Republic Risk: It Started Over A Fistfight in the 1950s… (Part One)

Today, we're talking about a controversial company riding two massive catalysts over the last few days. It has strong insider buying, big government contracts, and a fascinating metrics.

Part One: A Fist-Fight in a Room Full of Spooks

The modern private prison industry started over a fistfight between two former FBI agents in the 1950s.

In 1958, former FBI agent George Wackenhut ran a company called Special Agent Investigations with three other former agents. This team included Ed Du Bois, Jr., a well-known private security official.

The two men scrapped. Soon, Wackenhut wrestled control of the company.

He named it after himself.

The company carried the Wackenhut name until the 1980s.

Wackenhut was quite a character, well-known for his conservative views and incredible ability to navigate the politics of America’s emerging intelligence network.

Over the decades, he became a private warlord, shaping the uncomfortable connection between government and security contractors for the next eight decades.

Born outside of Philadelphia, Wackenhut studied at the University of Hawaii and witnessed the aftermath of Japan’s attack on Pearl Harbor. After World War II, he wanted to join the FBI and be a part of America’s growing intelligence agencies.

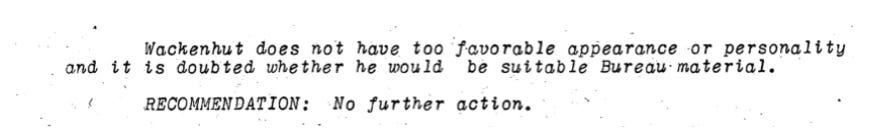

The FBI, however, wasn’t initially impressed by his appearance or personality.

They offered him a job at half his asking price, which he declined. As noted in the letter to HR below, the hiring manager recommended no further action after his first interview.

Wackenhut soon traveled to Baltimore, where he taught physical education classes while studying at Johns Hopkins University. He would reapply at the beginning of 1950.

Maybe the FBI felt sorry for him.

Maybe he turned a corner.

However, he found a job at the agency toward the end of Harry Truman’s second term in 1951. J. Edgar Hoover sent him an appointment letter for training at Quantico. After that, he’d report as a special agent in Atlanta, where he tracked counterfeit money, Army deserters during the Korean War, and kited checks.

He wasn’t there very long, but his FBI file is longer than most Russian novels.

They tell the story of an ambitious man extremely skilled at politics and forging relationships between the private and public sectors.

By 1954, Wackenhut had a new opportunity. The good politician he was, he submitted it directly to FBI Director Hoover and requested a signed photo of the bureau leader.

He and those three former agents would split off to create their own “intelligence” company.

The FBI didn’t favor this decision well. Government officials were concerned about the overlap between their work during the Communist Scare and these men's blatant effort to use their former FBI status as currency.

That was the first problem.

The second was that the company, at one point, only had $1.56 in the bank.

These former agents had to “pass the hat to make payroll.”

After years of struggles, that fight ensued. Du Bois went on one day to become a private investigator. Wackenhut took over the company and immediately sought favor with FBI Director Hoover. He’d regularly update Hoover on the company’s progress, pledging undying support to the agency and asking how they can provide service.

“Wackenhut Special Agent Investigators” soon expanded into new operations - and was renamed “Security Services Corporation.”

His shift away from just “investigative services: paid off. He wrote regular letters to Hoover whenever the agency received negative press attention.

By 1962, the company obtained a massive security contract with National Airlines of Miami. In the years following, SSC became the fourth largest private security company in America, with licenses in ten states. Revenue surged from $89,700 in 1955 to $2 million by 1960.

Five years later, revenue eclipsed $17 million. In 1965, in the wake of the Kennedy Assassination, the company turned its attention to Federal contracts.

And in the voice of Morgan Freeman in The Shawshank Redemption, “Oh, my Lord, how the money rolled in.”

That year, SSC won a contract with the Kennedy Space Center in Florida, reportedly worth $44 million over seven years ($430 million adjusted for inflation in 2024). It also oversaw security at nuclear test sites in Nevada.

Wackenhut was just getting started.

His company’s rise continued to shift its focus and pivot to market conditions.

He took SSC public in 1966, growing annual revenues north of $49 million by the decade's end. By then, it had 6,000 clients and 70 global offices. It used its cash flow to buy out other security companies, growing its revenue base and diversifying its assets away from an over-reliance on government contracts.

In the 1970s, it won a contract to protect an 800-mile pipeline in Alaska.

By the 1980s, however, it had unveiled airport security technology to help offset the rash of airline highjacking in the previous decade. Revenue had surpassed $148 million when Reagan was President. This was anchored by a three-year, $81 million contract at the Savannah River nuclear weapons facility in South Carolina.

At the time, it was the U.S. government’s biggest paramilitary security contract ever.

The decision that led to the rise and fall of Wackenhut came in 1987.

As the nation grappled with concerns about drug crime and increasing illegal immigration, Wackenhut launched a private correctional services system.

It became the largest operator of for-profit immigration detention services in America, all while operating private prisons for states due to correctional overflow. It was initially successful, but politicians and activists fervently opposed “for-profit prisons.”

After numerous abuses reached light in its prison operations, scandal haunted Wackenhut and the company. So, like many other companies facing scandal in the 2000s… Wackenhut and other leaders did something quite common…

They changed the name of the business.

It became Geo Group (GEO).

Over the last five decades, Wackenhut’s small business has grown, constantly shifting to appease a growing government’s need for new security services and showcase innovative solutions against emerging threats.

Pivot after pivot came in reaction to the shifting American political landscape.

And as you’ll learn, Geo Group is entering its next phase of a two-prong political shift.

Give Me Your Tired, Your Poor, Your Huddled Lawless Masses

Hedge fund manager Michael Burry forged his name during the 2008 Great Financial Crisis.

The book The Big Short (and its film adaptation) immortalized Burry for his massive bet against the U.S. housing market and world-beating returns.

Since then, Burry has largely kept to himself.

He occasionally shares his market views on Twitter (only to delete them later for undetermined reasons). In mid-2022, the Federal Reserve was struggling to contain inflation. The Consumer Price Index surged to 9.1% annually in July of that year.

Burry remained convinced that the equity markets would face an epic crash, fueled largely by rising interest rates and high valuations across critical sectors.

Burry sold 99% of his hedge fund’s equity positions.

This perplexed many investors, especially his clients. But the single stock that he did hold was even more confounding.

Burry held a large stake in none other than Geo Group (GEO).

Today, Geo Group operates private prisons, detention centers, and mental health institutions. Its global reach includes North America, Australia, South Africa, and the United Kingdom facilities.

Like its developing years, its core business operates in the United States, relying on government spending and policy changes.

By simple deduction, Burry seemed to be making a terrible bet, especially given the social climate for private prisons in the post-President Donald Trump era.

A few years ago, the media offered pictures of the ongoing myth of “Kids in Cages” under the Trump administration - images of young migrant children separated from their parents after illegally entering the United States.

Of course, those images were shot under the Obama Administration as illegal immigration began to swell during his first term.

Still, the virtue signaling around private prisons and detention centers fueled ongoing social pressures. Activists demanded the U.S. government end its relationship with private prison operators.

The Biden Administration agreed. On January 26, 2021, six days after his inauguration, President Biden issued an executive order to end the Justice Department's contracts with private prisons.

Geo Group stock had fallen under $6.00 by May 2021 to its lowest level in 16 years.

Burry may have known two things that others didn’t. .

First, the Federal government and states now focus more on prisoner rehabilitation than incarceration. The U.S. loves to spend money on social programs…

Geo Group is one of only two private prison operators with the scale to achieve these public policy initiatives. Geo Group has rebuilt part of its operations around lucrative rehabilitation and post-release services to decrease recidivism.

In addition, the Biden executive order did not impact Geo Group’s secondary focus on immigration detention or its relationship with individual states.

The ongoing swell of illegal immigration over the last two years has been a boon for the company.

Congress is kicking around a comprehensive border bill to send more agents and judges to the border to deter new migrants, and the Biden Administration is requesting billions in new spending in its 2025 Budget to focus on border security and detainment.

Over the last three years, the border crisis has hit manic levels. Roughly 6.3 million migrant encounters have happened, according to data from the Office of Homeland Security Statistics. Since that’s a government statistic, it’s probably best to double it to get the real figure. Something must be done with the millions who have crossed into the nation and now await hearings on their immigration status.

That is where Geo Group has pivoted - away from the 20th-century business of private prisons - and now toward the tracking and management of millions of foreign-born migrants.

Some private estimates theorize there are upwards of 22 million illegal immigrants living in the United States. That has forced Geo Group’s new profit model, which benefits from more illegal immigration while the government spends billions trying to streamline a failing model.

As we’ll explain - digging into government spending plans (and a recent Supreme Court case on Texas managing its border), Geo Group will be the biggest beneficiary of a new Federal model on immigration and rehabilitation.

All while expediting America’s transition into a greater surveillance state.

A Changing Business Model

It would have been easier to build a wall.

Four years ago, the proposal to build a border wall consisted of two numbers.

Even if we doubled that figure over the next five years, the U.S. government would spend more than twice the value of wall construction on deterrence, incarceration, and border security.

Why? Well, as I noted, you have to follow the money.

Any excuse to continue pumping new amounts of capital into the system…

Instead of a $20 billion wall, America will likely spend $100 billion over a decade on border security, migrant detention, deportation, tracking, and more.

Customs and Border Protection's January 2024 update shows a 15% rise in southern border encounters in 2023 over 2022, following a 40% increase from 2021. The pace for 2024 suggests a further 24% year-over-year increase, estimated to end the year with 3.9 million encounters.

The Immigration Court system - already stretched by inefficiency and lousy policy - now has a backlog of 3 million pending cases, up sharply from 2 million in 2022. That’s enough people to outnumber the population of nearly every U.S. city except New York and Los Angeles.

Judged - on average - juggle 4,500 cases, according to Syracuse University.

Is it even possible to round this many people up? Even deport them?

Not likely.

That’s where Geo Group is poised for a massive windfall over the coming years.

Why Buy Geo Group in 2024?

In the coming days, we’ll be digging deeper into Geo Group. I want this to be a deeper string of articles on the company and an opportunity for you to see how and why we approach a “government-driven, activist” approach.

We are thinking not only as people “following the money” but we are also taking the very approach of Wackenhut over his business career. If someone is willing to write us a check for solving their problem, then we should be willing to accept their generosity.

You’ll learn key things about the company across various morning letters.

First, its Alternatives to Detention program for migrants is a massive catalyst for the business. As a company engaged in tracking individuals who are backlogged years before their immigration hearings, we’ll cover this part of the business and its expansion into rehabilitation for prisoners in states nationwide.

Second, we’ll examine the company’s financials, explore its legacy businesses, and consider the obvious risks and opportunities ahead for Geo Group.

Third, we’ll talk about how to invest in the stock (we were initially at Buy at UP TO $13.00 as we started this, but it continues to rise). We’ll make the case for $18.00 to $20.00. We’ll discuss building a long-term stake, ways to trade options to generate capital if the stock is above your preferred entry price, and the benefits of LONG-TERM options strategies. We’ll also outline a simple 20-day momentum strategy.

Fourth, we’ll look at intangibles and anomalies. Geo Group is part of a natural duopoly on border detention and private prison rehabilitation with a long history of pivoting and catering to growing government needs. In addition, its CEO recently made another large insider purchase of $624,000 in stock at $12.48 per share. We’ll show you how to trade around that price.

This was a lot of information on a Thursday - and moving forward - these ideas will be part of a different form of editorial preparation moving forward. I felt it was best to break this up one section at a time. Looking forward to this case study with you.

Stay positive,

Garrett.

Somewhere a little while ago I read or heard that "There's a lot of money in migration". A quick search found no one so I think it may be from Hal Anthony, Behind The Woodshed at reallibertymedia.com.

As you indicate, closing the border is not their intention- you know them by their actions, not their words .

Im looking forward to taking advantage of the situation, I have no intention of sticking around, waiting for them to point the fan at me.

Oh, and do take a break now and again Garrett, your stories remind me a lot of my stories with my now 14 year old daughter... CAUTION- young girls are so emotional at this age, up to age 50. Probably later , actually.

Just sayin...