Oh... Now Moody's is Worried...

It wasn't the 25th trillion or the 34th trillion. Is it the 37th that has them on edge?

Dear Fellow Traveler:

I held off on responding quickly yesterday to the news that Moody’s had finally downgraded America’s pristine credit rating.

It was nice of them to notice what we’ve been saying since inception…

That's not just America, but the entire world is in fiscal trouble.

It only took Moody’s—checks notes—$36.8 trillion in U.S. debt to finally sound their alarm bells.

Was the first $25 trillion fine?

Was the second $10 trillion still cool?

So was inflation targeting in the 1990s, the four rounds of Quantitative Easing, and multiple decades of twin deficits at the trade and fiscal levels?

But was THIS particular trillion the dealbreaker?

What was it about the 36th trillion that finally made Moody's say, "Hmm, you know what? This might be problematic!"

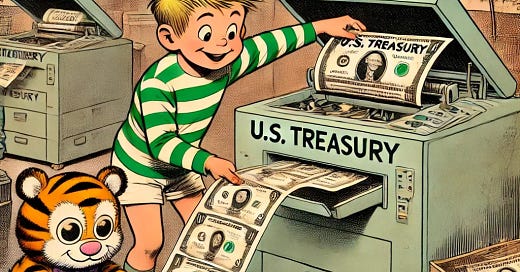

Meanwhile, where were all those brilliant economists who kept assuring us everything was fine because "the U.S. can print its own money"?

As if having a money printer is some magical economic shield!

"Don't worry about the debt—we can just make more dollars!"

Great plan! Why didn't Zimbabwe think of that?

These geniuses conveniently ignore that this whole scheme hinges on maintaining our reserve currency status. That status, by the way, isn't divinely guaranteed.

China, Russia, and the BRICS nations are actively working to dethrone the dollar. Their economies are built around real assets and real production: food, energy, coal, rare earth metals, and commodities.

We have an economy built around financialization: Monopoly with real money.

But sure, let's keep printing!

What these "print-our-way-out" economists also fail to mention is that their magical money creation is basically a stealth tax that crushes the middle class.

It also allows the wealthy to laugh as their asset-heavy portfolios appreciate.

Inflation from money printing doesn't hurt people with real estate empires and stock portfolios. It devastates people living paycheck to paycheck.

Once again… neither Congress nor the Fed works for the American people.

The sooner we admit this… the faster we can build and protect our wealth.

On Moody’s Decision

Moody's has been rating US debt since 1917.

That year is important because it seems like the laws were put in place to allow America to pump in as much money as it needed to fight World War I.

During World War I, the U.S. government heavily promoted Liberty Bonds to the public, often with patriotic appeals.

Wouldn’t you know it? Moody’s (and later Standard Statistics and Fitch) began rating Liberty Bonds and, unsurprisingly, rated them highly.

America has a long history of fiscal nationalism. Why? It works…

Funny though… Fitch seems to be downgrading America’s fiscal status at a time that we’re actively trying to end wars… reduce conflict in the Middle East… and put an end to the never-ending war machine. I’m sure that’s just a coincidence.

America has maintained its perfect Aaa rating through world wars, depressions, recessions, dot-com bubbles, housing crises, and a global pandemic.

May 2025 is when they finally decided to take a calculator to the national checkbook.

Thanks everyone…

This was like watching someone binge eat at an all-you-can-eat buffet for 20 years and then suddenly having the doctor act surprised when they diagnose diabetes.

"Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits…" Moody’s wrote.

No shit.

Since Nixon.

We’ve had decades of runaway spending. Is balancing the budget now treated like a quaint historical concept, like powdered wigs or civil discourse?

S&P downgraded us in 2011, and Fitch in 2023. Moody's was the last holdout, like that one friend who insists, "You're fine to drive," when you clearly aren't.

Except in this case, the car is the world's largest economy.

Here’s the best part…

Moody's upgraded our outlook from "negative" to "stable."

So, they’re saying we’re in terrible shape, but they don't think you'll get much worse.

Don’t give Congress a challenge. They’ll make it work.

Now we've lost our last perfect credit rating, and the fiscal house of cards continues to wobble.

Yet somehow, life goes on, markets keep churning, and politicians keep promising tax cuts and spending increases in the same breath, while economists keep telling us we can print infinite money without consequences.

Maybe the 37th trillion will be the charm. After all, what's the worst that could happen? Currency collapse? Hyperinflation? The end of dollar hegemony?

Don't worry; I’m sure Stephanie Kelton will argue we can print our way out of that, too…

Me? I’m focused on how to preserve your wealth - and maybe even come out richer on the other side of it… So, let’s break this down.

What to Own: The Core Playbook

All roads point to monetary inflation… more printing… more spending… There isn’t a way to get off this ride without serious problems. The sooner you prepare, the better.

This is where we start translating macro into moves. The goal here is twofold:

Protect capital in a volatile and weakening dollar environment

Position for upside as new liquidity flows emerge and reprice assets

Gold and Silver: The Monetary Anchors

Gold isn’t a trade anymore — it’s a reserve strategy.

Every major central bank that’s even remotely skeptical of U.S. monetary dominance is stacking it. China, Russia, Poland, Singapore — they’re all accumulating. And they’re not buying because it “goes up.” They’re buying because it’s neutral, unfreezable, and not tied to the fate of any one nation’s balance sheet.

That’s the real story.

We’re watching the return of gold as collateral, not just a commodity. It’s what countries hold when they don’t want their reserves sanctioned, debased, or weaponized. That’s why gold has moved from $2,100 to $3,400 and is still in the early innings.

But the more interesting trade might be silver.

Silver is at the intersection of industrial utility and monetary history. It’s used in electrification, solar energy, and electronics, but it also trades like a cousin of gold.

The gold-to-silver ratio is still hovering around 100:1, while historical norms in bull markets tend to compress closer to 60:1.

That spread alone creates the potential for a sharp reversion, before you even get into the speculation around paper market suppression.

If it breaks out with momentum behind it, silver has the potential to deliver the trade of the decade — and SILJ gives you the leverage to capture it.

Silver could reprice violently if even a fraction of that structural overhang breaks. And unlike gold, silver remains thinly owned and lightly allocated across most portfolios.

Here’s how I’m positioned:

For long-term exposure, I use the Sprott Physical Gold Trust (PHYS) and Physical Gold and Silver Trust (CEF).

For tactical trades, I lean on the Amplify Junior Silver Miners ETF (SILJ) and the Direxion Daily Gold Miners Index Bull 2x Shares (GDXU).

I also hold physical gold and silver — coins, bars, and stackable bullion — as a hedge against system risk.

Next: Capital Efficient, Alternative Assets.

As I noted, it’s time to turn more and more to alternatives in industries that produce ample cash flow, maintain duration, and can use leverage.

If you don't own real cash flow and contractually obligated yield, you're not investing.

You're gambling.

Consider allocating to the exact asset classes sovereign funds are targeting:

Digital Infrastructure: Data centers housing cloud computing and AI processing power, cell towers and communications networks, digital storage facilities, and the physical backbone that enables our digital economy.

Energy Infrastructure: Oil and gas royalty rights that collect payments without operational costs; LNG export terminals connecting U.S. energy to global markets; pipeline networks with long-term transportation contracts; midstream assets with inflation-protected fee structures.

Streaming & Royalty Models: Precious metals streaming companies finance mines for future production, while resource royalty trusts collect payments on extraction without incurring operational risk. Companies purchase the right to future cash flows without owning physical assets.

Infrastructure & Core Yield: Renewable energy generation with long-term power purchase agreements, utility transmission assets with regulated returns, green infrastructure financing platforms, and essential energy transportation networks.

Logistics & Storage: Industrial warehousing and logistics centers support e-commerce; cold storage facilities serve food and pharmaceuticals; container and transportation leasing operations are available; ground lease arrangements separate land from buildings.

Special Situations: Private credit vehicles with floating-rate exposure; mortgage REITs backed by government-guaranteed securities; business development companies funding middle-market growth; specialized financing vehicles with institutional backing.

What unites these investments?

They're capital-efficient post build-out, generate contractual dollar-denominated cash flows, resist or benefit from inflation, and enjoy backing from sovereign or institutional demand. I’ll have a report on these for Capital Wave readers in June.

Next: Capital-Efficient Stocks: Sleep-Well-at-Night in a Tight-Money World

Cheap credit fueled a decade of zombie companies — firms that survived only because money was free. But now, with rates higher and liquidity fading, the market is starting to punish anything that can't stand on its own.

This is where capital-efficient businesses shine.

These companies don’t rely on leverage.

They don’t need to chase scale at any cost. They generate high returns on invested capital, reinvest selectively, and consistently throw off free cash flow. That gives them pricing power, margin stability, and the ability to return capital to shareholders without begging the bond market for lifelines.

This is Warren Buffett’s playbook.

And in this environment, it works better than ever.

We’re already seeing strong relative performance from names like Berkshire Hathaway (BRK/B) — which sits on mountains of cash and owns the kind of boring-but-beautiful businesses that print money no matter what the Fed does.

Visa (V) continues to operate like a global tollbooth on electronic payments. With its asset-light model, Domino’s (DPZ) remains one of the best-run franchises in the consumer space. Deere (DE) quietly combines industrial leverage with an embedded financing arm, giving it a wide moat few competitors can touch.

For those looking for exposure through a single vehicle, the SRH Total Return Fund (STEW) offers a tax-aware, closed-end approach with exposure to many of the names above, including Berkshire itself.

These aren’t the flashiest names in the market. But that’s exactly the point.

I believe at least 40% of your core equity allocation should be in businesses like these — names that compound through cycles and don’t need the Fed to keep them alive.

They offer staying power in selloffs, relative outperformance in rotations, and real upside when liquidity returns.

Yes… Utilities and Midstream Energy: The Power Cycle Has Started

There’s a story playing out right now that almost no one is talking about — and it has nothing to do with AI chips or the Nasdaq.

It’s about electricity.

AI infrastructure, EV charging networks, semiconductor fabs, industrial reshoring — they all have one thing in common: they’re power-hungry. And the U.S. grid can’t handle it. We’re running up against hard transmission limits, generation constraints, and a regulatory environment still stuck in the 1990s.

This mismatch between accelerating demand and constrained capacity is one of the most underappreciated investment themes of the decade. And it’s already starting to move capital.

Utilities are breaking out of their sleepy reputation. The XLU ETF, which tracks the U.S. utility sector, is acting like a growth trade again.

It’s defensive, sure — but it’s also one of the few areas directly benefiting from this new surge in long-term energy demand. When XLU breaks above its 20-day moving average, it’s not just a technical trigger — it’s often a signal that institutional money is rotating into the names that will power the next wave of domestic expansion.

Midstream energy is the second part of this equation. While upstream oil and gas can be volatile, midstream operators — the pipelines, storage hubs, and LNG terminals — act more like tollbooths. They benefit from volume, not price. Companies like Energy Transfer (ET) and Enterprise Products Partners (EPD) generate steady, inflation-resistant cash flows and offer yields over 7%. They’re boring in the best possible way.

And don’t sleep on copper.

It’s the single most important metal for electrification, and it tends to move in explosive cycles — especially when China stimulates or infrastructure projects get fast-tracked. I’m not chasing it here, but I’m watching it closely.

Put simply, this isn’t just an energy trade. It’s a power infrastructure trade. And as electricity becomes the bottleneck for growth, the companies that produce, transmit, and store power will become the new growth stocks.

Finally… Global Diversification: Quiet Strength in the Right Countries

Let’s talk about where capital is going — not just within the U.S., but globally.

We’re seeing international money flow out of dollar reserves and into politically stable, resource-rich, economically free markets. You don’t need to go all-in on international exposure, but you do need to be selective and intentional about it.

Here’s the filter I use:

Does this country have commodity leverage?

Is it politically neutral or stable?

Does it operate under a rule of law?

Is its currency relatively sound (or does it hedge dollar exposure)?

My top picks right now:

Switzerland (CHF exposure) – A consistent safe haven. Strong currency. High financial transparency.

Poland (EPOL) – Emerging as a Central European economic power. Exposure to EU trade, military investment, and manufacturing.

Singapore – One of the most investor-friendly markets in the world. Tight capital controls and strong currency discipline.

Chile and Norway – Natural resource leverage (copper, lithium, oil) with relatively stable governance.

You’re not looking for moonshots here. You’re looking for durable non-U.S. return profiles, currency diversity, and hedges against American fiscal sloppiness.

Even a 5–10% allocation to these regions can give you meaningful protection if the next leg of the dollar decline unfolds faster than expected.

How to Position Right Now

We’re not at the start of a trend. We’re in the middle of a transition, and it’s one of the most important ones in a decade.

The dollar is eroding slowly.

Global liquidity is shifting unevenly.

And big changes are ahead… Position accordingly…

Be ready… Stay ready.

Be liquid… Stay liquid.

Be positive… Stay positive...

Garrett Baldwin

Secretary of Inflationary Screaming

Please expand on Global Diversification. On CHF, ThinkorSwim has a chart but no price quotes. Is it available another way? I assume you planned on using ENIC for Chile, but what do you suggest for Singapore and Norway?

I have been building a small position in a Singapore company trading on the NDQ as GRAB. I would love to hear your opinion if you have a few minutes to check them out. Word is they are getting ready to acquire a small business in Indonesia. Keep up the great work and we certainly appreciate everything you do.

Submariner 😉

Aka Spitfire