Republic Risk: Higher For Longer-Er

The Fed minutes... once again... told us what we already knew.

Equity Storm Watch Is GREEN on the S&P 500 and GREEN on the Russell 2000

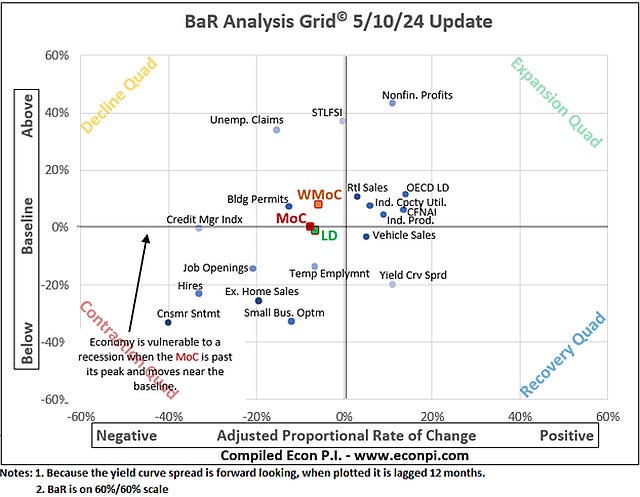

The Fed’s minutes showed that not only are our officials entertaining “higher for longer” on interest rates, but they also now suggest that interest rates may go up… not down in the future. Hate to say I told you so. That said, the damage is really starting to appear in the economy. This is a chart of major economic and financial indicators, with Leading Indicators moving into that Contraction area. A report wondered why so many Americans believed we were in a recession. The answer is everything contracting in the bottom left corner: Consumer sentiment, hires, job openings, temp employment, and small business optimism. Also, it doesn’t help that we’re borrowing 7% of GDP to produce a GDP of 3%. That’s… not real growth. That’s printed and borrowed.

What to Do Today: We know that seasonality in May and June during election years is typically good. But we are just coming off overbought levels on the RSI and MFI on the…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.