Dear Fellow Traveler:

I always respond to critics.

This time, I sorta wanna to understand why I received an expletive-laced email at 3 am on a Saturday about an extremely random topic…

I assume someone was reading my article in a club in the middle of the night after too many Rumpleminzes and decided to start lobbing grenades.

And there’s a 23-year-old version of me that would say, “Good form.”

But of all things to yell at me about…

Why America’s Net International Investment Position?

Recently, I wrote about the NIIP.

I explained that if any other nation had an NIIP comparable to the U.S., its currency would be worthless.

The world does own us.

And the next phase of this will be capital extraction…

So… in the middle of the night… in some colorful language, someone told me that it seemed like I had finally graduated from college and discovered the U.S. trade deficit.

I write this because many exceptionally intelligent individuals in finance have stumbled upon Me and the Money Printer.

And some have worked in finance for decades…

You know what you’re talking about.

You understand these things. I understand these things.

These are topics that are basically… bar conversation for some of us.

My message to you is… Be prepared to challenge your assumptions.

Given the current scenarios, I’ve largely given up on my MBA courses, all the CFA flashcards, and most fundamentals that aren’t tied to Wes Gray or Tobias Carlisle.

More importantly, my audience is primarily comprised of retail investors.

They’re still working on why P/E ratios are meaningless in today’s liquidity-driven world and how momentum works.

My mother reads this - and says, “What the hell are you talking about? Can’t you just talk about my granddaughter?”

I do sometimes.

But I spend at least an hour a day writing this and thinking about the markets, because this is something people can control.

Fair Warning

Most people don’t understand how hedge funds work. They are unfamiliar with shadow banking. They will never even step foot within 100 miles of Park Avenue.

However, in a few days, I will explain how I can take approximately $100 million and leverage it up to $2.5 billion using Treasuries, stocks, and various forms of collateral.

Some people will be excited about it, and they’ll be fascinated by how T-bills can be leveraged through repo markets. You can essentially own several hundred million in treasuries with a much smaller position, which leads to more speculation, drives markets higher, and creates concentration risk.

But I know there will be one guy somewhere in Geneva who will spend his entire afternoon writing me a thesis on Basel III and why I’m wrong about rehypothecation and optimization problems.

He doesn’t have to… (he doesn’t have to).

There will also be someone else who will take my theoretical story about leveraging up to 25x my original $100 million and tell me that this is amateur hour.

That I could leverage up to 50x or higher if I had better relationships with Goldman Sachs (yes, these people exist).

Funny thing… the point of the article won’t even be about the gross leverage.

It will be about the mismatch… and why government policies can and will exacerbate a crisis regardless of the net leverage.

Hey Man, I’m Just the Messenger

This is what happens when audiences expand.

I invite you to understand what we’re trying to do here.

It’s all right here. I'm not someone who believes in traditional finance anymore, and I view this world from a perspective outside the traditional lens.

I can take the criticism… and I can handle it all.

I wonder if it’s worth someone’s time.

We’re not on a Higgins boat heading toward Utah Beach.

We’re talking about money.

And how to make more of it in a world of fund leverage, moral hazard, and terrible central banking…

If that’s not for you… check out this link for adoptable dogs in New York City.

Now… let’s get to the chart of the week…

The Last American Bull Market

Bank of America says that we’re on pace for $51 trillion in debt come 2032.

I’m not an end-game kind of person… But this chart speaks volumes…

I do believe that this financial system can go on much longer than people think.

That said, debt is exponential, and the capital necessary to refinance that debt runs in cycles.

So, I expect two things to happen.

Based on Michael Howell’s Liquidity Cycles, we are likely to face challenges in 2027-29. We seem to have a major financial crisis every 10 years that aligns with the plumbing of the system. Whether this is 87ish… Asian Financial Crisis like… or GFC-esque… we’ll find own.

I expect that we’ll face something significant in the next 36 months.

That said, I think we’ll then see some form of fiscal dominance or fiscal repression, which will lead to a bull run on the backside of the decade and into the next.

They’re going to print a lot of money…

And if we’re heading into 2032, I’m calling that The Last American Bull Market.

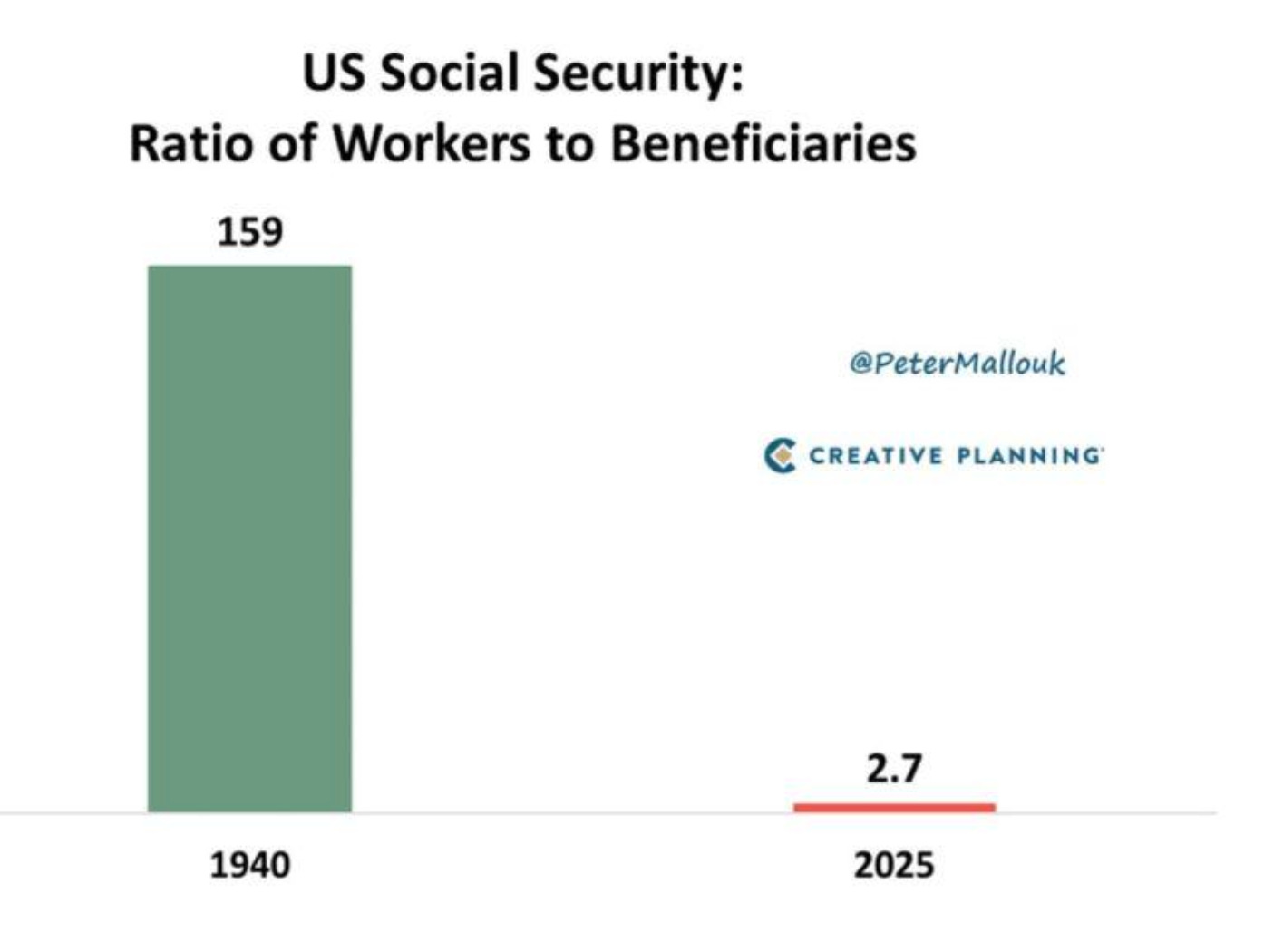

We’re facing a crisis with Social Security in the next seven years.

We just don’t have the people to keep this MLM running… In a gig economy, how are we replenishing the system that has devolved into feudalistic fever dreams?

So… fair warning.

You’ve got a solid seven years to buy as many real assets as you can.

From there, get ready for someone with the mentality of Zohran Mamdani to end up in the White House. The cracks are there… be prepared for something big to happen.

Stay positive,

Garrett Baldwin

No problem, I just want to keep people informed and awake.

Garrett thank you for a great article. I'm that older retail investor. I thought PE was a thing for donkeys years. Always learning from you - today's lesson was to understand rehypothecation.

Loved your response to Thomas: "If you strip out the divinity… the Gospels are the story of a man against a central bank and the related corruption." https://tinyurl.com/bdhms5

Don't be reading emails at 3am from tipsy economist colleagues who lack your courteous, gracious tone.

Mum is right - how did Emily enjoy the celebrations?