Republic Risk: Energy is Getting Crushed

let it go... be ready to buy if it goes into oversold territory...

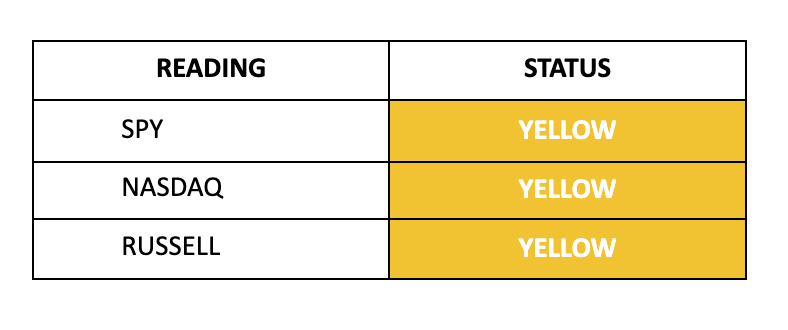

Equity Storm Watch Is YELLOW on the S&P 500 and YELLOW on the Russell 2000

Futures are under pressure again this morning as weak manufacturing data and a drop in construction spending add to concerns about the state of the U.S. economy. As investors await critical job reports this week, including job openings today and nonfarm payroll figures on Friday, market momentum remains cautious. Energy and basic materials are leading the downturn, with WTI and Brent crude closing at their lowest prices since early February. This follows OPEC+'s decision to phase out 2.2 million barrels a day of voluntary production cuts over the next year, starting in October, which has sparked fears of potential oversupply. This sell-off has an eerie feeling reminiscent of June 8, 2022, when a downturn in the energy sector led to a market drop of over 10% in a week. Stay frosty, things can get ugly in a hurry when the energy sector suffers a technical breakdown.

What to Do Today: Pay close attention to the NRG…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.