Risk: How to Kill Time in Washington D.C.

Wrapping up this Ideas event... now I have a few hours to kill

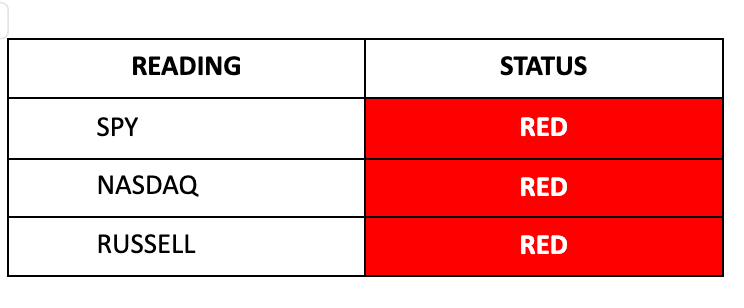

Equity Storm Watch Is RED on the S&P 500 and RED on the Russell 2000

We're kicking off this morning right where we left off yesterday, with futures staying mostly flat as investors sift through the latest employment data. Traders are increasingly betting on a more aggressive 50-basis point rate cut in September, now at 41% likelihood.

However, I don’t see the Fed going for the full 50—it’s too sharp a move and might signal major economic concerns, effectively throwing any hope of a soft landing out the window. It’s more probable that they’ll adjust by 25 basis points, especially considering the market's reaction in July when the Bank of Japan unexpectedly raised rates by 25 bps instead of the anticipated 10 bps. Powell likely doesn't want a repeat of that scenario or to stoke further inflation, so a gradual approach to rate cuts seems on the cards.

As September unfolds, there’s growing anxiety that our weakening labor market might hint at an impending recession. Today, we’ll get more cl…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.