Why Can't We Innovate Home Lending?

A pretty easy question falls on the shoulders of Wall Street.

Dear Fellow Traveler:

Wall Street loves complexity.

Our smartest minds have engineered collateralized loan obligations (CLOS) so byzantine that even their creators need flowcharts to explain them.

Exchange Traded Funds (ETFs) now exist for everything from "companies with female CEOs" to "businesses that might benefit if aliens landed tomorrow."

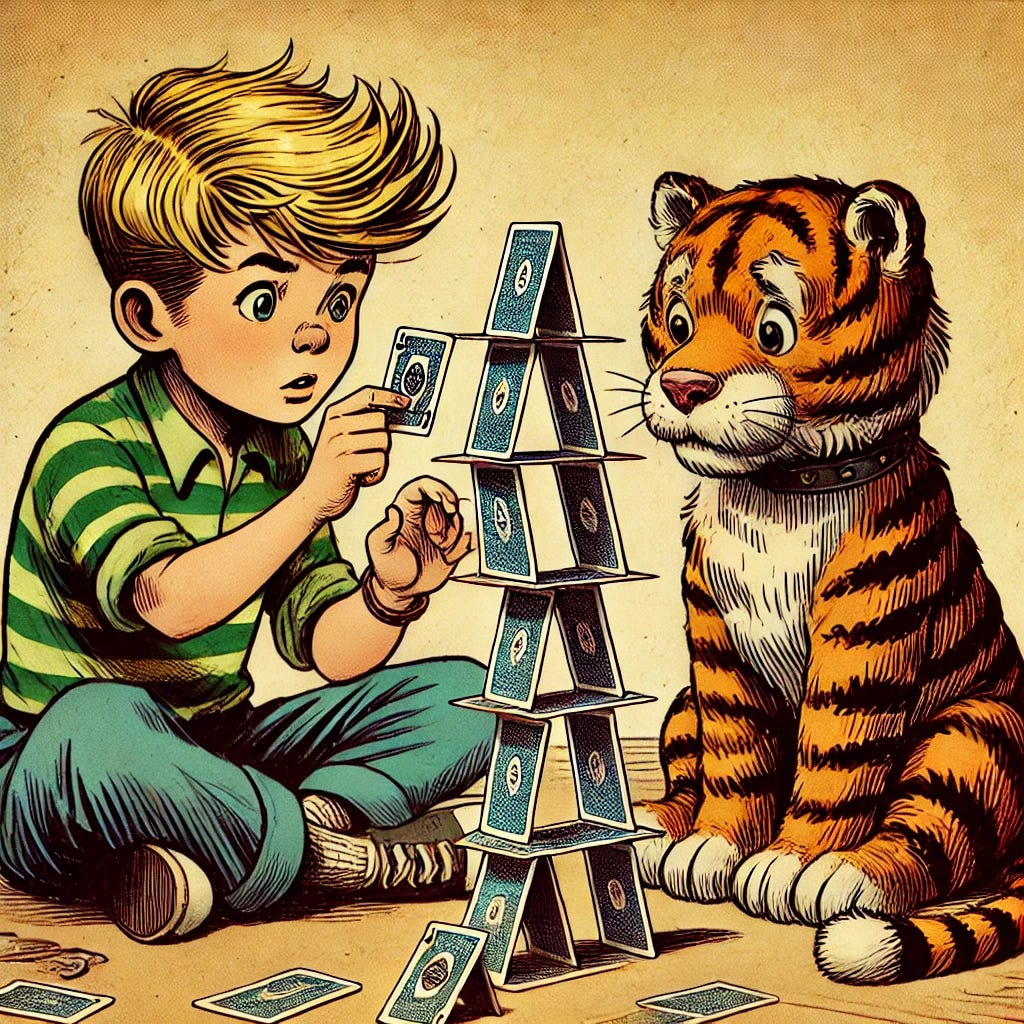

The financialization of America is a pyramid of derivatives on top of derivatives on top of derivatives.

But when it comes to home lending… guess what?

The single most important financial product owned by Americans has not changed much. We’re still essentially using the same 30-year fixed-rate structure first popularized in the 1950s..

What drives the lack of innovation in housing?

I’m glad you asked…

Keep reading with a 7-day free trial

Subscribe to Me and the Money Printer to keep reading this post and get 7 days of free access to the full post archives.