Republic Risk: Let's Talk Cheap, Beaten Down Stocks

It's hard to find value in a market where the S&P 500 is trading at nosebleed multiples. But a contrarian investor can tap into value in places that no one else wants to touch.

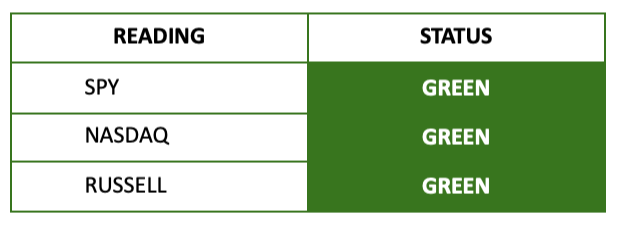

Equity Index Strength Is GREEN on the S&P 500 and GREEN on the Russell 2000

Each morning, we assess the full flows of the market by measuring statistical metrics on a very specific number of stocks to determine broader sentiment and the momentum trend. When these readings turn red, we focus on cash, build trades around positive sectors, or take inverse positions against indices. When it is positive, we focus on short-squeeze stocks, companies with improving fundamentals, and trading/investing around the actions of corporate insiders.

Nothing changed.

We’re in a strong breakout territory with much capital rotating to small-cap stocks. I’ll highlight a few small-cap names that are on my radar below. Meanwhile, cruise stocks continue to break out. Carnival Cruise (CCL) is a fantastic stock to buy when our readings turn positive.

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.