K Street Confidential: Buy America's Latest Monopoly Courtesy of Washington Insiders

Welcome to the trial balloon of a letter I'd like to market and sell: It's called K Street Confidential, tracking +40% of the U.S. economy that's driven by government influence, greed, and activism.

“It’s Not a Free Market… It Never Was…”

Dear Reader,

The Willard Hotel is a stone's throw from the White House.

It is a silent sentinel to one of the most pivotal transformations in American politics.

Imagine it’s 1870 in Washington, D.C., five years after the Civil War ended.

The air is thick at the Willard with cigar smoke and whispered deals.

Enter Ulysses S. Grant, Civil War hero turned reluctant president.

More at home on the battlefield than in the political arena, Grant sought solace in Willard's cozy lounge.

Little did he know that his evening ritual of nursing a whiskey and cigar would give birth to a practice that would shape the nation for generations.

Word spread fast among Washington's power brokers about his evenings there.

Soon, Willard's lobby became a bustling hive of activity, with everyone from cunning financiers to railroad tycoons vying for a moment of the president's time.

The rumors go that the art of lobbying, as we know it today, was born here. Here, business and political leaders meet with government officials in informal settings, such as in (you guessed it) the lobby, to influence legislation and policy decisions.

This trend forever linked the Willard Hotel to the art of influence peddling in American politics.

Today,

Lobbying is a massive Washington D.C. business… that now spends north of $4.27 billion a year, anchored by 12,939 registered lobbyists.

It is one of the most essential undercurrents of our economy, north of $25.4 trillion annually.

Welcome to K Street

The spirits of those 19th-century influence peddlers live on, but they've traded the Willard's lobby for a more potent symbol of power: K Street.

K Street has long been the hub for organizations, firms, and individuals looking to influence public policy, lawmaking, and government decisions. This notorious road - highlighted in purple below stretches from the wealthy enclave of Georgetown to the outskirts of Embassy Row, where foreign countries house their official business in the nation’s capital.

Many lobbyists, law firms, public relations agencies, and trade associations set up offices on or near K Street, making it a central business location.

During my time in Washington, D.C., I worked for one of the most influential lobbying firms on this street and in other powerful enclaves like Dupont Circle and National Harbor.

But K Street was unlike anything I’d ever witnessed in my travels.

Imagine walking down K Street on a crisp fall morning. Steakhouses and power broker meetings surround you. As sharply dressed men and women hurry into imposing office buildings, the air buzzes with anticipation.

These modern-day power brokers represent a staggering array of interests:

Energy trade associations fighting for favorable regulations

Wall Street's biggest banks seeking to shape financial policy

Non-government organizations aiming to influence everything from environmental laws to foreign policy

And the stakes?

Higher than ever.

We're talking about firms that can make or break legislation with a well-placed phone call or a strategically timed campaign contribution.

Of course, K Street isn't just home to lobbyists.

Walk a few blocks, and you'll find yourself at the doorstep of The Federal Reserve Board of Governors, the puppet master of American monetary policy.

Its 1850 K St NW location is one of four buildings run by the Fed and is just a mile from the Eccles Building, where its main offices sit.

This duality is what makes K Street the beating heart of American influence.

It is the most important financial street in the world.

It's more influential than Rodeo Drive.

More powerful than Fleet Street, La Défense, Bay Street, and Dalian Road combined.

And Wall Street?

We may wonder what investors are eyeing or what secrets are shared on Wall Street.

But K Street is what drives policies, shapes industries, and fuels global liquidity.

All three drive the equity markets…

And all three influence the biggest player in all of modern finance.

The U.S. government.

So many financial publications have overlooked the U.S. government for years, failing to understand that if you follow the money, you can do exceptionally well just riding the trends shaped by policy.

It is $6.2 trillion - that’s correct - is up for grabs every single day.

And we, as investors, must act like those hungry D.C. lobbyists—seeking our cut on the action by doing one simple thing: following the money.

The $6.2 Trillion Elephant in the Room

For years, I’ve connected myself to two types of investors and done very well.

First, I follow insiders, the executives at companies (CEOs and CFOs) who buy their own stock with their own cash. Academic studies have proven that insider buying is the top anomaly in finance—one that has generated significant returns for investors following the purchases of key executives.

Second, we Must follow activist investors.

These individuals or groups purchase significant stakes in a company to push for changes they believe will increase shareholder value.

They may advocate for restructuring, cost-cutting, or management changes.

Their goal is to influence company decisions and improve financial performance, often resulting in short-term gains for shareholders.

Well, let us ask ourselves a question.

Who are the ultimate activists and the ultimate insiders in America today?

It’s not the hedge funds in Connecticut. It’s not the banks in Manhattan.

In a world driven by public policy, activism, and walls of influence spending, there is only one activist who matters.

I was reluctant at first to admit this…

But I've come to a simple, startling conclusion after two decades in finance.

The United States government is the world's most powerful activist investor, wielding a mind-boggling $6.2 trillion annual budget.

This cannot be debated. Considering how activist the U.S. government and its central bank have become over the last three decades showcases the results of our economic and political system.

This isn't just spending; it's a force that shapes entire industries with the stroke of a pen.

Let me give you an example from my own experience:

I once worked with a major healthcare company before the Affordable Care Act was drafted. This was only in 2009 when Democrats pushed for a sweeping law that would influence at least 20% of the American economy.

The corridors of power were abuzz with activity, and every word in that bill could mean billions in profits or losses for our clients.

You don’t even need to hear about the meetings I had. You don’t need to hear about the Congressional aide drinking four martinis at a K Street steakhouse while bragging about how this legislation would “lower costs” - even though it never did. You don’t need to hear about the insane back-door deals made to buy out Senators for their decision votes.

You need only look at one chart—that of health insurance giant Cigna (CI) since the passage of that law.

Shares of Cigna are up more than 900% since the passage and implementation of the Affordable Healthcare Act (April 2010).

Cigna has an annualized return of 18.1% since April 2010… far outpacing the 13.7% return on the S&P 500.

Coincidence? I think not.

But it's not just healthcare.

Take the lobbying and influence peddling of our massive military-industrial complex.

In the last three years, I have explicitly pointed out that the U.S. government effectively bailed out three major contractors at different periods. How do they do this? By passing tailormade legislation around global military actions that explicitly benefit a supplier based on the military needs at that moment.

Look at RTX Corp (formerly Raytheon), which was in a tailspin after Pratt & Whitney turbo engine recalls wiped out $35 billion in market cap. But the Hamas-Israel conflict provided a lifeline. As a critical Iron Dome missile defense system supplier, RTX saw demand for its Tamir interceptor missiles soar. With each rocket costing $50,000 to $100,000, U.S. aid to Israel funneled billions toward replenishing these systems, stabilizing RTX at a critical moment. Problem solved.

Then there’s Lockheed Martin, which faced similar pressure last year after cutting its guidance for F-35 deliveries due to production delays. This news sent its stock down 11%, wiping out roughly $12 billion in market cap. But like RTX, October 6th was a lifeline as the stock slipped. Again, there is no coincidence here.

Finally, we have Boeing. Years of scandal—whether the 737 Max disaster or 787 Dreamliner issues—have left the company in rough shape. But somehow, just when Boeing hits new lows, defense contracts flow in like clockwork.

Take the $2.6 billion contract from the Air Force for two new prototype aircraft, not to mention orders for Apache helicopters, Ospreys, and F-15 Eagles. The timing of these contracts seems almost perfect, as Boeing continues to receive government lifelines that keep it afloat.

As we enter another decade of war, it seems the U.S. government has extended the same “Too Big to Fail” status to military contractors as it did to banks in 2009. Whether through legislation or defense appropriations, the government ensures these giants—RTX, Lockheed, or Boeing—always land on their feet.

And now, as you’ll read in this report, I have a hunch that one of our Naval suppliers received the same treatment in the last three weeks.

And that sector… is another 3.5% of GDP.

In the last five years, the U.S. economy has transitioned greatly to a “command economy”—one dominated by government spending. The percentage of government spending as a share of GDP has varied significantly from 2008 to 2023.

Here's a summary of the trends during that period:

2008-2009: Due to the financial crisis and subsequent recession, government spending increased sharply, peaking at approximately 25% of GDP.

2010-2019: Spending as a percentage of GDP stabilized between 20% and 22% as the economy recovered and stimulus measures were phased out.

2020-2021: During the COVID-19 pandemic, government spending surged again, reaching around 31% of GDP in 2020 and 30.5% in 2021 due to emergency relief measures and economic stimulus packages.

2022-2023: Government spending began to decline as pandemic-related spending decreased, moving closer to historical averages at around 24-26% of GDP.

But these figures don’t accurately describe Washington’s influence. I’d estimate that we undercalculate the amount of spending by roughly half.

If we consider direct government spending (typically 20-25% of GDP) and add sectors influenced by government policy (healthcare, education, defense, etc.), the "government-influenced" share of the economy could range from 40-50% of GDP.

This includes the government's direct spending (federal, state, and local) and indirect influence through regulations and subsidies in critical industries like healthcare, housing, and agriculture.

This broader view highlights how a substantial portion of the U.S. economy operates under government direction or heavy influence, even if it’s not formally classified as public spending.

And that’s the money that we genuinely need to follow.

What Private Market?

What’s the impact of a more influenced economy from the government?

The answer is simple: Less economic freedom.

The tentacles of government reach further into the private sector with each passing year.

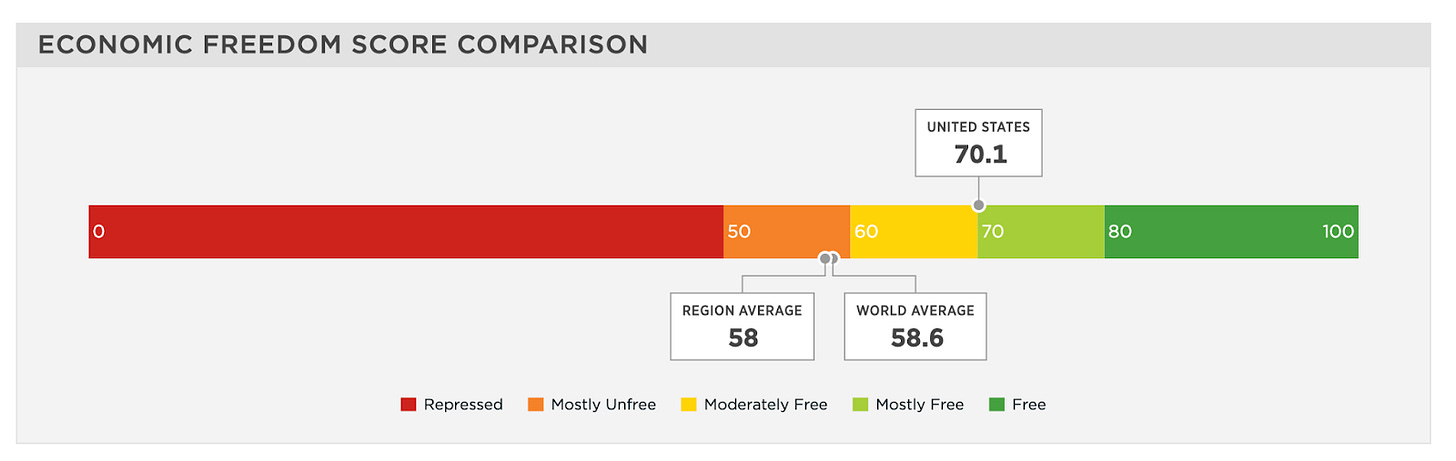

Since 2011, the United States has plummeted from 7th to 25th on the Heritage Foundation's Economic Freedom Index.

The primary causes?

Debt levels that would make even a Wall Street trader blush

Government spending that seems to know no bounds

A worrying erosion of government integrity

The Heritage Foundation issues the following warning in its 2024 rankings:

“Enormous policy challenges undermine long-term U.S. economic competitiveness. Big-government policies have eroded limits on government, public spending continues to rise, and the regulatory burden on business has increased. Restoring the U.S. economy to “free” status will require significant changes to reduce the size and scope of government. Over the years, unchecked deficit spending and government debt have accelerated, and inflation has undercut economic livelihood. Uncertainty and poor policy choices have left the U.S. economic outlook in flux.”

And the trends will continue.

There's no history of nations becoming more economically accessible. The trend tends to go the other way—with more government intervention and more influence in the private markets.

This trend is known as dirigisme, an economic policy in which governments actively steer the economy by influencing and directing private sector activities.

Originating in post-war France, dirigisme has been employed by various nations to foster growth in strategic industries, ensure economic stability, and maintain national security.

Today, in the context of K Street, dirigisme manifests through substantial government spending and regulatory influence, effectively 'picking winners and losers' based on political agendas.”

While we oppose these draconian measures and the do-gooders who think they can run the private markets better than the invisible hand, it is how the world works.

I don’t write this as a eulogy to America, and I don’t plan to return to politics.

I simply invite you to come along and play the Washington game with me.

We must ask ourselves how to get our tax money back and boost our return on investment by following the money in D.C.

And for that reason, we have launched this new publication.

Why K Street Confidential?

Why float K Street Confidential as an idea?

I've been interested in this for decades, and I’d like a publisher to see it for what it is.

The intersection of politics and finance… and an honest look at how the U.S. economy works.

and a place where opportunity—backed by policy, bought into by politicians, and fueled by relentless money printing and borrowing—exists for retail investors eager to “follow the money.”

In my years navigating the murky waters of Washington's influence, I've seen how the game is played.

I believe that you, whether you’re a member of the American public or an expat watching from another longitude, deserve to know what's happening behind closed doors.

In each issue of K Street Confidential, we'll:

Expose the hidden influences shaping policy, and find one company poised to benefit each month - including a dive into how U.S. government action will fuel their success.

Track major government spending initiatives and their real-world impacts for companies poised to profit from ongoing government influence.

Analyze stock purchases by Congressional officials (you'd be surprised what you can learn from public disclosures) to get a sense of sectors and businesses poised to succeed.

Decode the often cryptic moves of the Federal Reserve and lobbying efforts on K Street.

We're here to follow the money and connect the dots that others miss or ignore.

Because in Washington, knowledge isn't just power—it's currency.

The lobbying game may have started in Willard's smoke-filled lobby, but the real action is happening on K Street and in the corridors of power.

With K Street Confidential, you've got a front-row seat to the most incredible show in American politics.

But more importantly… to the borrowed, printed, and spent money.

Put your politics aside… and follow the money.

You’ll be pleased with the results.

So… let’s get to it.

This month… we’re looking at one of the most apparent plays in American technology… an AI player that has done the most brilliant thing possible to preserve its monopoly…

It has followed in the footsteps of previous industrialists who aligned their business with U.S. national security interests, forging a 21st-century digital moat that will be nearly impossible to replicate.

This month, we will examine the tech giant ASML in the Netherlands.

ASML - The Modern Monopoly Shaping Our Silicon Future

At the dawn of American industrialization, two figures emerged.

They were destined to sculpt a nation on the rise. Andrew Carnegie, a Scottish immigrant turned industrial titan, envisioned a future built with steel.

Meanwhile, Andrew Mellon, raised in a world where investment and economic growth were daily discussions, aimed to make his mark on American finance.

In the late 19th century, Carnegie created Carnegie Steel, a monolith that monopolized the industry and propelled the country's infrastructure.

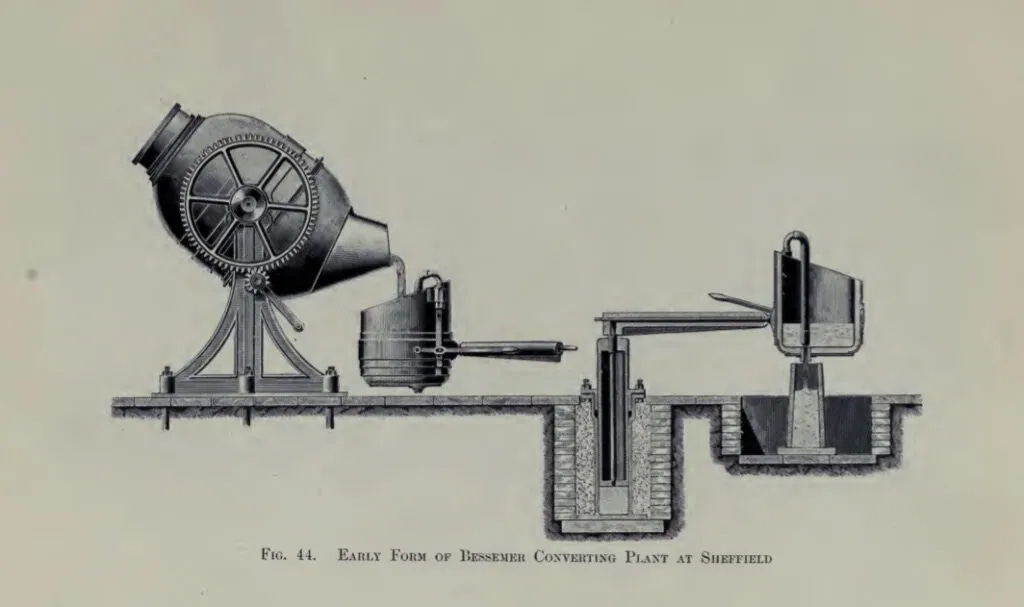

Carnegie pioneered the Bessemer process at Edgar Thomson Steel Works in Braddock, Pennsylvania. This revolutionized steel production and ushered in an era of immense industrial prosperity.

Carnegie's strategy was clear: he minimized costs and eliminated competition through innovation and control over the supply chain.

His mills tirelessly produced steel, essential for a growing nation's insatiable appetite.

By owning everything from mines to railroads, Carnegie's influence was unparalleled.

Competitors could only match his empire's scale and efficiency.

But Carnegie's success wasn't just about vertical integration and technological innovation.

He masterfully leveraged government policy and resources to cement his dominance:

Railroad Expansion: Carnegie capitalized on the federal government's push for a transcontinental railroad, securing lucrative contracts to supply steel rails.

Regulatory Capture: Carnegie and his associates actively lobbied for policies favorable to the steel industry, cultivating close relationships with politicians and regulators.

Infrastructure Projects: As the federal government invested heavily in modernizing the nation's infrastructure, Carnegie positioned his company as the primary supplier.

Military Contracts: By aligning his business with national defense interests, Carnegie secured lucrative contracts and strengthened his political influence.

Urban Reconstruction: Following devastating urban fires, Carnegie promoted steel as a fire-resistant building material, effectively creating a government-mandated market for his products.

This monopoly didn't just amass enormous wealth.

It transformed the American landscape, marking the rise of a global industrial power.

As Carnegie's steel laid America's foundations, Andrew Mellon recognized the significance of this dominance. Thanks to his keen understanding of how market leaders could drive the burgeoning American economy, he went on to make a fortune by investing in industries poised for growth.

Mellon's strategy was to invest in unmatched company leaders defining their markets.

His knack for identifying such businesses before their potential was widely recognized fueled his success.

This era marked a significant collaboration between industrial magnates and government initiatives, channeling substantial public resources into infrastructure.

The government's investment in infrastructure effectively fueled Carnegie Steel's growth, solidifying its monopoly and Andrew Carnegie's legacy in American history.

It also helped Andrew Mellon build a family bank into a financial empire.

Mellon leveraged the profits from government-funded infrastructure projects to expand Mellon Bank's influence.

He diversified into various sectors and financed other burgeoning industries. This strategic expansion solidified Mellon Bank's status as an American finance powerhouse and underscored the Mellon family's legacy in banking and investment.

T. Mellon and Sons, founded in 1869 by Andrew's father, Thomas, focused on serving the financial needs of Pittsburgh's growing business community. Under Andrew's guidance, the bank expanded its reach and influence, eventually becoming Mellon National Bank and Trust Company. This expansion laid the groundwork for T. Mellon and Sons to evolve into a cornerstone of American banking.

In the 20th century, Mellon Bank continued to grow, both organically and through strategic mergers. The transformation into a global financial services company culminated with the merger of Mellon Financial Corporation and The Bank of New York in 2007, creating BNY Mellon, an international financial services powerhouse.

Today, BNY Mellon is a testament to the enduring legacy of Andrew Mellon's investments in the late 19th century, most notably where government dollars met little competition. It plays a crucial role in facilitating the dollars printed in Washington, acting as a linchpin in the U.S. financial system and ensuring the smooth flow of funds that underpin the nation's economy.

The Modern Monopoly: ASML's Reign in the Silicon Age

Fast-forward to today, and we find ourselves amid a new industrial revolution—the age of silicon. At the heart of this revolution stands a company that embodies the spirit of Carnegie's monopoly and Mellon's financial acumen: Advanced Semiconductor Materials Lithography, better known as ASML.

Founded in 1984 in the Netherlands, ASML has consistently pushed the boundaries of semiconductor manufacturing. What sets ASML apart is its pioneering photolithography equipment, an engineering marvel at the forefront of chip fabrication technology.

Now, picture this: a machine so massive it takes 250 crates to transport, weighing in at a whopping 330,000 pounds. It's like shipping the Statue of Liberty, only this lady is printing the future.

And the price tag? Hundreds of millions per unit for their current models.

That's right, folks. For the price of a small island nation, you, too, can own the key to technological supremacy.

ASML's next-generation High-NA EUV tool, the Twinscan EXE:5000, is set to double that price to a jaw-dropping $380 million. Intel's CEO Pat Gelsinger casually called it "400-ish million." Because when you're playing in the big leagues, what's a few million between friends?

This behemoth isn't just expensive; it's a technological marvel.

It can print at an 8nm resolution, a significant leap from the 13nm resolution of current Low-NA EUV scanners.

In layperson's terms, it's like going from writing with a Sharpie to etching with a laser. This advancement allows for building about 1.7 times smaller transistors than today's, resulting in almost triple the transistor density.

We're talking about the kind of precision crucial for producing chips using sub-3nm process technologies, a target the industry hopes to reach between 2025 and 2026.

And here's the kicker: ASML has already disclosed "10 to 20" orders for these high-NA EUV machines from companies like Intel, Samsung, SK Hynix, and TSMC. That's potentially $8 billion worth of orders for machines that don't exist yet. Talk about a seller's market!

The Only Game in Town

ASML isn't just a leader in its field; it's the only player.

Here's why:

ASML is currently the only manufacturer of EUV machines on the planet. If you want to make the most advanced chips, you have one option: ASML. Other companies like Canon are developing alternative processes such as "nanoimprinting."

But it's not EUV. It's like competing with a Ferrari by building a fast bicycle.

Canon, Nikon, and others are all playing catch-up, but they are still years behind.

As the Biden administration pushed for ASML to stop its contracts with China for EUV machines, China, which used to be a big customer, is now left out in the cold.

They're scrambling to develop their technology but need to catch up.

Experts estimate China is still at least a decade behind ASML's technology.

That’s a heck of a moat, aided entirely by the U.S. government.

ASML’s Competitors: Falling Behind

Other traditional players in photolithography, like Nikon and KLA, have tried to keep pace, but ASML’s relentless R&D investment has left them far behind:

Nikon: Once a powerhouse in lithography, Nikon has yet to make meaningful progress in EUV. Industry experts estimate Nikon is at least 7-10 years behind ASML in EUV technology.

Canon: While innovative, Canon’s focus on nanoimprinting just doesn’t stack up against EUV. It’s a niche solution that won’t soon challenge ASML’s dominance in advanced chips. Canon is likely a decade behind.

KLA: Though KLA remains a strong player in process control and metrology, it hasn’t leaped EUV lithography. The company’s expertise complements ASML’s tools, but in EUV development, KLA has also been trailing by at least 8-10 years.

ASML’s advantage is not just technical—it’s systemic. The company has carefully built and controlled a vast, intricate supply chain, including critical partnerships with specialized suppliers like Carl Zeiss for ultra-precise lenses and Trumpf for lasers.

These suppliers are vital to creating ASML’s EUV machines, making it nearly impossible for competitors to replicate the entire ecosystem. ASML manages a critical choke point in the semiconductor industry. Intel, TSMC, and Samsung rely on ASML’s machines to push their technology forward, making ASML an indispensable partner to the next generation of chip production. The moat they’ve built around their EUV technology is fortified by billions in R&D, an unmatched supply chain, and a massive technological lead.

There's no alternative for anyone looking to make the world’s most advanced chips. ASML is lapping the competition.

Market Dominance: A Dutch Giant

ASML isn't just big; it's a colossus straddling the global tech industry.

This dominance hasn't gone unnoticed by the Dutch government.

They're so concerned about potentially losing ASML that they've launched "Operation Beethoven" to keep the company on Dutch soil. After watching Shell and Unilever move their headquarters to Britain, the Netherlands is in no mood to lose another crown jewel.

ASML is expanding its operations in the Brainport Eindhoven region, with plans for a new campus that could create up to 20,000 jobs.

This expansion is causing a shift in local housing demands, as ASML's workforce typically consists of highly educated, well-paid employees.

Consequently, Eindhoven is adjusting its housing strategy to accommodate this change, moving away from its previous focus on social and affordable housing towards developing residences suitable for highly skilled workers.

The Dutch government has committed a substantial €2.5 billion to enhance local infrastructure and housing to support ASML's growth and ensure it remains in the Netherlands.

This investment will address pressing concerns such as inadequate transportation networks and the strain on the local electrical grid. The area’s infrastructure—from roads and public transport to utilities—has struggled to keep pace with the booming high-tech industry.

ASML CEO Peter Wennink has even publicly expressed that ASML’s ability to expand and meet global demand could be severely hampered without upgrades to the electrical grid. The Dutch government’s €2.5 billion commitment will meet these critical needs.

In addition, the government will review tax breaks and policies related to attracting skilled migrants to ensure ASML can continue recruiting top talent from around the world. The company has raised concerns about the potential phase-out of tax incentives that have historically made it easier to bring in highly specialized talent from abroad.

These are just a few examples of how governments will move mountains for monopolies with leverage. When a company like ASML holds such strategic importance in the global supply chain, it evolves from an “ordinary company” to “a national asset.”

With Operation Beethoven, the Dutch government is making clear that it will do whatever it takes to keep ASML at the heart of the nation’s economy.

Why Uncle Sam is Just Cool with This Monopoly

The U.S. government's stance on ASML's monopoly might initially seem puzzling.

After all, isn't America all about free markets and competition? Well, sometimes geopolitics makes for strange bedfellows. Here's why the U.S. is comfortable with ASML's dominance:

Technological Leadership: By letting ASML stay on top, the U.S. can focus on other areas of innovation rather than trying to reinvent the wheel.

Supply Chain Security: Having one reliable source is easier to manage and secure than a complex network of suppliers.

Economic Stability: ASML's dominance ensures American semiconductor manufacturers have access to the best tech, keeping them competitive globally.

International Collaboration: ASML's Dutch roots allow the U.S. to work closely with European allies, presenting a united front in the tech race against China.

Controlled Access: By maintaining ASML's monopoly, the U.S. can better control who gets their hands on this critical technology.

China Enters the Chat

The geopolitical implications of ASML's monopoly came into sharp focus recently as the U.S. doubled down on efforts to limit China’s access to critical technologies.

ASML’s dominance in the semiconductor industry, particularly its EUV lithography machines, is now a crucial piece of the U.S. strategy to contain China’s technological advancement. By pressuring the Dutch government to expand export controls, the U.S. has effectively barred China from acquiring the most advanced chip-making technology, keeping the country from catching up in industries critical to civilian and military applications.

On September 8, 2023, these tensions escalated when China’s commerce ministry expressed its “dissatisfaction” with the Dutch government’s decision to expand export licensing requirements for ASML’s 1970i and 1980i DUV (Deep Ultraviolet) immersion lithography tools.

The Dutch government’s move, which aligns with U.S. restrictions, further tightened China’s access to ASML’s cutting-edge tools, solidifying the country’s position in the global tech race. In response, Beijing accused the U.S. of attempting to "maintain its global hegemony" by pressuring allies such as the Netherlands and Japan to join export controls.

The Longer Telegram, an Atlantic Council report, outlined the U.S. strategy in detail and recommended a robust economic and technological containment policy to limit China’s rise.

This strategy involves tightening the noose around vital technological advancements that could fuel China’s ambitions in artificial intelligence, military technology, and semiconductors. The U.S., leveraging ASML’s monopoly over EUV technology, ensures that China’s high-tech future remains stifled by the lack of access to critical tools.

This approach ties into the Broken Nest strategy, a concept developed by the U.S. Army War College that proposes a scorched-earth approach for Taiwan in the event of an imminent Chinese invasion. The strategy suggests Taiwan could cripple its critical infrastructure, specifically the Taiwan Semiconductor Manufacturing Company (TSMC), to deny China any significant gains from an invasion. TSMC is the world’s largest and most advanced semiconductor producer, and its destruction would severely disrupt the global semiconductor supply chain, significantly impacting China's technological and military ambitions.

This helps explain the sudden rush to bring hundreds of billions of dollars worth of semiconductor factories back onshore.

The goal is to make Taiwan a problematic military target and an economically and technologically unattractive prize, preventing China from seizing valuable technology that could fuel its future dominance.

The strategy is rooted in the idea that China’s reliance on foreign-made semiconductors and slow progress in domestic chip manufacturing make it vulnerable to supply chain disruptions. Should Taiwan destroy TSMC’s facilities, China would lose access to a crucial source of high-tech components when it needs them most.

The U.S. and its allies can continue to delay China's technological ambitions by ensuring that China cannot obtain ASML’s advanced equipment and by preparing for the potential destruction of Taiwan's semiconductor capacity. Meanwhile, China’s frustration with the export controls only highlights how critical this technology is to its growth and how effective the U.S. strategy has been in keeping it behind.

ASML sits squarely at the center of this geopolitical chessboard. By maintaining its monopoly on the world’s most advanced semiconductor manufacturing technology, the company finds itself at the heart of global tech supremacy, with the U.S. using it as a critical tool to contain China’s rise.

A Financial Powerhouse in Transition

ASML's financial story is as compelling as its technological one:

The "Transitory Year" of 2024: ASML's calling 2024 a "transitory year," expecting a slight 3% decrease in EPS.

2025: The Year of the Bull: Projections for 2025 show a staggering 59% growth in earnings.

Long-Term Growth Trajectory: Analysts project 14-18% annual growth for the rest of the decade.

Valuation: While trading at about 39 times its current earnings, based on projected 2025 earnings, that multiple drops to about 25 times.

Dividends and Buybacks: Since 2015, ASML has increased its dividend 4.8 times and reduced outstanding shares by over 10%.

The China Factor: China made up 49% of ASML's total Net Sales in Q2 2024, a significant portion now at risk due to export restrictions.

Future Outlook: With orders for "10 to 20" next-gen high-NA EUV machines and plans to ramp up production capacity, ASML's pipeline looks robust.

Source:Marketsandmarkets.com

A Monopoly Built on Science Fiction

ASML isn't just a company with a competitive edge.

It's a company operating in a realm that seems more science fiction than reality.

This monopoly isn't built on market manipulation or unfair practices.

It's built on pushing the boundaries of what's scientifically possible.

ASML has revolutionized semiconductor manufacturing with its Extreme Ultraviolet (EUV) Lithography technology.

EUV employs light with a minuscule wavelength of 13.5 nanometers, creating tiny and precise transistor patterns on silicon wafers.

This advancement is pivotal for maintaining the pace of Moore’s Law, ensuring that chips become faster and more efficient without escalating costs.

By monopolizing EUV technology, ASML controls the future of chip manufacturing and holds a significant sway over the global technology landscape.

For investors, ASML isn't just a safe bet – it's potentially the only bet if you want exposure to the bleeding edge of semiconductor technology.

They're the gatekeepers to the future of computing, AI, and anything requiring advanced chips.

It's not every day we recommend buying an expensive stock, but then again, it's not every day we stumble onto a glaring monopoly operating in a strategically critical sector. The stock is currently trading.

ASML is the real deal – a true monopoly in a world where such things are increasingly rare.

As we watch this high-stakes game unfold, remember: in Washington, and indeed on the global stage, the real stories are always hidden in the fine print. And sometimes, they're etched in silicon, nanometer by nanometer.

In the chess game of global tech dominance, ASML isn't just a player – it's the board itself. And that, dear readers, is a position of power that even Carnegie and Mellon would envy.

ACTION TO TAKE:

Consider a starting stake in ASML at $840 to $850 per share.

If the market pulls back, purchase a second stake and aim for $650 to $700 per share. The consensus stock price on Wall Street is north of $1,200 per share, or 44% upside.

It’s worth noting, however, that market optimism is mixed now, and concerns remain about China, Japan, and U.S. debt. Buy on pullbacks and follow momentum. Should this stock ever hit oversold on the Relative Strength Index and Money Flow Index at the same time, as it did in early September, consider adding to the position.

We expect the equity market to struggle in late 2025 and 2026 as liquidity peaks and equities face challenges from higher U.S. bond yields in the future.

However, corrective action by central banks, in addition to another rise in liquidity starting in late 2027/2028, can fuel an incredible rally for ASML.

In addition, ASML may begin to exhibit more muscular monopoly strength, similar to what Microsoft has done over the last few years. Strong growth for ASML would also fuel greater passive investment and activist performance benchmarking.

Given its volatility in recent years, this stock belongs in the more speculative portion of a long-term portfolio. That said, it will continue to benefit from the expansion of liquidity, greater institutional investment, and increasing spending on AI.

Currently, just 59% of ASML stock is owned by institutions. We expect this figure to continue rising through the decade, helping to stabilize the share price.

Who in Power is Buying What?

How do some investors anticipate market shifts before they happen? The answer isn't always about complex algorithms or Wall Street connections.

Sometimes, it's about paying attention to the right people—like members of Congress.

Members of Congress are uniquely positioned to influence legislation and regulatory changes that can significantly impact various industries and companies.

Their investments often reflect their insider understanding of upcoming policies, giving them a strategic advantage in anticipating market movements.

This alignment between legislative power and financial investments creates a potent mix that can shape industry trends and economic landscapes.

When lawmakers invest in specific industries or companies, it can signal upcoming legislative priorities or regulatory adjustments that may favor those investments.

For instance, a member of Congress investing in a tech company poised to benefit from new technology policies might indicate forthcoming support for that sector.

These investments can influence stock performance, drive market trends, and even affect the strategic decisions of other investors who may follow suit.

While insider trading laws prohibit the unlawful use of non-public information, lawmakers' investment activities still raise ethical questions.

When legislators stand to gain financially from the policies they enact or influence, conflicts of interest can occur. Transparency and strict adherence to ethics rules are crucial to maintaining public trust and ensuring financial gains do not compromise legislative integrity.

Let's peek behind the curtain at some recent purchases that caught our eye:

Greg Landesman (D-OH-1)

Picture a congressman, not just any congressman, but one sitting on the House Subcommittee on Technology Modernization. Imagine him quietly investing between $16,000 and $65,000 in Arista Networks. Intriguing, isn't it?

Arista is no bargain-bin stock, but it's another glittering name in the ongoing Artificial Intelligence gold rush. This investment speaks volumes for a member of Congress on a tech modernization committee. Arista stands at the forefront of AI networking infrastructure, a critical component in the ongoing AI revolution.

As Uncle Sam increasingly focuses on maintaining technological leadership, Arista's role in enabling large-scale AI deployments becomes more than just a good investment—it becomes strategically significant. The company's open architecture and scalability make it an attractive partner for major tech companies and, potentially, government projects aiming to modernize infrastructure.

Margerie Taylor Greene (R-GA-14)

Ten positions, all ranging between $1,000 and $15,000 on disclosure

Now, let's turn our attention to a portfolio that reads like a who's who of American industry. Berkshire Hathaway, Blackstone, Cardinal Health, Crowdstrike, Alphabet, Intel, Lam Research, Southern Copper, UPS, and Microsoft. A veritable buffet of blue-chip stocks and tech titans.

Typically, I'd dismiss a large allocation of capital like this. But this portfolio is a "Taylor"-made allocation that will benefit from continued government spending, an increase in global liquidity, and defense against monetary inflation. It's a 10-stock portfolio, and I'd estimate that it's equally distributed and likely in a total portfolio range of $100,000.

The purchases of these stocks - on September 20 - come on the heels of multiple significant shifts in monetary policy and fiscal policy in the United States, Japan, and China. The U.S. is slashing interest rates - which is beneficial to the tech side of this portfolio.

But China has started a massive stimulus program that will likely require trillions in additional injections, which is bullish globally, especially for copper prices. Based on aggressive demand, we are looking for Southern Copper (SCCO) to take out its 52-week high of $129.07.

Senator Markwayne Mullin (R-OK)

Lastly, let's not overlook Senator Mullin's $15,000 to $50,000 stake in IQVIA Holdings. IQVIA, born from the union of IMS Health and Quintiles in 2016, is a global titan in advanced analytics, technology solutions, and contract research services for the life sciences industry.

This isn't just another healthcare stock. IQVIA is a potential AI beneficiary, supporting pharmaceutical companies, biotechnology firms, medical device manufacturers, and other healthcare organizations. The senator's investment suggests he sees a bright future for the intersection of AI and healthcare. We'll be diving deeper into IQVIA and its operations in future issues.

September: Spotlight on Spending

Over the weekend, I strolled down memory lane, scanning through the Johns Hopkins School of Government alum list in Washington, D.C. As a former student of Global Security Studies, I couldn't help but notice the overwhelming number of my fellow alums who now hold influential lobbying roles.

What's fascinating isn't that these lobbyists work for the names you'd expect. We see plenty representing oil giants like ConocoPhillips, defense contractors like Northrup Grumman, and financial behemoths like Bank of America.

But isn't it incredible that among the top-ranked lobbyists, we find potent influencers working for companies like 7-Eleven, the NCAA, or non-profits and trade associations like the American Industrial Hygiene Association and The Real Estate Roundtable?

The obvious question is, "Why?"

Let's take 7-Eleven as an example. Why would a convenience store chain spend more than $1.08 million last year on lobbying? The answer lies in the labyrinth of policies impacting their operations, profitability, and strategic growth.

You might think you're just walking into a convenience store, but every aspect of that experience is orchestrated through a delicate balance of government influence and never-ending policy advocacy.

Just consider the issues that 7-Eleven alone must focus on in Washington:

Regulatory Compliance and Licensing: From alcohol and tobacco sales to food safety regulations, 7-Eleven fights to simplify licensing processes and shape product marketing rules.

Labor and Employment Laws: As a significant employer, 7-Eleven is interested in minimum wage laws, overtime rules, and employee classification standards.

Taxation Policies: Lower corporate taxes directly impact the bottom line, while tax breaks for expansion into underserved areas could drive growth.

Environmental, Energy, and Sustainability Regulations: Energy efficiency standards and tax credits for sustainable practices are high on the agenda.

Trade and Supply Chain Policies: With a global supply chain, 7-Eleven pushes for lower tariffs and favorable trade agreements.

Technology and Data Privacy Regulations: As the company expands its digital footprint, it seeks regulations encouraging new technologies while balancing data privacy concerns.

Healthcare and Pharmaceutical Regulations: Selling over-the-counter medications means lobbying for favorable product approvals and sales practice guidelines.

SNAP Program Expansion: 7-Eleven benefits from increased SNAP participation, lobbying for more eligible products, and improved transaction infrastructure.

You thought you were just going in for gas and a bag of chips, but you'll discover that all of this is a delicate balance—millions of dollars are spent to protect competitive advantage.

It's not a free market. It never was.

Biggest Lobbying Spend Disclosures (September 2024)

Finally, let's shine a spotlight on the top lobbying disclosures of September. We’re explicitly eyeing lobbying efforts over $1 million in disclosures.

Huntington Ingalls (HII) - $1.77 million. While Russia breaks the bank with a $142 billion defense budget, it's a drop in the ocean compared to the $916 billion the U.S. spent in 2023. Huntington Ingalls secured a $9.6 billion contract for new amphibious Naval ships. A pretty good return on their lobbying investment, wouldn't you say? However, there might be more to this story, with reports of defective welding on aircraft carriers and submarines in their yard. Damage control ahead? Likely. However, investors and traders may find a lot of defense in the stock at the $240 level.

Mastercard Worldwide (MA) - $1.15 million. As Washington tries to blame inflation on everyone but their money printing, efforts to rein in credit card fees are intensifying. Meanwhile, Visa faces a lawsuit from the Justice Department. Coincidence? I think not. Mastercard is part of a natural oligopoly in the financial markets. And with global liquidity set to rise in the year ahead, we project that stock will easily surpass its 52-week high and press new records in 2025. It is the backside of 2025 and 2026 where we are skeptical of the bull market’s continued run.

Until Next Time

In Washington, every handshake and every deal on K Street carries immense weight, shaping policies and influencing the economy in ways most remain unaware of.

With K Street Confidential, we aim to unveil these hidden dynamics and offer unparalleled insights into the forces that drive our nation.

Stay informed, stay empowered, and join us as we continue to uncover the intricate dance of politics and finance in our upcoming issues."

Stay positive,

Garrett Baldwin

Secretary of Defense

Yep Mullin bought a lot of

BMI

I need to followup on that. That was the point.

Pelosi invests based on spending and Fed activity.

I’ll touch on her when she is relevant.

I honestly thought I added the BMI stuff.

Let me send an adendum