My First Warning on Volatility

The ugly bond auction will soon introduce America to the Bond Vigilantes.

Dear Reader:

And we’re off.

This doesn’t look like that significant of a move when you scale back.

But it tells me something. For the last week, I’ve been warning about our momentum signal in the markets. Effectively, we stopped seeing any significant selling activity.

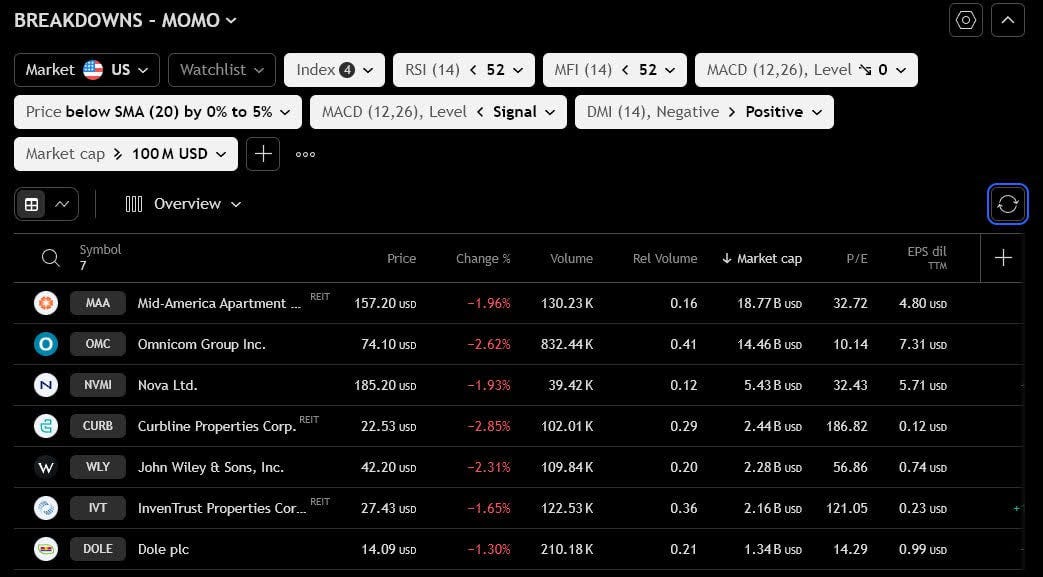

Euphoria hit… Now… here we are… Watching breakdown activity in names like Mid-America Apartment (MAA), DOLE (PLC), and Nova (NVMI).

Watching FICO (FICO), CarMax (KMX), and LendingTree (TREE) face new pressures.

When we hit these zero-selling periods, it becomes a contrarian time for many funds and traders to take profits. Remember, the purpose of the market is to sell.

We could start to see the onset of another 2022-like cycle that takes us lower and puts retail investors in a dizzying motion. As you know, I told investors to get out of the way on February 21 and March 26. I also mentioned our contrarian insider buying on April 10 and when momentum returned to the market on April 23.

Now, I’m worried that we’re back at the onset of another leg down, with us potentially retesting that 5,500 level. The bond market will be our guide. But I’m actively urging caution about loading up on equities again.

This is what we do. We’ve avoided every major drawdown since February 2020 by focusing our attention on key momentum levels. My next key level will be 5,780. Things can get very ugly from there.

If you’re not a member of the Capital Wave Report, I’m giving you another chance to navigate these markets in the coming weeks with me. I’ve made the best offer yet for new and long-time readers of Me and the Money Printer.

You’ll get daily pre-market analysis, up-to-date momentum readings, and a breakdown of stocks falling under key technical thresholds as they unfold (here’s a preview). If this market goes sideways…

Plus, we’ll have a full report in two weeks on Sovereign-style investments, which provide ample wealth protection, income generation, and long-term upside.

Can I make this any easier for you?

Hope to see you tomorrow… at 9 am with our best ideas.

Stay positive,

Garrett Baldwin