Risk: The Real Takeaway from Last Night for the Markets

Plus... CPI numbers aren't what you think they are.

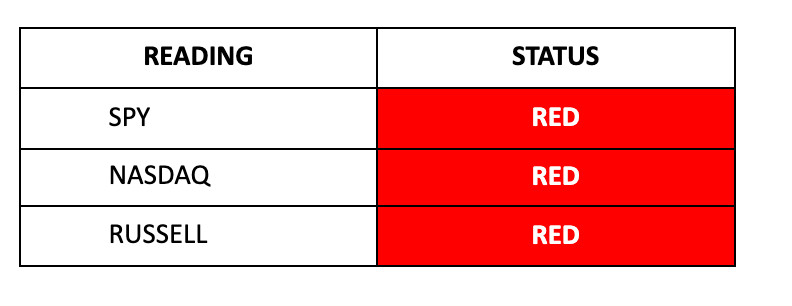

Equity Storm Watch Is RED on the S&P 500 and RED on the Russell 2000

Markets have done little this week to break out of the range set last Friday.

Futures ran up in premarket only to get slammed as the day progressed, ultimately ending lower by a couple of points for the Nasdaq and nearly so on the S&P. Now, we've spent the first two days of this week stuck in the mud, with everyone pointing to this morning's CPI as the catalyst to get us going.

This morning, the CPI came in hotter than expected (wow… so shocked, am I…) after showing a 0.2% monthly increase. The annualized CPI without energy and food was up 2.6%. I’m watching people still pretend that the core parts of the economy are not in a recession. Someone told CNBC that the longer we’re holding rates at 5%, the more likely we are going to see a recession.

Remember, a recession is just a government equation that can easily be tweaked. In October 2022, the government bought oil (investments)… and sold oil (exports)… in the third qu…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.