The Insiders Have Called a Bottom (For Now)

Insider buying to selling is now at its strongest level on a dollar-for-dollar basis since the October 2023 lows. While our signals are negative, bottom feeding on oversold sectors is worth your time.

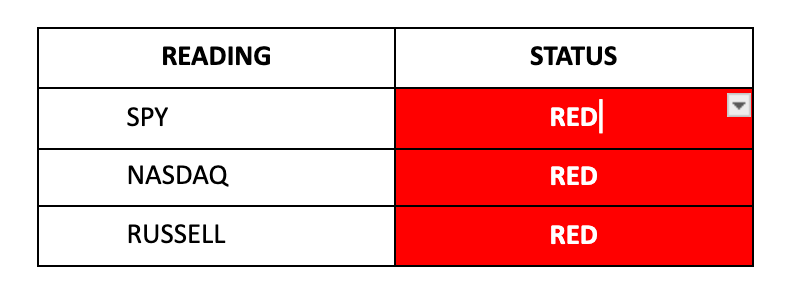

Action to Take: Markets are treading water this Christmas Eve morning, which seems appropriate for today's abbreviated session (1 pm ET close, 2 pm for bonds). Though yesterday's tech rally brought some cheer, markets still show stress, with treasury yields stubbornly high at the long end of the curve. Low-volume sessions like today often tend to drift higher as algos set on cruise control take the reins while traders head out of town. As I’ll explain, the insiders are also buying at their strongest levels since October 2023 - so that’s a positive sign that a bottom has formed for now after such an aggressive level of selling that transpired across the bottom half of the S&P 500.

Case in point: American Airlines (AAL), which downed all flights this morning over technical issues, still found a premarket buyer when the stock dipped into the 2nd standard deviation of its Volume Weighted Average Price (VWAP).

With markets closing for the Christmas holiday, critical trading decisions should be wrapped up early.

Santa is already working hard and making impressive progress - NORAD reports over 600 million gifts delivered as he crosses the Federated States of Micronesia.

Keep an eye on the Big Guy’s journey at noradsanta.org/en/map while you finish those last-minute preparations, and we'll reconvene on Thursday to tackle year-end positioning.

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.