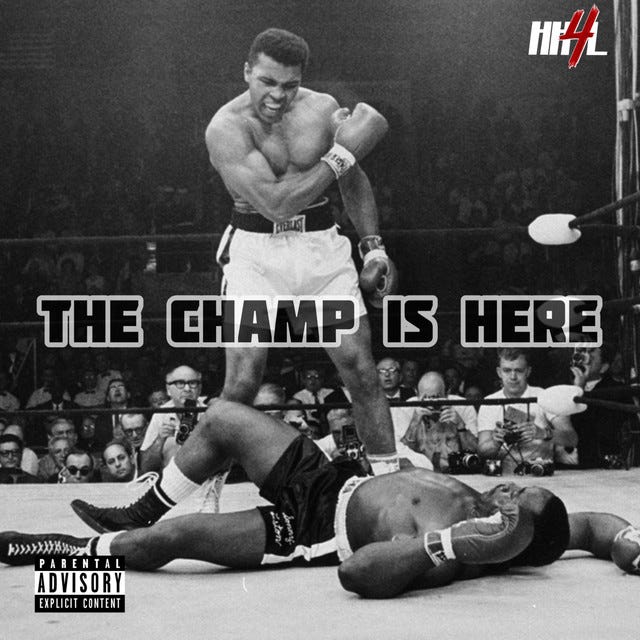

The Champ is Here...

Buffett buys OXY, momentum continues to weaken, and all 11 sectors are negative. Our early signal went negative December 10, confirmed last Friday, December 13.

Action to Take: Markets face a perfect storm heading into Friday - quad witching, PCE data, a looming shutdown, and the hangover from Powell's hawkish cut. Since Covid, energy stocks have reached their most oversold levels, catching Buffett's attention for his first major purchase in months. While the selling pressure is real, it's worth remembering that today's central banks have an extensive toolkit to stabilize markets - from the discount window to QE.

If you've followed Rule #1 of our negative momentum playbook and maintained a healthy cash level, you're exactly where you need to be. Once again, our signal went negative on December 10, the first time it had done so since August 1 (three days before the Nikkei crash).

Check those stop losses and power down the screens for those still exposed. Let others panic while we stay disciplined—that's how we've navigated every major decline this year. Our signals have been spot-on: catching April's banking fears, the Japan carry trade unwind i…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.