The Morning BRRR (Capital Wave)

Vindication comes on a Sunny Thursday morning...

Dear Fellow Traveler:

My friend and colleague JC Parets came up with a newsletter this year that made me jealous. And I don’t get jealous. The title was genius. It’s called “Everybody’s Wrong.”

I wish I had come up with that… because that’s the subject of this article.

Over the last month, I’ve been arguing that liquidity and capital flows have been trending upward. Since the April selloff, markets have moved in one direction, burning to all-time highs, without a real catalyst in nature. Repeatedly, I’ve said that markets are not reflecting fundamentals; they’re reflecting liquidity expectations.

No… I’ve been told.

Every Fed defendant under the sun has been claiming that we’re engaging in Quantitative Tightening, implying that there is no new money.

I’ve been arguing that what has been happening with rollovers might not be QE… but it certainly is support.

Meanwhile, I’ve shown repeatedly that the Treasury Department has once again turned to short-term credit creation at the front of the yield curve (which boosts credit and leverage, Everyone wants T-Bills as collateral).

No… these critics of mine told me… there’s no new money.

[Garrett picks up a microphone.]

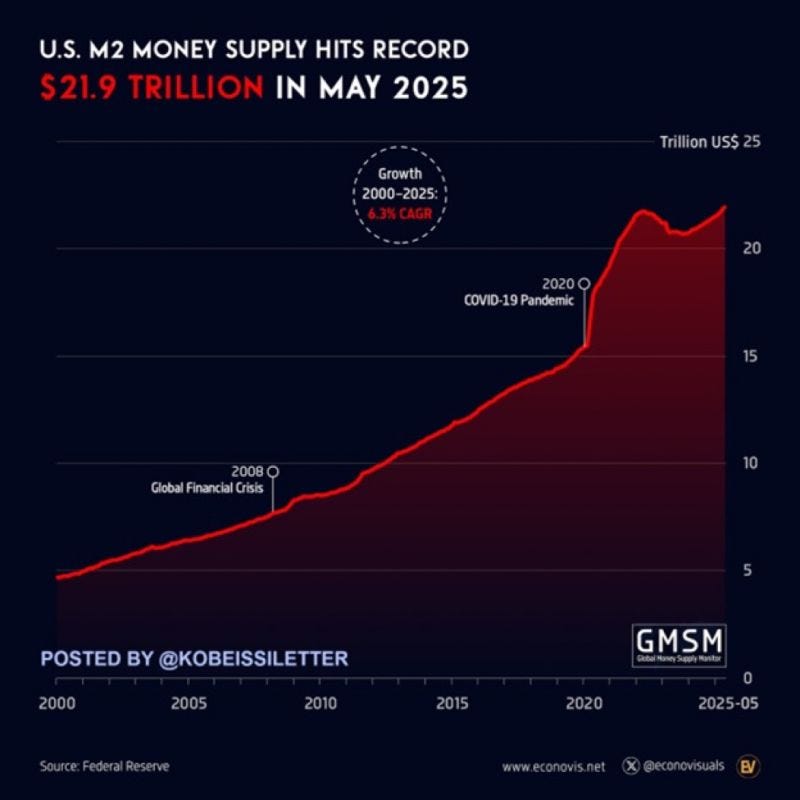

This tells you everything… From the Kobeissi Letter.

The U.S. M2 Money Supply just reached a new all-time high of $21.94 trillion in May.

“BBBBBRRRRRRRRRRRRRRRRRRR!”

Garrett slams the microphone into the ground. It explodes into a pack of white doves. Those doves fly into a ceiling fan. They explode. Money falls from the sky.

Since the COVID-19 pandemic, the M2, which includes cash, checking deposits, and easily convertible near money such as savings accounts and money market funds, has increased by $7 trillion.

And we wonder why we can’t get inflation under control?

Money is what moves markets higher. And this explains not only why we’re at all-time highs in equities… but why we’re likely heading higher.

This chart is exactly why I do not listen to the Fed.

Because you’re not just being gaslit, you’re straight up being lied to by officials.

Remember, it was just a few months ago that former Fed Chair Janet Yellen told the Australian Financial Review that all this money printing didn’t cause inflation.

Supply chains caused it, she said.

Yes, it wasn’t the $7 trillion you clowns dropped from the sky… and it definitely wasn’t all the giveaways from Congress in the name of saving us from ourselves.

It was the supply chains.

The supply chains have been so bad in the last two years that instead of getting stuff from Amazon in two days… I now have to settle on getting stuff… (checks watch) in four hours. And if the supply chains were in such bad shape, why didn’t we go back to the error we made in 1993 and fix supply-side regulation?

The purpose of this market is to generate profits to refinance the system and then mislead the public about it. The outcomes of this system, in this case, a record high on the M2 to prevent a refinancing or deflationary crisis, are by design.

Judge the system by its outcomes… not by what Yellen or Powell or any other official says it’s designed to do.

Finally, before we delve into the morning tune-up, be aware that the M2 doesn’t encompass the broader reading of global liquidity supply, as covered by Michael Howell at Capital Wars.

This was the book and blog that provided the final stool to my broader macro-vision, which has allowed me to sidestep every significant drawdown since COVID-19. That liquidity figure represents the pool of money (approximately $176 trillion) that must be used to refinance around $300 trillion in global debt…

Which means there will be plenty more money printing ahead.

The officials will likely try to refer to it by a name other than Quantitative Easing, stimulus, or capital injections.

Now… Good BRRRR to you…

Let’s get to the Trader's Focus…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.