Dear Fellow Traveler:

Well… It’s Fed Day.

Great. While I’ll be talking markets at 2:30 today right here…

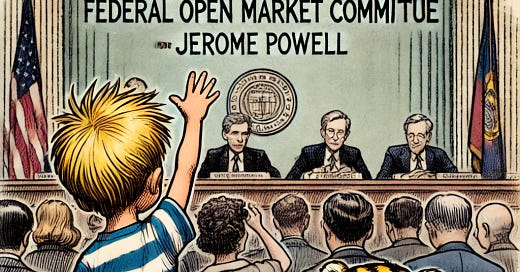

I want to note that I won’t have the answers I want about the Federal Reserve. I’d love to be in the room when Jerome Powell takes the podium today.

If I could, I’d ask 10 questions to Powell and the central bank.

However, I likely would only get to ask one - and would never be allowed back.

History shows that journalists who ask tough questions… on things like insider trading among Fed officials or the full scale of emergency repo bailouts… often disappear from the presser lineup shortly afterward.

It certainly appears that the Fed is actively managing the tone of questioning. It also suggests that the Fed has a very comfy relationship with media gatekeepers like 60 Minutes and CNBC.

Truly uncomfortable questions get sidelined.

So… let’s ask them here.

And if anyone has Powell’s phone number…

I’ll start with a text that says… “Yo James… you up?”

Here are the 10 things I want to ask Powell.

Question 1: QE for Foreign Banks Before Main Street

Senator Ted Cruz has criticized the Fed for paying interest on reserves. A lot of that interest flows to foreign banks via reverse repos. Effectively, Cruz argues this is a 'bailout' pipeline abroad. Why do you prioritize shoring up foreign financial institutions before ensuring similar relief reaches struggling Americans?

Why Powell Would Dodge This Question: Senator Cruz estimates up to 50% of those interest payments benefit non‑U.S. banks.

Question 2: QT in Words, QE in Action?

You say QT is continuing, yet balance-sheet data show the cap on MBS runoff remains at $35 billion/month, and overall asset sales have slowed dramatically. Right now, we’ve been cutting just $5 billion/month in Treasuries since April, while we’ve also seen the Fed step in and buy assets in recent weeks.

Are you running a stealth QE?”

Why Powell Would Dodge This Question: The Fed cut runoff caps from $25 B to $5 B in April—hardly the hallmarks of a hawkish QT. Also, pay no attention to the big purchases in multiple duration bonds in the last month. Totally NOT QE, you guys.

Question 3: Treasury Bills Creating Covert QE?

You claim T‑Bills serve only to manage short-term fund balances.

But with Treasury General Account rebuilds draining reserves, while reverse repos soak them up, it smells like liquidity management thinly veiled as monetary policy.

Can you clarify if this is collateral-driven or if it is another QE in disguise?

Why Powell Would Dodge This Question: The Fed’s own reports link TGA flows, RRP usage, and liquidity. This plumbing exercise is monetary policy in stealth.

Question 4: Global Swap-Line Hypocrisy?

Europe’s central banks are uneasy about U.S. swap lines.

This is true with rising ‘America-first’ sentiment at home. The ECB Chair just suggested that the Euro should be the global reserve currency. You reaffirm global commitment. However, if Congress or the President pulls the plug next year, isn’t that a bait-and-switch on global financial stability?

Why Powell Would Dodge This Question: The Fed promotes itself as a global financial stabilizer while U.S. politics signal retreat.

Question 5: Wealth Inflation vs Wage Growth?

Your QE efforts during COVID doubled the Fed’s balance sheet. These actions disproportionately inflated stock and housing wealth. With inequality reportedly back to 1920s levels, what’s your answer to Americans whose real wages haven’t budged?

Why Powell Would Dodge This Question: Powell’s policies have been tied to rising inequality and a K-shaped recovery.

Question 6: Is Interest on Reserves Just a Wall St. Gift?

You pay 4.4% interest on reserves to banks that merely park funds at the Fed. Isn’t this just corporate welfare? Meanwhile, Main Street gets zero, and community banks are struggling under intense regulation. Why is Wall Street earning outsized returns for no risk?

Why Powell Would Dodge This Question: Due in part to this policy, the Federal Reserve has been operating at a loss since interest to banks outpaces earnings on bonds.

Question 7: Repo Loans Redux

In 2019 and again during the COVID crisis, the Fed quietly deployed trillions in emergency repo loans to Wall Street without Congress’s approval or mainstream scrutiny.

How do you reconcile that with your commitment to transparency? When will the American people see a full audit of those ‘secret’ bailouts?

Why Powell Would Dodge This Question: This just brings attention to the Fed’s unchecked power and the media's failure to litigate it.

Question 8: Another on the Wealth Gap

Your policies have arguably fueled a staggering transfer of wealth to the top 1%. Call this the new Cantillon Effect. Billionaire fortunes soared during QE, while ordinary Americans saw stagnant wages.

Does the Fed have any moral standing to claim it promotes ‘maximum employment and stable prices’ when wealth inequality is surging?

Why Powell Would Dodge This Question: This question forces Powell to choose between economic rhetoric and human impact.

Question 9: “Moral Hazard & Unchecked Monetization”

Critics like Barry Eichengreen warn that QE instills moral hazard in governments and markets when central banks become the buyer of last resort.

How do you respond to the charge that you’re monetizing debt and unwittingly enabling fiscal profligacy?

Why Powell Would Dodge This Question: Calls out a core economic critique of modern central banking.

Question 10: Accountability and Consequences

You’ve earlier remarked that you’ll ’leave overshoots to historians’.

So I ask plainly: What happens if the Fed gets it wrong? Do you or any of your colleagues face personal or institutional accountability?”

Why Powell Would Dodge This Question: Calls the Fed’s ivory-tower insulation into question. They have over 200 Ph.D.s in that organization, and not one seems to understand how their policies impact the average human being.

All right… I gotta go prepare for the Fed annoucement…

Stay positive,

Garrett Baldwin