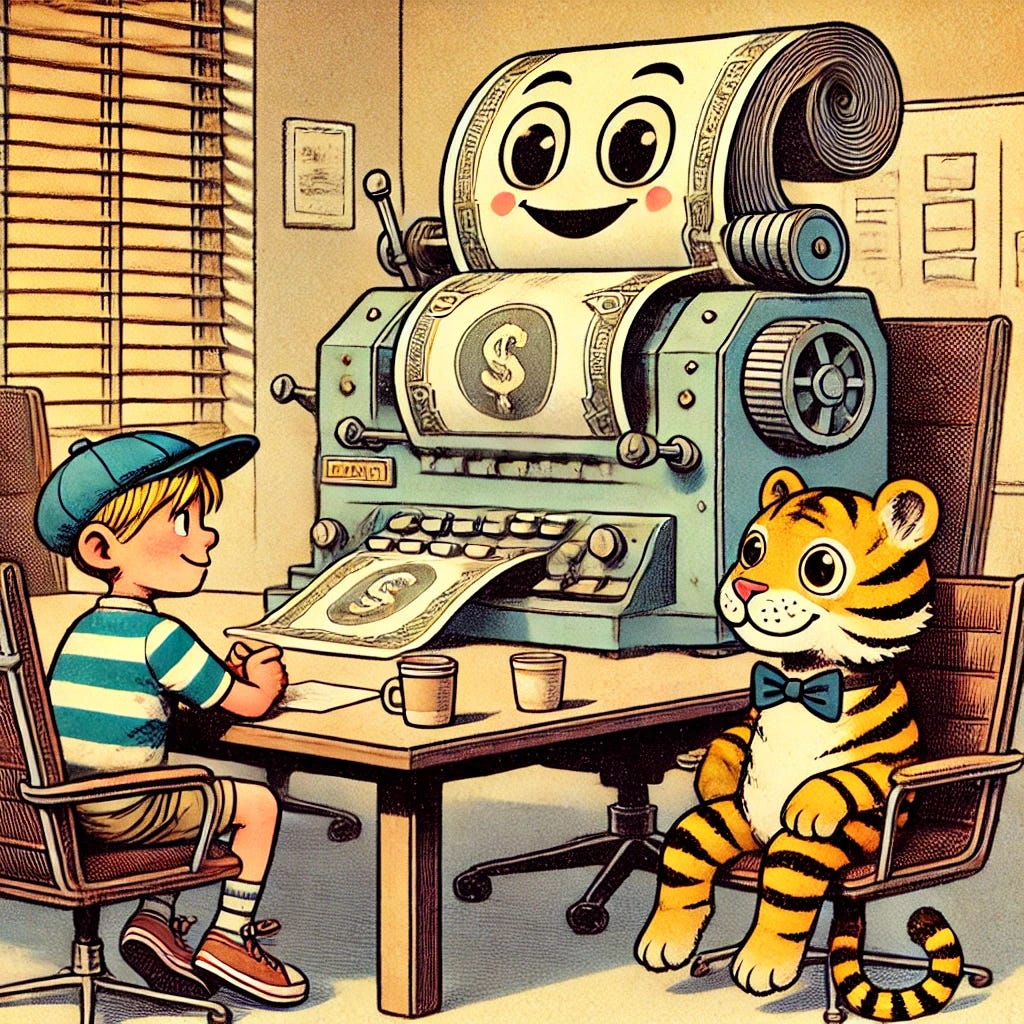

The Money Printer's New Boss

Fiscal domination is taking over central banking independence. You'd better position yourself now because this is going to be a mess for the next 10 years.

Dear Fellow Traveler:

The Federal Reserve has a new master, and it's not inflation.

Welcome to the era where massive government debt tells the Fed what to do.

The Fed will go from inflation fighter into a debt enabler.

And that’s going to change the stock market… forever.

I’ve discussed how 1971’s move off the Gold Standard fueled manic dollar liquidity cycles.

I’ve discussed how inflation targeting created most of the affordability problems we have…

I’ve discussed how Quantitative Easing has fueled massive inequality in asset markets…

But I haven’t explained before how COVID changed the whole system.

So… let’s do that…

We Printed Too Much %^$#%$#$ Money

COVID stimulus pumped $5 trillion to $6 trillion into the U.S. economy.

That pushed our deficit to 15% of GDP in 2020.

Now, with debt near 120% of GDP and new spending plans adding another $2.4 trillion, the Fed is stuck.

It can't fight inflation properly because it would make our debt too expensive.

The Bank for International Settlements (BIS) is sounding alarms.

Their chief warns that governments must stop their "relentless surge in public debt" before central banks have to print money to cover it.

His message: cheap money is over, but reckless spending could bring back inflation or crash currencies.

Bond Markets Flash Red

Bond investors are the canaries in the coal mine.

They’ve been nervous since COVID. The vigilantes haven’t really attacked yet.

But they will.

For now, governments are slashing bond sales to reduce the lack of demand at current rate expectations.

Japan just cut bond sales by 10% after weak demand. U.S. Treasury auctions are struggling despite rate cuts. They’re shifting to short-term T Bills to keep the lights on.

Long-term yields are rising when they should be falling.

The Financial Times reports this is classic debt stress.

Investors doubt central banks can stay independent when governments need endless cash. When bond yields rise while the Fed hints at cuts, markets say one thing: debt problems now matter more than economic data.

The Debt Trap

What we’re going to see is a massive fiscal trap.

Raising rates to fight inflation increases the cost of government debt. That’s been the problem since 2022, when the Fed jacked up rates and took a baseball bat to financial institutions' holdings.

Silicon Valley Bank collapsed. But Bank of America is sitting on many longer-term U.S. bonds that it can’t sell without taking a massive loss. So, it doesn’t sell them, and the Fed keeps supporting it because it’s deemed Too Big to Fail.

Every 1% rate hike adds $350 billion to what we owe yearly.

So the Fed keeps rates lower than they should, letting inflation run hotter to keep debt manageable. If we had moved to 6% rates in 2022, like I advised, to drown inflation, Bank of America’s losses on paper would have created headlines about its insolvency.

That would have fueled a bank run for the ages.

Again… Too Big to Fail.

This Debt Crisis is a Doom Loop.

Fighting inflation makes debt explode.

Keeping debt manageable lets inflation run.

The Fed has to choose between bad and worse.

It’s enabling debt.

That said, you must try to laugh because otherwise you’ll cry and drink.

The politicians have no understanding of what they are doing.

Reuters reports that even if central banks want to cut rates, huge deficits might stop them.

Politicians won't cut spending, so monetary policy can't work properly. Elected officials now control the money printer through their spending choices.

The IMF agrees, warning that growing deficits force central banks to fund governments instead of controlling inflation.

The money printer isn't turned on for economic need.

It's turned on for political want.

What This Means for You

Fiscal dominance changes everything… especially your finances and your freedom.

Inflation Will Not Die

With huge deficits and nervous bond markets, any crisis could restart inflation—no matter what the Fed wants.

Wild Currency Swings Are Coming

Expect big moves in bond yields and the dollar as debt pressures build.

Who Will You Trust?

If markets stop believing the Fed is independent, inflation expectations could explode, forcing harsh actions later.

Your Game Plan for What's Coming

Four big trends will shape the next three years.

The Dollar's Slow Decline

In 2000, 71% of global savings were in dollars.

Today it's 58%.

As countries diversify, demand for U.S. debt weakens, making it costlier to finance.

More Money Printing

Every crash since 2008 ended with printed money. Europe and Asia are already printing. When things break, the Fed will too.

They always do. As I said yesterday, a system must be judged by its outcomes. Those outcomes tell us what the system is designed to achieve. Bailouts and money printing are outcomes of the design.

Trump Will Change the Fed

With Trump back, I expect a new Fed boss by 2026 who'll cut rates and weaken the dollar. Markets will bet on this throughout 2025.

Where to Put Your Money

The same playbook for the money printer remains…

Gold and Silver

Central banks are hoarding gold as dollar insurance.

Silver is starting to explode as its price gap with gold shrinks.

Buy PHYS for gold, CEF for both.

Cash-Printing Companies and Assets:

Own businesses that make money without debt. Visa, Berkshire Hathaway and good utilities. They survive when debt-heavy companies die. And pay close attention to the pipelines and what the sovereign wealth funds are building here in America.

Power Infrastructure

AI and EVs need massive amounts of electricity. Our grid can't handle it. Utilities and pipeline companies offer safe growth with 5-7% dividends.

Foreign Holdings:

Switzerland, Singapore, and Norway offer protection outside the dollar system.

Cash Reserve:

Keep powder dry for when the Fed cracks and prints. Then buy aggressively.

Now, I’m off to the pool.

Stay positive,

Garrett Baldwin

Watching out for it after seeing the jocuar FED chair

Sho nuff!!