Republic Risk: Recommendation - A New 20-Day Breakout

People don't seem to understand what is happening with Bitcoin and other risk assets. Let's dig into the state of affairs here and discuss what's happening in the world.

Equity Storm Watch Is GREEN on the S&P 500 and YELLOW on the Russell 2000

Futures are steady this morning as a bevy of machines awaits last month's jobs report, set to be released at 8:30 a.m. ET. We're going to pretend that actual human beings are on Wall Street today and are not enjoying the sand and surf of East Coast beaches. The jobs data is expected to show a slowdown in payroll growth, which, if the machines are programmed properly, will make markets charge higher as bad news is good news for the Federal Reserve to start easing monetary policy.

Dear Fellow Expat:

Bitcoin has slumped from $71,000 in the last month to roughly $55,000. That has fueled a big cheer from Peter Schiff’s of the world who spend their days claiming gold is on the way to $5,000. We’re still waiting on that day… but we do know that BTC has now surpassed new records this year. And that cycle likely isn’t over just yet.

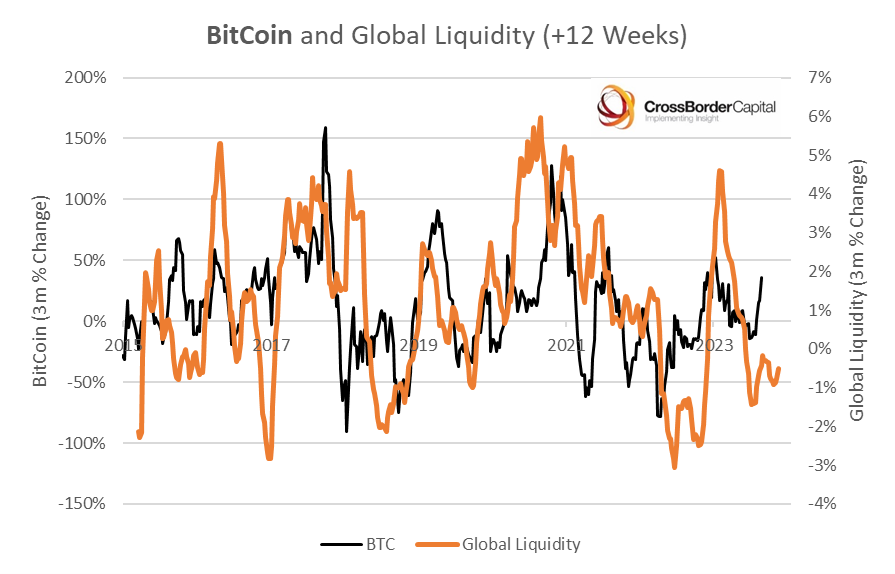

So what is the issue here? Well, Bitcoin tends to operate on the grand liquidity cycle in the global financial system. This is a chart from Michael Howell’s Capital Wars from last year.

What it implies is a relationship between Global Liquidity and BTC prices.

Now… what’s happening today? Liquidity has been so-so since April - and we’re seeing weak support from central banks like the Federal Reserve and the People’s Bank of China. Howell released his weekly update on the matter on July 2.

As I’ve noted repeatedly, there is a huge divergence between the S&P 500, the Nasdaq 100… and the Russell 2000.

And if we didn’t have this Mega Cap crowding that has dominated this market (with money flowing into the Magnificent Seven) - we’d have negative momentum readings across the board. Capital continues to flow into those stocks thanks to indexing and crowding by passive and active managers attempting to replicate their benchmarks.

There is another factor at hand with BTC as well. More than a decade ago, a massive security breach happened at an exchange called Magic: The Gathering Online Exchange… or Mt. Gox. After a decade, there will be a $9 billion payout to those impacted - and it’s underway. The people who lost their BTC in February 2014 did so when the price was around $520.

It’s now $55,500. So… yes… a lot of those victims will be cashing in at 100x.

Bitcoin is a largely technological hedge that aims to take advantage of increasing global liquidity and the debasement of global currencies. It is a very volatile asset because liquidity is sometimes volatile- but it is still the only perfectly finite asset in the financial system.

Markets can mine more gold, companies can issue more stock, and investors might panic sell BTC because of the occasionally large moves. It’s not for everyone…

But it’s still up 25% on the year.

Remember - if you are a buyer - dollar cost average like everything else.

Now… let’s get to our latest stock pick… and the state of the new portfolio.

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.