Why We Should Keep Working... and Other Things I Think I Think

It feels like a Monday, but it's really Friday...

Dear Fellow Traveler:

On Fridays, I tend to shift away from a single subject to think about the world, the markets, and other tidbits circling the hallways of my brain…

To start, I’ve done my best to avoid the Minnesota fraud story over the last month, largely because I didn’t want to get caught up in the noise. Fraud in the U.S. is extensive, especially in Medicare and Medicaid.

When you build programs that lack guardrails and are “trust-based,” “Western” systems, we quickly see how quickly people will exploit them. COVID was a perfect example of this… The great economist Peter St. Onge puts the total government fraud tab at about $1.5 trillion…

Today, I watched a video of a young woman expressing her displeasure with the situation and the fact that so much fraud has been uncovered over the last five years.

People are starting to feel stupid. They think “well, I’m here, I’m playing by the rules, I’m working hard, I’m providing for my family, I’m doing th hard work, and I’m the idiot. You see the memes online, and we laugh - “I’m on my way to work, thinking that I should have just opened a daycare center in Minnesorta and made millions” - it’s funny, but it’s deeply sad. because the next thing is “why am I even doing this?” And that’s the part that no-one wants to talk about, because this kind of feeling shapes culture.

Yes… It will shape our culture. It will lead to more grift, more shortcuts, more people looking to reach into someone else’s pocket instead of building real shit.

Yes, I think what’s very hard is that in this day and age… It isn’t easy for people who play by the rules to find purpose and financial stability at the same time… in the same place.

It’s extremely frustrating to have those thoughts.

Why am I working so hard? Why am I paying taxes? Why am I willing to sacrifice time?

And that’s the thing that bothers me - it’s the TIME that I lose in the form of taxes. (I wrote an entire satire book about grift and the loss of time that became an instruction manual for social grifters…) There is no “warmth of collectivism…”

But I keep my head down… and I enjoy the individualism… to write and research…

For me… I like what I do. I’m challenged by it. It feels bigger than me.

Yes, it bothers me that people take shortcuts. For example, in today’s world of content… tons of people have 50,000 followers on Substack, and all their content is clearly written by ChatGPT (you can see it in the patterns). But I can’t let it ruin my day. I can’t let it ruin my time. I have to remember that I do something… different.

It’s not easy to do. And there are bad days…

But again… I go back to asking you to start your year by identifying your purpose.

From there, you’ll be able to shrug this type of bullshit off.

Countless people around the world feel the same way about the very situation we face because they’ve lived it… and invested through it (the basis of Postcards).

But the ones who are successful in the face of growing corruption and fiscal mismanagement… find purpose, meaning, and the ability to shake off outside bother to focus on their health, their wealth, and themselves… the three things over which they do have full control. I have friends in Argentina who have lived there all their lives… and in the face of that fiscal insanity… love where they are because of the mentality they bring to life each day… That’s a life of real meaning.

What else do I think this Friday?

Thing I Think No. 2: Fire Everyone At Bank of America [Or, Why I Need to Put My Journalism Degree to Work Finally]

Josh Brown and I talked about the K-shaped recoveries, where the rich get richer, and everyone else tries to keep their heads above water. What was the difference between our conversation and what was discussed in this Fox Business story?

Josh and I got to the root cause: Monetary policy.

This article in Fox goes on the words of a Bank of America report… which says:

“Trends in the labor market are likely a key driver of the K-shaped dynamics seen among consumers, the report noted.

Holy Balls on a Honey Bear…

Does anyone actually understand monetary policy and its impact? Does any journalist ever ask the people who wrote the report… What about the Federal Reserve?

Well, I checked the Bank of America report…

A key reason behind this “K-shaped” spending pattern is the labor market.

That was one reason…

The second reason? Bank of America describes it as “wealth effects.”

The report says [Emphasis mine]:

The top 20% of households by income held around 87% of the total value of directly held equities in 2025 Q2, according to Federal Reserve data, which means that rises in stock markets tend to disproportionately benefit the higher-income cohort.

Reminder: the S&P 500 ETF (SPY) is up 78% since the start of January 2023… which is where the wealth effect comes from - it’s driven by “investment” income…

But… let me get this right?

The only citation on why the K-shaped thing was happening in relation to the Federal Reserve … was by CITING DATA FROM THE FEDERAL RESERVE.

And they don’t bother explaining why the stock market keeps going up and boosting wealth effects… which is the FEDERAL RESERVE, monetary policy, Treasury policy, and liquidity expansion over the period they measured.

Shoot me…

Fire everyone at the network and at Bank of America.

The Fed and the Treasury are THE DRIVERS behind the K-Shaped recovery…

Not labor markets.

I feel like I need to start putting this Medill diploma to work, finally, at some of these places, but I’m still worried that my editors won’t understand a word I’m writing…

Think I Think No. 3: We Enter Stage 3 and China Looms

I wrote my annual outlook last night for Capital Wave Report (paid version of this subscription)… Well… the “anti” 2026 outlook. It was much different than what I’ve done in the past, and it walks through liquidity and capital flow expectations.

I’ll share a quick part of it… since it matters. As the U.S. peaks in its cycle, China is about to storm out of the gate with stimulus in 2026. It’s not me saying that. It’s coming from economists at SocGen, analysts at ING, and the actual people who run China. Roads point toward significant stimulus… and the IMF called for even more than what’s planned during meetings in Beijing last month, China Daily reports.

Here’s the thing. Chinese stimulus is directed at their manufacturing economy. And that could be very bullish for materials and metals in the year ahead. The issue for the United States is that rising coal, uranium, copper, and oil prices… (fueled by Chinese stimulus efforts) would be inflationary for this economy. All while… as RealInvestmentAdvice.com raised the concerns about structural inflation driven by electricity in the future. (My electricity bill is screaming…)

That could put a cap on interest rates… and that could make inflation a serious concern for the road ahead. In addition, it could lead to an unusual year for this market. Don’t expect the “growth” and “YOLO” narrative to continue much longer.

And Finally… Think I Think No. 4: Then Buy the Dip…

This headline is classic CNBC… Berkshire stock is down.. 0.3% today.

So… Buy the Dip.

I buy my daughter a share of Berkshire B (BKB.B) stock every year for her birthday.

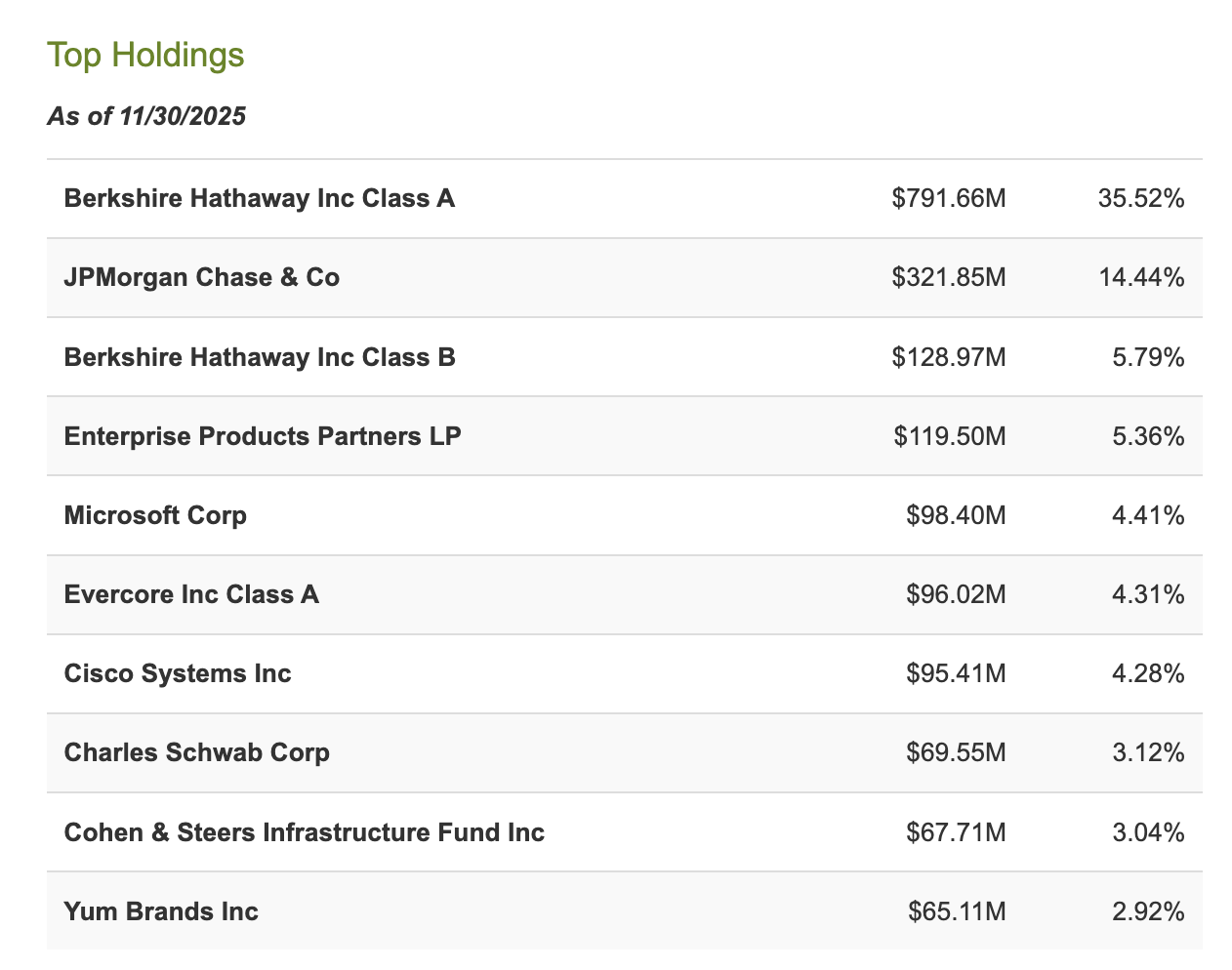

And yes, it’s possible… that Berkshire and everyone else struggle when the momentum and liquidity cycles shift. But I’m still going to be buying… and when I have $18.40 lying around. Instead of buying a 12-pack of Corona Light, I’ll buy a share of SRH Total Return Fund Inc (STEW), a closed-end fund that trades for 80 cents on the dollar and largely owns Berkshire stock and other Buffett-style holdings.

If it’s not going in my liver… and it’s not staying in the dollar…

I’ll definitely put it in Abel’s hands.

I hope you all have a great day.

I’ll be back this weekend with a video for Capital Wave subscribers on trading the quality momentum strategy… and, of course, we’ll have our first Chart Party of the Year.

Stay positive,

Garrett Baldwin

I try to stay away from all that Advanced Ignorance stuff...

I much prefer ChatGB right here!

"When you see that men get richer by graft and by pull than by work, and your laws don't protect you against them, but protect them against you - when you see corruption being rewarded and honesty becoming a self-sacrifice - you may know that your society is doomed.” -Ayn Rand.