Republic Risk - Weekly Issue

Breaking down portfolios, positions, and new ideas...

Equity Storm Watch Is GREEN on the S&P 500 and GREEN on the Russell 2000

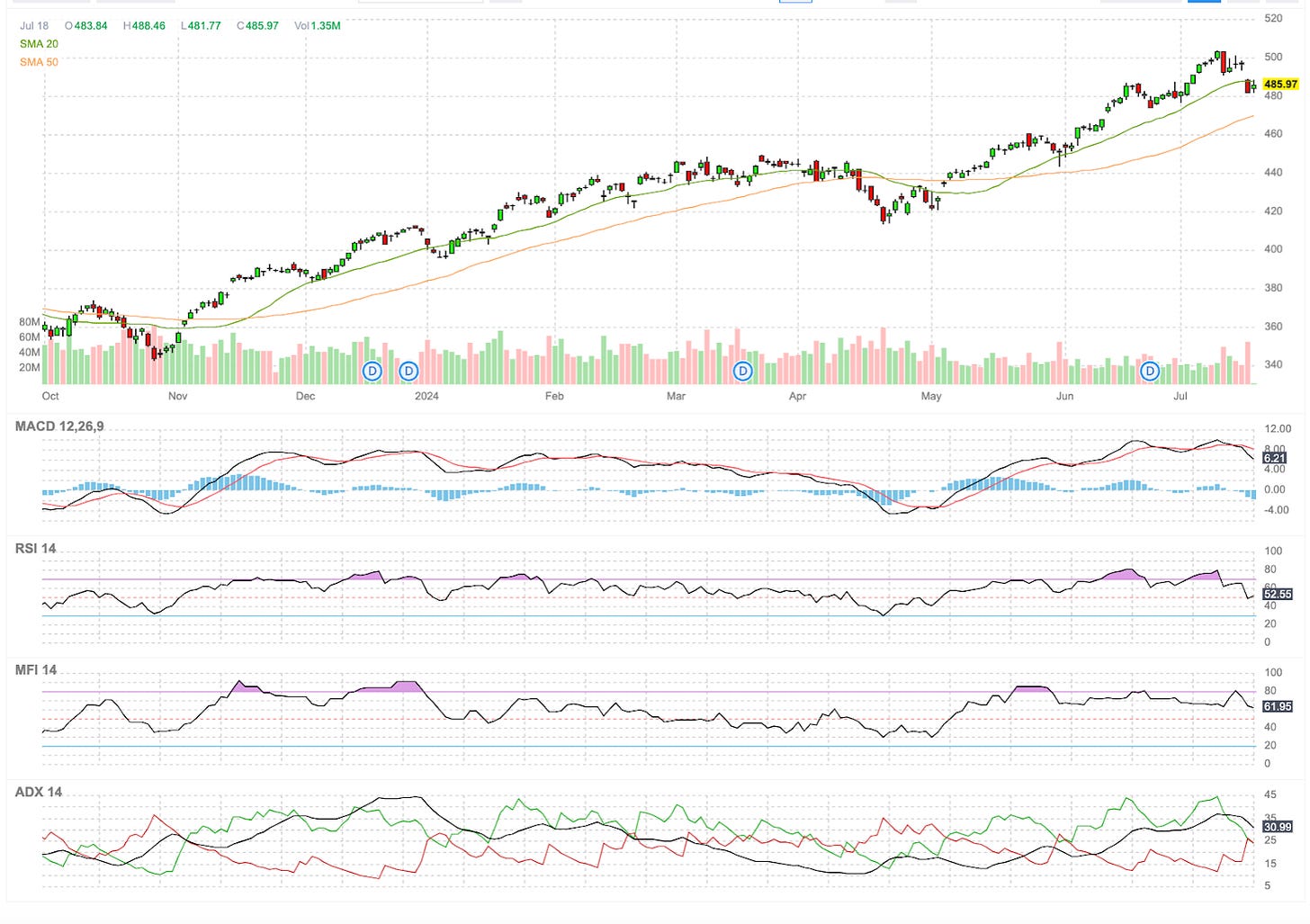

Yesterday was the worst-performing day for the NASDAQ since 2022. The Invesco QQQ Trust Series 1 (QQQ) dropped under its 200-day moving average, which offered some temperature concerns for anyone who’d been buying late into the tech rally since June.

If we look at that fund right now, many technical indicators should concern us about the viability of those stocks. The MACD is currently negative, and the rate of change is expanding at a more rapid pace. The Relative Strength Index (a price momentum indicator) is dropping toward 50, which is concerning. The MFI (price and volume) is falling but still coming out of overbought. The ADX - where the red line is coming to meet that green line - is Yellow and concerning. I expect a short-covering pop this morning, but we must monitor the situation.

We are in the middle of a rotation right now - as sentiment is shifting toward a rate cut by the end of the year.

The S&P 500…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.