Republic Risk: Inflation at 3.3%

Monthly inflation was flat. The number is still wrong.

Equity Storm Watch Is YELLOW on the S&P 500 and GREEN on the Russell 2000

Today marks the collision of two of the market's most volatile events: the release of the Consumer Price Index (CPI) and the conclusion of the Federal Reserve's two-day policy meeting on interest rates.

These simultaneous events, happening only 13 times since 2008, have typically been bullish for the market. The CPI will be announced at 8:30 a.m. EST, followed by the Fed wrapping up its FOMC meeting at 2 p.m., with Jerome Powell delivering prepared statements at 2:30. Keep an eye on the market at 2:37, when algorithmic traders have had a chance to process Powell’s statements. The market will be eager to see where certain members stand concerning future rate cuts, as the Fed is expected to hold rates steady.

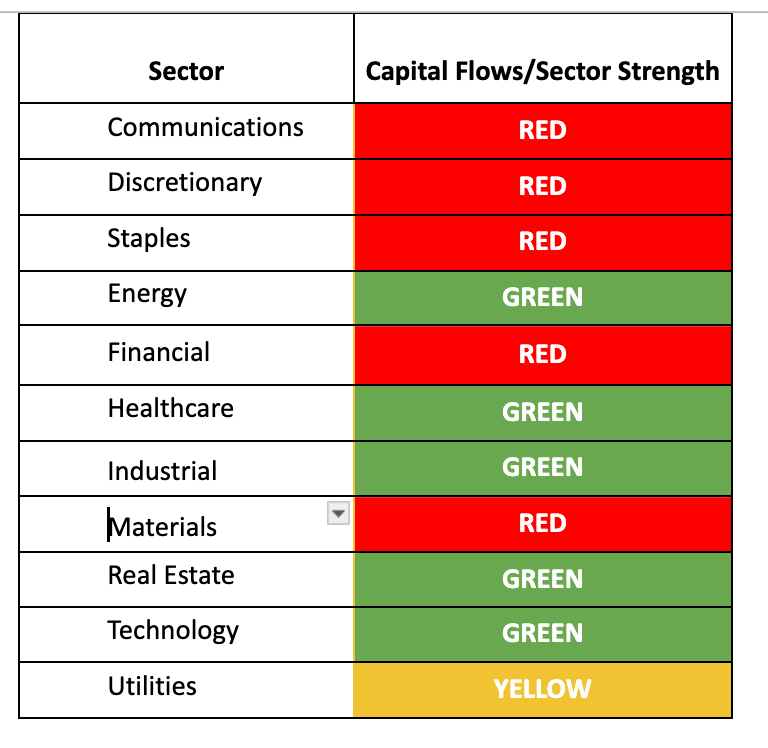

Sector By Sector

On Inflation

Inflation is rapidly eroding the value of cash holdings. America’s economic engine is increasingly fueled by the refinancing and monetization of debt. Investing in the stock market i…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.