Blame Her... Part I

These markets are effectively turning into a redux of 2022, a stimulus fueled bubble spurred by the world's greatest money printer: Janet Yellen.

Editor’s Note: Some people will find this story difficult to follow. I assure you, though, that if you use the right kind of scotch, it will make a lot more sense.

Dear Reader:

In 1994, Bill Clinton nominated Janet Yellen to join the Federal Reserve’s Board of Governors.

It was considered unusual to appoint academic scholars to such roles at the U.S. central bank back then.

But Clinton’s advisers had a goal in mind.

By appointing Yellen and Princeton economist Alan Blinder, these Ph. D.s would buffer the “market conservativism” of then Fed Chair Alan Greenspan. A labor economics professor, she specialized in Keynesian-leaning macroeconomic theory.

That’s not my summary, but one of New York Times writer Binyamin Appelbaum's 2013 glowing endorsement of Yellen, the then-Fed Vice Chair.

A libertarian crank might argue that a Big Government administration appointed her because her approach was rooted in centralized monetary policy and government intervention. (But I gave up such sentiment for Lent.)

But it’s fair to say that Yellen aligned with the Fed’s historical preference for meddling with market interest rates and maintaining a grip on economic levers.

And boy, did we ever get that firm grip starting that decade.

In the following Two-Part Series, I’ll explain why Yellen’s ascension to modern economic leadership has helped fuel the ongoing financialization of the American economy, the never-ending boom-and-bust cycles since the 1990s, drastic inequality in America, and a complete lack of accountability in the financial system.

If you see a problem in the U.S. economy… feel free to Blame Her.

Revisiting 1993

If you’ve read me for a long time, I view the first Clinton term as the pinnacle years that unleashed the dark forces of the Great Financial Crisis in 2008 and the massive levels of inequality in U.S. society.

For example, a funny series of things happened during Clinton’s first term, all fueled by the mindset of economists with the tilt of Yellen.

The finest example of false incentives created by government meddling was in tax policy.

Advisers argued that Clinton should impose a sizeable tax on any company that “wrote off” the compensation of any executive who received $1 million or more.

Clinton and those economists were convinced that this Big Government approach would level the playing field and reduce the difference between the average CEO's and worker's pay.

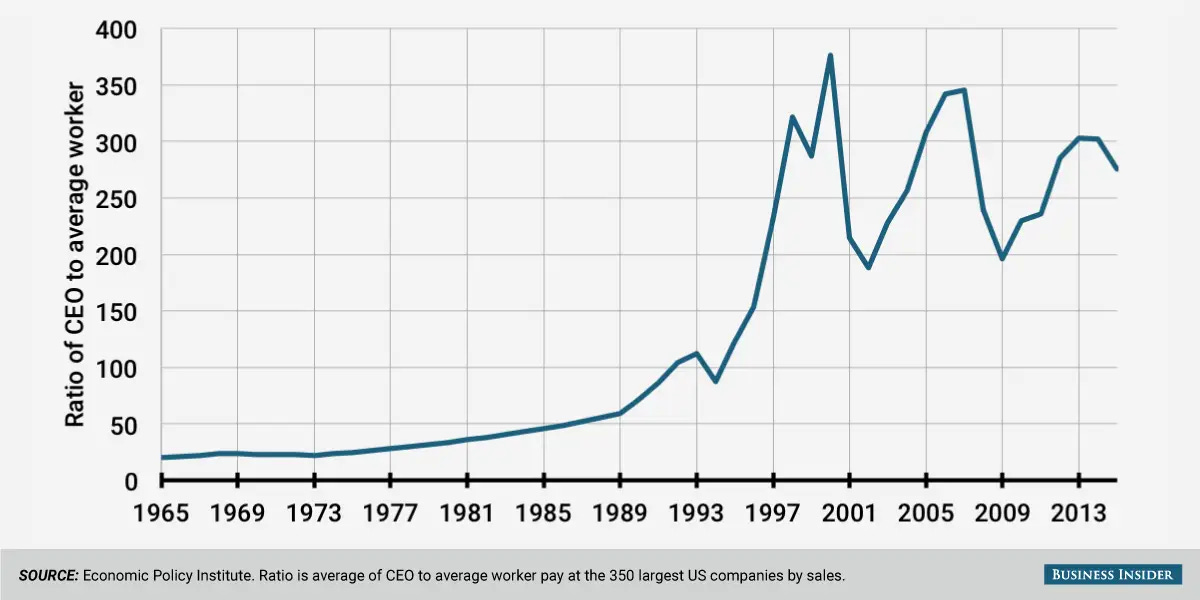

After all, at the time, the CEO-to-worker pay ratio was about 100 to 1.

After that policy came in, incentives changed. Did it solve inequality?

Did executive pay fall back in line with historical averages?

Of course not.

To avoid that tax, companies just paid executive salaries up to the Clinton-enforced cap.

Then, they added additional compensation in stock and options.

It didn’t take long before the stock market boom of the 1990s (fueled largely by central banking policies at the back half of the decade) drove executive compensation through the roof.

By 2000, the average CEO earned 365 times the average worker's salary.

We call this the "law of unintended consequences.”

But that was fiscal policy.

If you think tax policy can create inequality, wait until you learn about Monetary Policy at the Federal Reserve.

Enter Janet Yellen, Keynesian Overlord

Janet Yellen was a central banker and academic.

She’d worked in the fish bowl theory of labor economics at the University of California-Berkeley (where the hell else would she work?). She now had her sights set on improving the labor markets through Fed policies… or something like that.

Yellen firmly believed that the Federal Reserve needed to ensure full employment through accommodative public policy.

In the 1990s, the Federal Reserve, under Greenspan’s leadership, tried to address the challenge of inflation.

Greenspan wanted to engage in policy targeting NO - or ZERO inflation. That means the Fed would do what was necessary to keep prices stable - year after year.

However, doing so required tighter interest rates and more restrictive policy.

That naturally meant higher interest rates.

This policy faced challenges.

First, e-commerce emerged and created deflationary pressures across the economy.

However, as we know, technology is deflationary, where increasing the money supply tends to drive the prices of things that matter (food, housing, energy, education, and tangible assets) up.

Second, the academics were concerned that higher rates would lead to too much unemployment if the economy went sideways. And now that the economy and inflation had won the 1992 election for Clinton (the Gulf War had a drastic impact on energy prices and thus the economy), monetary policy would become political too.

That brings us to Yellen, now two years into her role at the Federal Reserve.

In 1996, Yellen repeatedly pushed for the Fed to target a 2% interest rate policy.

What does that mean?

It means that the Fed would allow their tracked “prices” to rise annually by 2% on the aggregate if it could ensure that it didn’t negatively impact the jobs market.

Sarah Foster at Bankrate recounts the story:

For instance, did you know the Fed's 2% inflation target wouldn't have come together without a little debate between Yellen and former Fed Chair Alan Greenspan at a July 1996 Fed meeting? Greenspan, for instance, was convinced the Fed should informally target 0% (He didn't want it to be public back then). Yellen, however, argued it could come with consequences for the labor market and consumers' livelihoods — not to mention the economy, if it were to face a devastating recession.

Ah, yes, 2%.

It was a random number, but just enough so you wouldn’t notice them stealing your time and money from you - as if they were removing one brick from your home's foundation at a time.

Somehow, that target became dogma without rigorous re-examination.

Of course, the things that matter—which I mentioned above—have outpaced aggregate inflation in major categories since we started keeping records in 1978.

And 2% would be a target that wouldn’t be made public until 2012… when Ben Bernanke (Yellen’s predecessor as Fed Chair) would formally announce the Fed’s target in a speech to justify what would later be a decade of Quantitative Easing (injecting money into the markets and adding bonds to the Fed’s balance sheet to stimulus economic growth and inflation.)

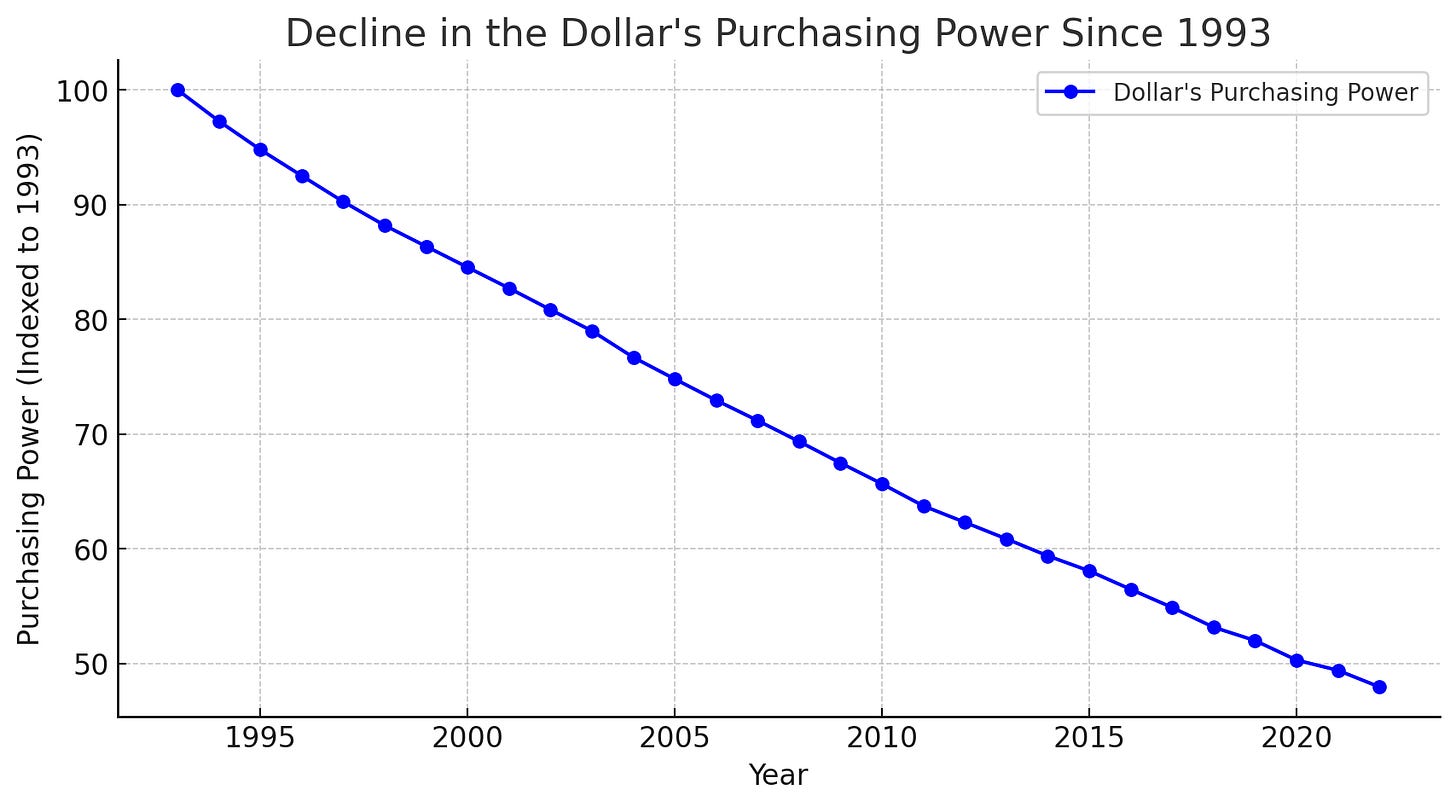

You and I know and live 2% or higher inflation for what it really is: a tax.

It ate at the savings accounts of the Average American without them even knowing that this Independent Board—entirely beholden for U.S. banks and not the American people—was rigid at work debasing the currency every year.

The only thing that Americans have to protect themselves is wage growth…

But wage growth (even without the target) has lagged behind inflation growth.

That inflation target has eroded 2% a year of the average American’s purchasing power from 1993.

Since 1993, the U.S. dollar has lost more than 55% of its purchasing power (thanks to other policies, deficits, poor management, grift, and money printing).

All the while, here’s the even more insane part of the Yellen policy support.

It led to the outright empowerment of Wall Street and Washington over our lives.

The What Effect?

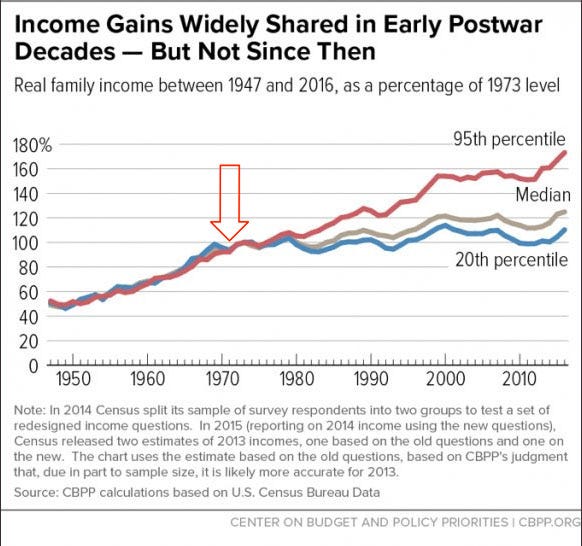

Inflation targeting has fundamentally empowered and enriched hedge funds, private equity firms, Wall Street banks, and - don’t forget - politicians, NGOs, defense contractors, and anyone else near the D.C. trough.

“But, Garrett,” you say… indeed that’s an over-reaction.”

No… because of something that benefits these insiders called the “Cantillon effect.”

It’s a pretty simple concept.

What happens is that newly created money (aimed at increasing inflation to reach that 2% target) enters the economy through major financial institutions, favored industries, and government spending (turns out that the banks are in New York, the favored defense contractor and NGOs are in Virginia, and government is in D.C. The money never seems to leave, and the politicians never see how the Cantillon effect hurts the rest of the United States.")

This effect means that these privileged groups get the first bite at fresh credit and newly injected currency before prices adjust, allowing them to invest, acquire assets, and fund pet projects at artificially low costs.

Then, when the costs go up, the value of those assets or the end goods go up.

Those assets include stocks and other risk assets.

Meanwhile, ordinary savers and wage-earners face rising prices and devalued earnings later in the cycle.

This transfers wealth from the broader population to those directly accessing the money spigot—hedge funds, private equity firms, Wall Street banks, politicians, and connected industries near the D.C. trough.

Got that?

While Janet Yellen was doing the wonderful progressive thing of trying to save the jobs market, she was constantly fueling the Cantillion Effect.

So, whenever someone wonders how and why the U.S. economy has looked like the chart below since 1971, consider that we went off the Gold Standard, debased the currency, turned on the money printers, and handed it to those favored institutions.

“WTF happened in 1971?” a website asks showing a series of charts like this?

The answer is that the American Cantillion Effect went into full force.

And all that inflation targeting did in the mid-1990s was pour gasoline on that fiery trend. The inflationary target goosed the equity markets and helped drive that executive-to-employee gap higher (because one owns stock and pays capital gains and the other makes a wage and pays income taxes).

Janet Yellen’s policies are easily some of the biggest drivers of wealth inequality in human history - as much as, if not more so, than any Robber Barron, person with the last name Walton, or military junta.

And what’s funny is that this absurdist, savings-devouring policy is nothing compared to what she did in the last three years with fiscal policy - once she became the head of the Department of the Treasury.

How Can This Go On?

Janet Yellen became the Treasury Secretary in January 2021.

Most ex-Federal Reserve chairpersons go home.

They teach.

They write books where they talk about how heroic they were.

Most of the book covers feature them standing there with their arms crossed.

And the titles of the book sound “high stakes.”

Titles like: The Courage to Act (Ben Bernanke) or The Age of Turbulence (Alan Greenspan)

Instead, Janet Yellen stayed in D.C. and joined the Brookings Institution - like any other progressive who never leaves Washington and is eager to get another job with an upcoming administration…

While at Brookings, he made a series of incredible bets that sounded like she had accidently walked into a dentist's office and stolen the nitrous oxide.

While still Fed Chair, she predicted in 2017 - partially due to her work - that we would not have another financial crisis in our lifetime. First she said…

“I think the public can see the capital positions of the major banks are very much stronger this year,” Yellen said. “All of the firms passed the quantitative parts of the stress tests.”

Then she followed up:

“I think the system is much safer and much sounder. We are doing a lot more to try to look for financial stability risks that may not be immediately apparent but to look in corners of the financial system that are not subject to regulation, outside those areas in order to try to detect threats to financial stability that may be emerging.”

When it comes to forecasting - Yellen has always sucked at it.

This was probably the worst forecast of her career.

Since then, I count a 2018 bond panic driven by the Repo market, the 2020 COVID liquidity crash, the 2022 GILT Crisis, the 2023 Silicon Valley banking crash, and…

Well, what’s lying ahead this year?

Four years later, she’d claim that inflation was transitory.

But then in 2022, the Fed had to raise rates.

It hiked rates so high that multiple banks collapsed because they were holding bonds that dropped in value so much that the banks became insolvent on paper.

Then, the Federal Reserve changed its policies on stress testing because so many other banks are insolvant on paper - and the central bank wants to prevent a bank run again (probably as soon as this summer).

But don’t worry, they definitely didn’t abandon stress testing or the discount window… wink wink… just like creating a bank lending program that aims to provide the effects of stimulus isn’t “stimulus.

They’ve been lying about what stimulus is because it invokes bailouts.

But let’s be honest: Every policy involving monetary policy expansion is a bailout. It usually just happens much slower - like inflation targeting - so you don’t notice it happening.

Let’s Pay More For Our Own Money

If you need more proof of how bad she was at her job, consider that the U.S. government was living in a debtor’s paradise when Yellen took over the Treasury Department.

The Treasury Department physically prints the currency… and yet somehow, Yellen made it possible that the U.S. must now pay more interest on the money it prints, adding needless amounts of extra interest to annual debt payments.

Read that sentence again, but not twice, or else your nose will start to bleed.

The U.S. could have refinanced an untold amount of debt way out on the yield curve when interest rates were incredibly low.

Despite the stimulus from COVID-19 and the massive government spending on COVID relief, Infrastructure bills, and good old-fashioned D.C. grift, Yellen could have refinanced existing debt on a 20-year bond at 1.85% in the summer of 2021.

Heck, even the 30-year bond yield found itself collapsing in late 2021.

A year later, the Fed funds rate was over 5.25%. The 10-year bond would charge to 5% in late 2023, creating a short-term panic in the equity markets (and that’s where she came to the rescue with yet another insane plan that spiked the debt).

Why didn’t Yellen aim to reduce the debt burden and the cost of refinancing?

For the same reason that they missed the massive spike in inflation that would follow in the next 18 months, they are terrible at forecasting.

The Federal Reserve has more than 200 plus Ph. D.s, and Yellen—with years of fishbowl theory and incorrect assumptions—couldn’t take any hint from the past that inflation is largely driven by printing too much money.

Even today, Yellen pouts and claims that supply chain problems had driven the wave of inflation during COVID.

The media - run by people who haven’t even read even the economics cliffnotes, let alone looked up Milton Friedman - are happy to clap along with this lunacy just because they want to be able to get access to interviews and be in the room in the Eccles Building when Jerome Powell gives a post-Fed talk.

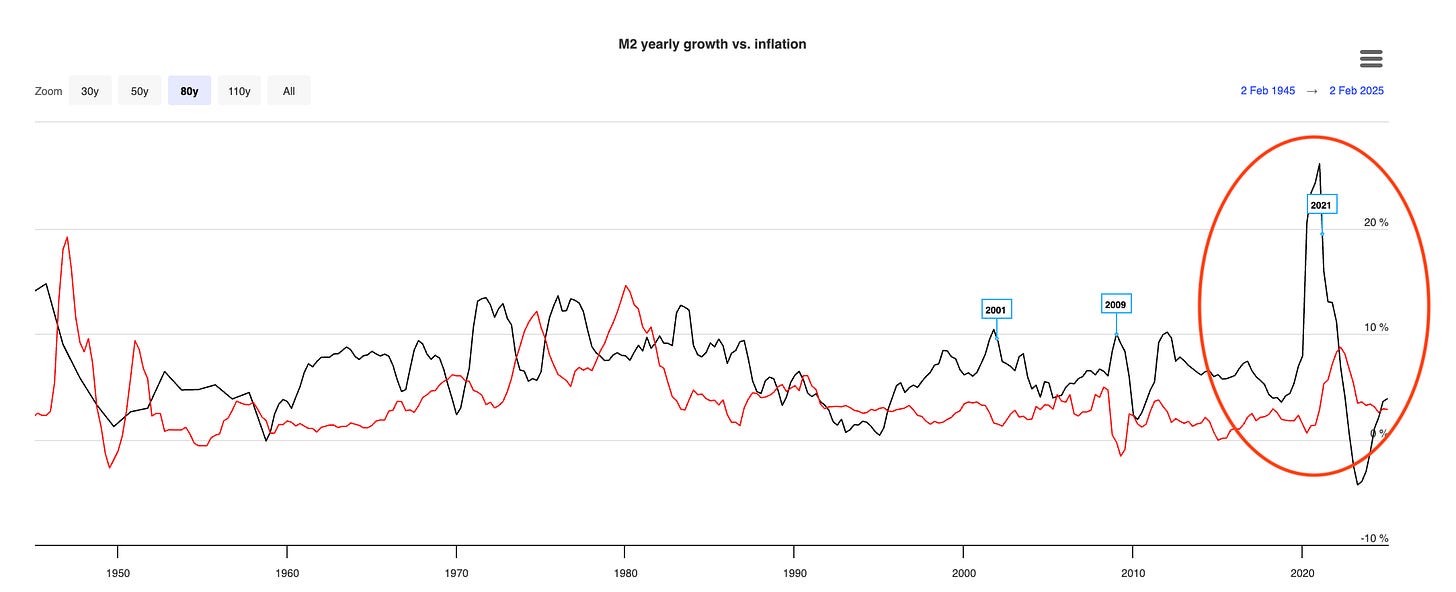

Yellen effectively denies that monetary expansion (money printing) played the lion’s share in the inflation that destroyed small businesses and parts of the middle class during COVID-19 and under her watch in the ensuing “transitory” period.

"It may have contributed a little bit to the inflation, but by and large, inflation was a supply-side phenomenon," she said in January.

I want to show you a chart.

The black line shows the yearly growth of the money supply (M2), and the red line shows official inflation.

If you look at this chart - and you see that incredible spike - and then correctly conclude that it’s “the money printing”, then you win.

You win the disappointment of knowing you should have been the Treasury Secretary in 2021 instead of Janet Yellen..

The M2 Growth rate (the money supply) from January to March 2021 was 26.8%.

But sure… that had nothing to do with inflation jumping from 0.58% that same quarter to over 8% in 12 months.

Yeah… just a “little bit.”

Is anyone… the hell… home?

What Comes Next?

I’ve long said, “Why work for something (the dollar) that someone else can print?”

That someone is Janet Yellen.

And for all the griping today, she somehow outdid herself in the last 18 months.

I’m going to show you what I uncovered and put together tomorrow.

If you’re trying to understand why the U.S. economy is slowing down and why the stock market has been in a free fall, don’t focus all of your attention on Trump, tariffs, and the economy, as the media has.

Focus on Janet Yellen’s actions as Treasury Secretary in late 2023 until the election…

Tomorrow, I’ll explain what happened and what you need to do with your money… in Blame Her: Part II.

Stay positive,

Garrett Baldwin

Secretary of Ahhh!!!

Great blog.

For all intents and purposes, the Federal Reserve was designed and created by the Rockefeller's and Rothschild's in 1913. It has been run for the benefit of their large banks (and other large banks) ever since. As the Fed Chairman, Yellen did the job, just like all prior Fed Chairmen, but she was easily the worst of the worst. For much of the past 112 years, the needs of the Fed and the US citizen overlapped. However, when they didn't, the US taxpayer got crushed and these non-overlapping periods have occurred far too often.

My loathing for Yellen is bottomless. IMHO, she has done more damage to the US taxpayer, than any other individual (FDR comes to mind as a contender) in US history. The problem is that very few people pay any attention to this type of stuff. Even when I try to explain this to like-minded individuals, I can see their eyes gloss over, as they try to change the subject. For the most part, people don't like to feel stupid.

GB, if you ever have the time and energy, you should write a book about Yellen. Or a screenplay, as I'd like to see it get made into a movie.