Postcards: Steak Lunch and Oil Stocks

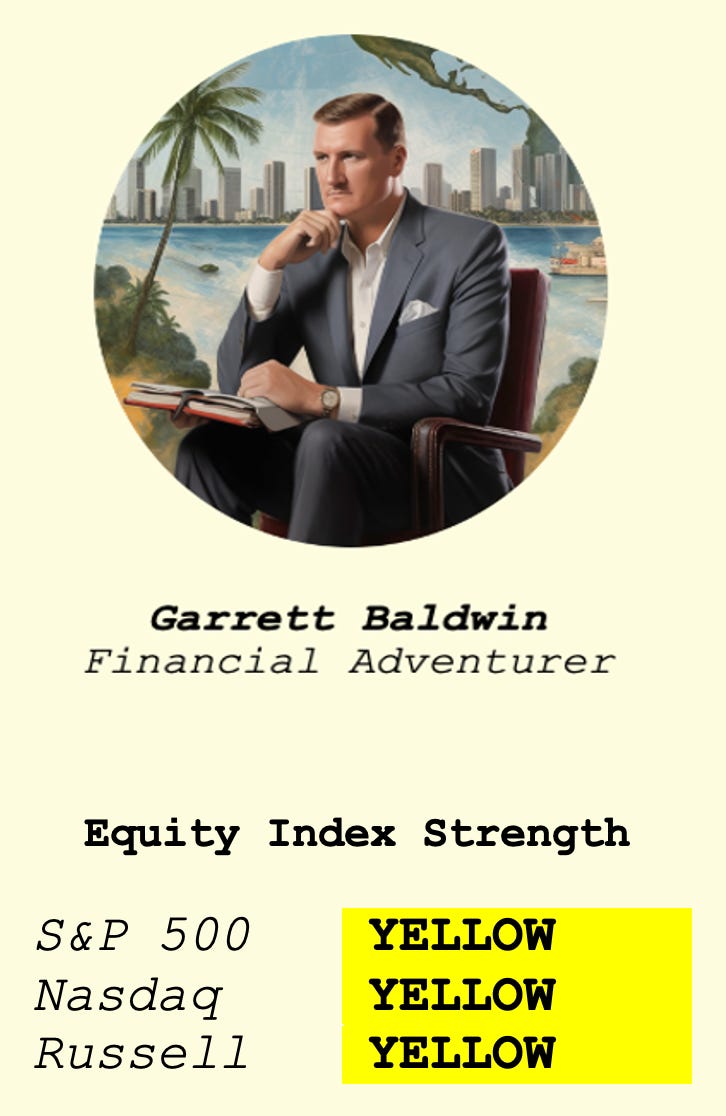

Tech squeezes higher, but things that matter are falling off a cliff.

Market Update: Don’t get comfortable with today’s technology pop.

The S&P 500 is rising today - and so is the Nasdaq 100 - on VERY light volume.

The SPY relative volume is at .67x, and the QQQ is at .74. This is a light volume compared to the usual amount of equity trading. I’m worried that the market is about to head much lower. Stay cautious. Selling pressure is VERY high on the energy side.

Oil producers and refineries are taking a hit. Valero (VLO), our top energy stock to trade, is off another 1% today. Not shocking, given that our energy signal is negative. Add that to the fact that other good companies are selling off—names like Devon Energy (DVN), Halliburton (HAL), and Ovintiv (OVV).

If any of these companies fall into a combination of oversold territory on the Relative Strength Index (RSI) and Money Flow Index (MFI), sell put spread about 10% lower than current prices. It’s a great trade - and you’d want to own these companies for the long term anyway.

Dear Fellow Expat,

Ameli…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.