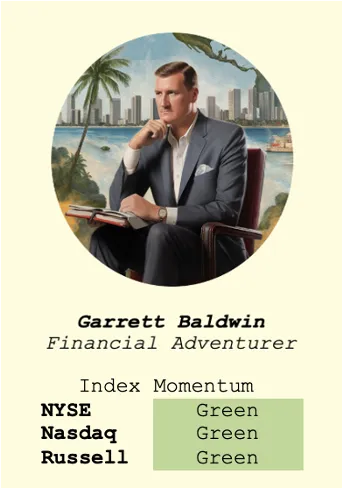

Postcards: How the Markets Really Work

It's not supposed to make sense. All you can do is react.

Dear Fellow Expat:

It’s not supposed to make sense.

I argue that anyone who thinks their MBA or CFA matters in today’s environment is foolish.

Machines run the equity markets…

Not humans.

Valuations are distorted by the massive amounts of passive investing via exchange-traded funds (ETFs), and machines regularly buck trends, which I’ll explain.

Algorithms do more than 80% of all trading. We are simply hired actors.

The only thing we can do is react, and that’s why we created our Equity Strength Signals. We know when the machines are selling, and we are well ahead of liquidity challenges that might send the market… much… much lower.

A few things brought me to this conclusion.

Michael Howell’s book Capital Wars altered my thinking about how “money moves markets.” Grant Henning’s book Trading Stocks By the Numbers helped me understand momentum at its core.

But Stanley Druckenmiller is the one person who really helped me recognize how distorted reality is in the financial markets.

In 2018, h…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.