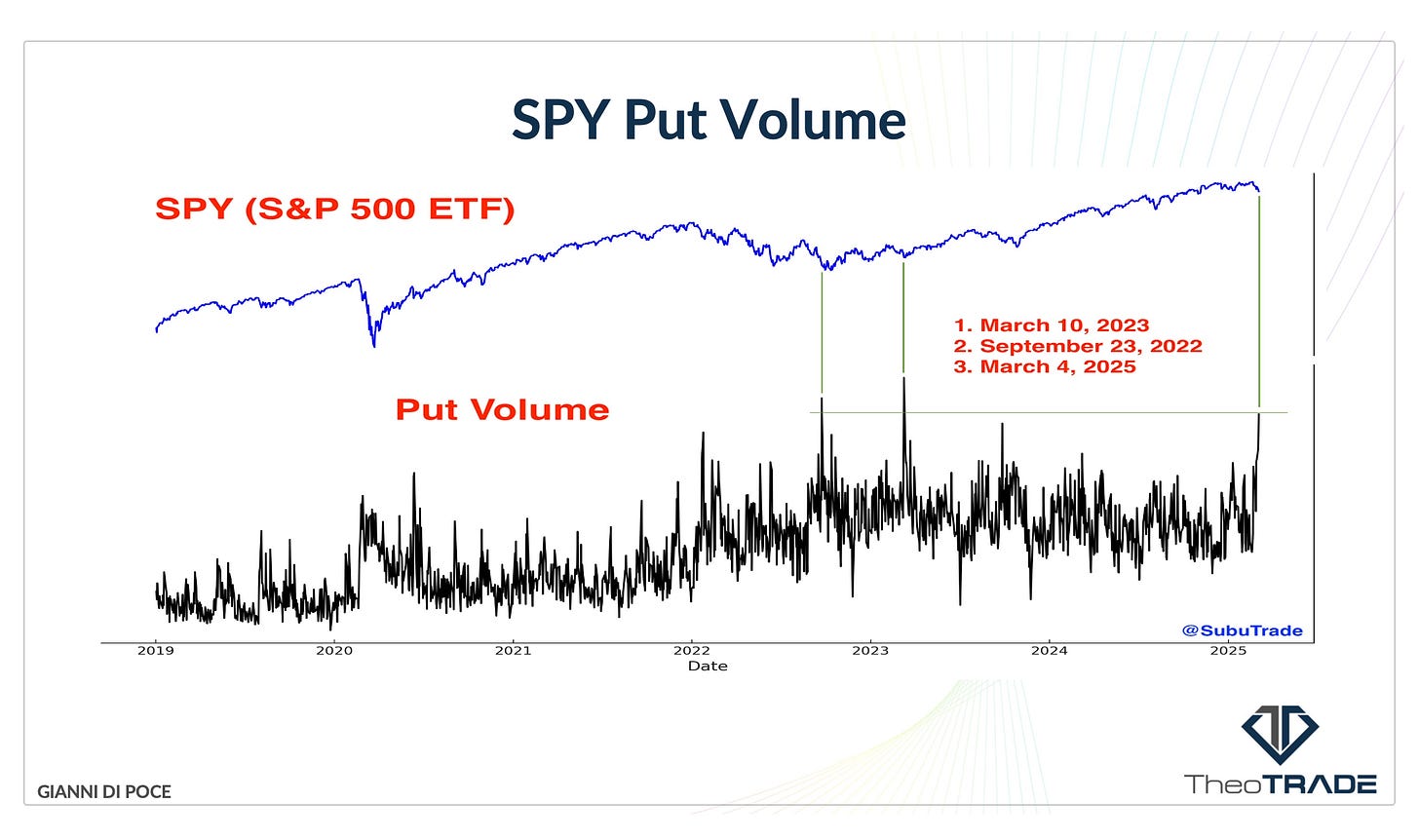

In addition, S&P 500 Put purchases recently hit their highest levels since the 2022 GILT Crisis (the global liquidity bottom) and the March 2023 Silicon Valley Banking Crisis. These are two signs we could and should be bottoming out right now.

Add that we’re now seeing a few stocks gain buying momentum… and you may have reason to speculate.

Or…

Whe…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.