Action to Take: Sell GEO Group (GEO) at Market Price

Geo Group (GEO) was a special report we released earlier this year.

At the time, the stock traded at roughly $13.00. If you’ve been a long-term holder of this stock, it’s time to take gains. Shares hit $26.39 this morning, and the stock is incredibly overbought. If you want to follow the “Free Trade” rule, you might sell 50% of your stake and then set a 25% trailing stop on your existing position.

Other Notes:

As the market pushes new highs and Bitcoin breaks $82,000, global central banks are starting to show their hands, with Japan opting for more quantitative easing to fight inflation and China leaning on debt swaps rather than direct economic stimulus. Today's market reinforces the strategies outlined in our spring Hedge of Tomorrow report, which focused on safeguarding purchasing power with hard assets (like gold and quality real estate), reliable stocks with strong cash flows, and a balanced approach to crypto. In a landscape where currency devaluation and soaring deficits are the norm, diversifying into assets that can’t be printed is increasingly crucial. If you haven’t yet positioned yourself against the quickening erosion of the dollar, there’s still time—Q1 2025 deficit forecasts indicate we’re just at the start of this monetary expansion. BUY ALL DIPS. Especially in the banking system.

-----------------------------

Momentum: Market breadth expands beyond mega-cap tech as capital rotates toward sectors positioned for the policy environment ahead. Financials, in particular, look strong, with better fundamentals and relatively low investor interest. Still, there’s a gap between rising stock prices and slower earnings growth. The strong dollar might squeeze multinational profits, but domestically-focused companies could see a boost from regulatory changes. As corporate earnings take on a bigger role in driving momentum, keeping an eye on sectors that benefit from Trump-driven policies and a stronger dollar is smart.

Insider Buying: Bezos Sale Causes Extremely High Ratio

The ratio of Buys to Sells: 1:196 ($8m to $1.72b)

Top Buy: $3.8m of CVR Partners LP (CVR) by 10% owner Carl Icahn

Top Sell: $1.2b of Amazon (AMZN) by 10% owner Jeff Bezos

Liquidity: As Japan’s currency weakens toward 154, the resurgence of the yen carry trade is adding fuel to an already hot market. Traders borrowing low-yielding yen to fund positions in higher-yielding assets drive a self-reinforcing risk-taking cycle. Meanwhile, the sell-off in Treasuries has pushed up real yields and strengthened the dollar as markets brace for larger deficits. Adding to this, the Federal Reserve’s Reverse Repo (RRP) balance hit a 3.5-year low following Trump’s win, boosting liquidity by releasing funds back into the financial system. This mix of aggressive carry trades, rising term premiums, and falling volatility are reshaping the investment landscape. Don’t sleep on December tax harvesting or the prospect of repo jitters come March 2025.

Market outlook:

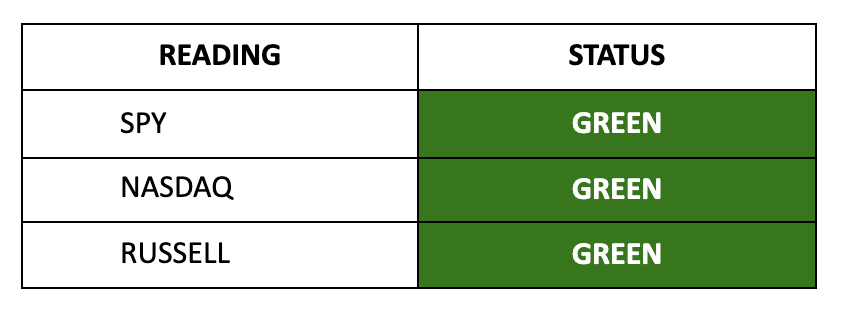

Futures UP: S&P +44bps, Nasdaq +46bps, Russell +145bps

Bitcoin smashes through $82K on institutional demand

China export surge hits 12.7%, highest since July 2022, ahead of Trump Tariffs

WTI Crude slides to $69 on China demand concerns

Tesla (TSLA) is up 8%, and market cap surpasses $1T on the Trump alliance, causing $5 billion hit to short-sellers

Dear Fellow Expat:

Good morning.

Greetings from Starbucks (SBUX). I guess they’ve just skipped Thanksgiving and moved directly to Christmas songs. This is what my wife did to my house over the weekend. There are already two trees in the house… this is insane.

I left the winter wonderland to write at a coffee shop and then downtown to the office.

Today, the story is Bitcoin.

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.