Republic Risk: December Model Portfolios as Powell Kicks Off Friday Trading

We've just had one of the best single-month returns in a decade - and now everyone is back in the pool. Today, we'll get a test to see if the markets were right jumping ahead of the Fed on rate cuts.

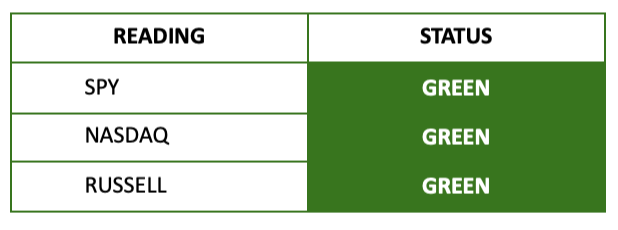

Equity Index Strength Is GREEN on the S&P 500 and GREEN on the Russell 2000

Each morning, we assess the full flows of the market by measuring statistical metrics on a very specific number of stocks to determine broader sentiment and the momentum trend. When these readings turn red, we focus on cash, build trades around positive sectors, or take inverse positions against indices. When it is positive, we focus on short-squeeze stocks, companies with improving fundamentals, and trading/investing around the actions of corporate insiders.

We’re green heading into Friday. Nothing significant to report, as yesterday was more of the same. The Russell is still trying to poke its head higher. But note that I explained how NVIDIA’s (NVDA) four technical readings in RSI, MFI, MACD, and ADX all went negative yesterday. It might be important for Nasdaq traders to note.

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.