Postcards: The Corporate Drama at McDonald’s (MCD)

The company's pushing a lot of chips across the table on value deals to maintain market share. The question now is whether that strategy will enhance its other goals for 2024 and 2025

Market Update: As expected, our S&P 500 signal has moved back to neutral (Yellow) due to position adjustments made before the Fed meetings on Tuesday and Wednesday. We are looking for a positive drift ahead of the FOMC conference on Wednesday. From there, pay close attention to the market's direction at 2:35 p.m., and then look for structured selling from CTAs in the final hour of trading after the Powell speech.

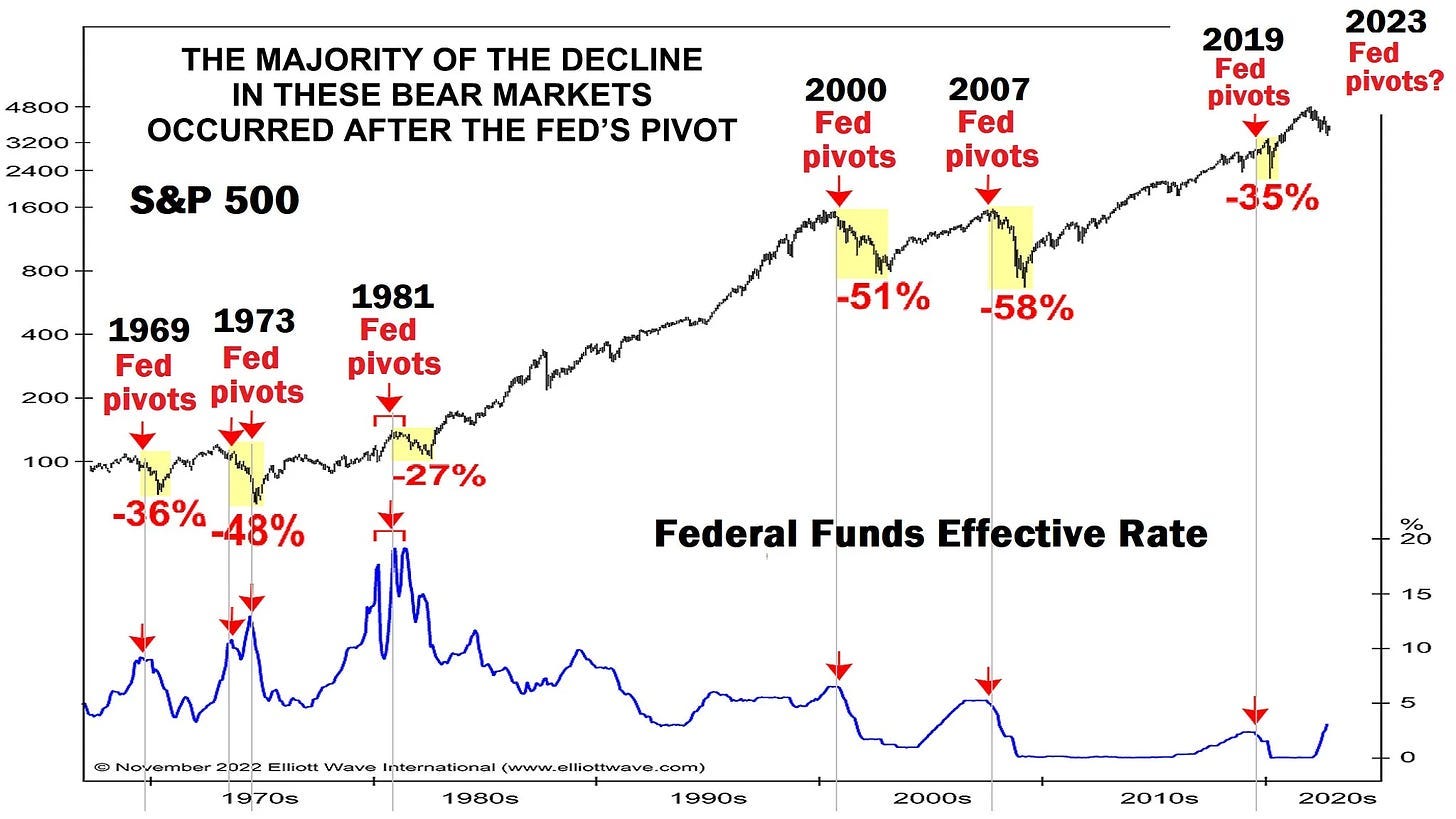

Volatility was ticking higher today as the market awaits a busy week of earnings reports and an update from the Federal Reserve on rate-cut expectations. Markets don’t expect a July rate cut but are projecting that the central bank could start cuts as soon as September. Recall my historical warning that Fed pivots on interest rates have led to sizable downturns in the market. Here’s a chart from Elliott Wave International explaining this phenomenon.

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.