Republic Risk: There Goes GEOS

Agro had a good day, and the S&P 500 is looking to climb into the Fed's meeting next week in Jackson Hole.

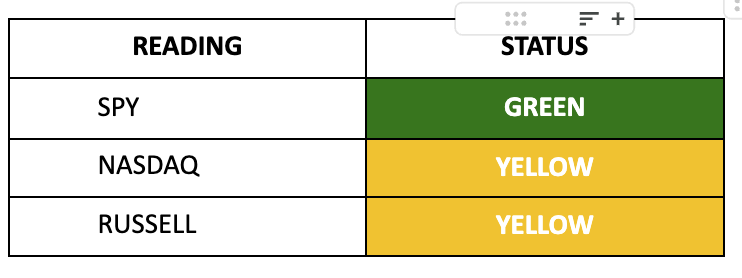

Equity Storm Watch Is GREEN on the S&P 500 and YELLOW on the Russell 2000

Markets have rebounded from the volatility surge two Mondays ago, and investors continue to sweep back. I’ve written extensively about what happens when the S&P 500 Index hits OVERSOLD on the Relative Strength Index (RSI) and the Money Flow Index (MFI) in the free Six Rules for Negative Momentum report I gave away last week… So, we can call it what it is, with the S&P 500 ETF (SPY) moving back above its 20-day moving average for now and everything else following.

Those two signals are critical. An RSI of about 30 signals oversold levels, while an MFI of around 20 signals oversold. Since the COVID-19 selloff, that has been an entry point for funds for the last four years. Retail investors tend to capitulate in those environments, while hedge funds are usually buyers.

The state of the S&P 500 is positive. The MACD for the S&P 500 ETF (SPY) has turned positive. The MFI and RSI have moved above 50, and the ADX gap is …

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.